Natural Gas Corner

The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Thursday, August 4, 2016

Natural Gas Corner Is Closing

After two years of posting, I am burned out.

Thanks for reading.

Carl Neill

Monday, July 25, 2016

Friday, July 22, 2016

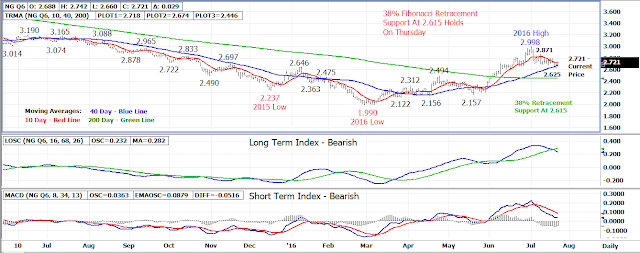

Natural Gas Corner - Technical Update - Key Support Area Holds On Thursday

The rally in the August 16 natural gas contract may not yet

be over following Thursday test of a key support level.

This support level is the 38% Fibonacci retracement of the

March-July uptrend which is at the 2.615 level.

The August contract fell to a 2.625 early morning low on Thursday but

rallied back higher into the close once support held finishing the day at

2.692, up .034.

Daily settle back above the 40 day moving average on

Thursday has brought in renewed buying interest today as the August contract

attempts a breakout above 10 day moving average resistance at 2.720.

A close above this average today will turn the near term

trend back up with following resistance at 2.780-2.790 and the 2.871 weekly

high set two weeks ago. Longer term

resistance is the 2.998 high set in

early-July.

The 40 day moving average at 2.675 is the first area of

support today followed by the 2.615. A

close under 2.615 will turn the longer term trend back down.

Bottom line – Bulls back in today with key support holding

on Thursday.

Technical Indicators:

Moving Average Alignment – Neutral

Long

Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Posts (Atom)