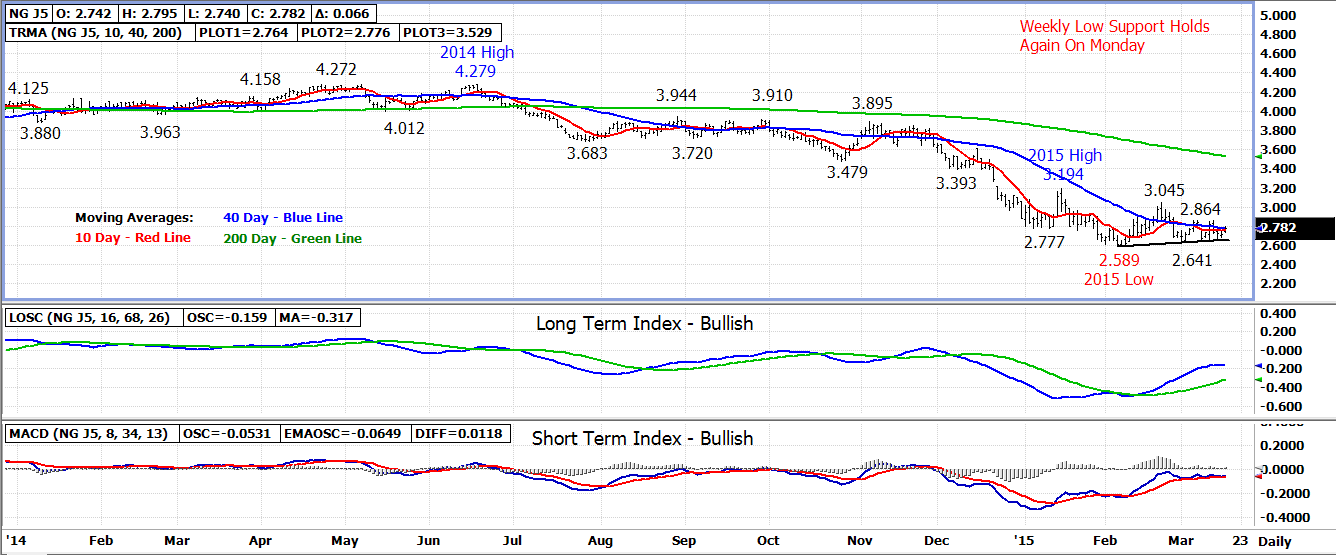

The April 15 natural gas contract closed lower for a third

consecutive day on Monday but held above key weekly low support near the 2.680

daily low.

With support holding again on Monday, the market has

reversed back higher in the overnight session with the April contract currently

attempting a breakout above 10 and 40 day moving average resistance between

2.765-2.775.

Following resistance is at 2.864, a price set over the past

two weeks. A breakout above 2.864 would turn the 3.045 high from February

into the next upside resistance level.

Weekly low support between 2.660-2.680 remains primary

support. A close under this support would turn the 2.589 contract low

into the next downside support with longer term support at the lower-2.400

level.

Technical Indicators: Moving Average Alignment –

Neutral-Bearish

Long Term RMI Index – BullishShort Term RMI Index - Bullish

No comments:

Post a Comment