The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Saturday, June 27, 2015

Friday, June 26, 2015

Dow Jones - Natural Gas Retreats On Expectations For Strong Supply

DJ Natural Gas Retreats on Expectations for Strong Supply

By Timothy Puko

Natural gas prices were giving back most of the prior session's gains on expectations for strong supply.

Natural gas for July delivery fell 6.9 cents, or 2.4%, at $2.781 a million British thermal units on the New York

Mercantile Exchange.

Money managers have been strongly positioned in favor of falling gas prices, but the market has been resilient. Power

plants have ramped up demand and there are signs that production may be in slight decline after a period of rampant

growth. Prices rose 3% on Thursday as government data showed the smallest weekly surplus in more than two months and

analysts said the market had come into balance.

But many believe that balance won't last. The U.S. Energy Information Administration also said on Thursday that

production had grown 1% this week despite pipeline shutdowns for maintenance. Production is back at its near-record

pace of 72 billion cubic feet a day, EIA said, citing the data provider Bentek Energy.

Friday's quick reversal in the market is also a sign that traders haven't fundamentally changed that widespread

bearish view, analysts said.

Money managers have had about five bearish positions for every three bullish positions, and that balance can lead

prices to rise quickly if bearish traders close out their positions by buying back a gas futures contract.

Many likely did on on Thursday to protect themselves against the bullish government data on gas stockpiles, analysts

said. And so, with that news now in the past, a retreat in prices on Friday is probably a sign those traders are

reestablishing a bearish trade or that the larger expectation is still that the market is oversupplied, analysts said.

"With the production levels we're seeing, the market can't sustain rallies. This is another example," said Gene

McGillian, an analyst at Tradition Energy.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.77/mmBtu, compared with Thursday's

range of $2.775-$2.805. Cash prices at the Transco in New York last traded at $1.43/mmBtu, compared with Thursday's

range of $2.30 to $2.40.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 26, 2015 10:15 ET (14:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062615 14:15 -- GMT

------

By Timothy Puko

Natural gas prices were giving back most of the prior session's gains on expectations for strong supply.

Natural gas for July delivery fell 6.9 cents, or 2.4%, at $2.781 a million British thermal units on the New York

Mercantile Exchange.

Money managers have been strongly positioned in favor of falling gas prices, but the market has been resilient. Power

plants have ramped up demand and there are signs that production may be in slight decline after a period of rampant

growth. Prices rose 3% on Thursday as government data showed the smallest weekly surplus in more than two months and

analysts said the market had come into balance.

But many believe that balance won't last. The U.S. Energy Information Administration also said on Thursday that

production had grown 1% this week despite pipeline shutdowns for maintenance. Production is back at its near-record

pace of 72 billion cubic feet a day, EIA said, citing the data provider Bentek Energy.

Friday's quick reversal in the market is also a sign that traders haven't fundamentally changed that widespread

bearish view, analysts said.

Money managers have had about five bearish positions for every three bullish positions, and that balance can lead

prices to rise quickly if bearish traders close out their positions by buying back a gas futures contract.

Many likely did on on Thursday to protect themselves against the bullish government data on gas stockpiles, analysts

said. And so, with that news now in the past, a retreat in prices on Friday is probably a sign those traders are

reestablishing a bearish trade or that the larger expectation is still that the market is oversupplied, analysts said.

"With the production levels we're seeing, the market can't sustain rallies. This is another example," said Gene

McGillian, an analyst at Tradition Energy.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.77/mmBtu, compared with Thursday's

range of $2.775-$2.805. Cash prices at the Transco in New York last traded at $1.43/mmBtu, compared with Thursday's

range of $2.30 to $2.40.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 26, 2015 10:15 ET (14:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062615 14:15 -- GMT

------

Natural Gas Corner - Technical Update - Yesterday's Rally Suspect

Today’s expiring July 15 natural gas contract gained ground for a second day on Thursday rallying higher from a two-week low reached earlier in the week to settle at 2.850, up 3.3%.

10 and 40 day moving average resistance was broken on

Thursday but there has been no follow through buying in today’s early trade.

The 40 day moving average at 2.830 has been broken as

support turning the 10 day average at 2.810 into the next downside

support. A drop back under 2.810 will turn the near term trend back down

with the 2.711 weekly low becoming the next downside support.

Thursday’s 2.854 is the first area of resistance today

followed by a down sloping trend line currently at 2.900-2.910. A

breakout above this trend line would be a bullish technical signal for the

market.

Technical Indicators: Moving Average Alignment –

Neutral

Long Term Trend Following Index – BearishShort Term Trend Following Index - Bullish

Thursday, June 25, 2015

Dow Jones - Natural Gas Hits One-Week High As Oversupply Evaporates

DJ Natural Gas Hits One-Week High as Oversupply Evaporates

By Timothy Puko

Natural gas made steady gains Thursday on signs of a rare reprieve from chronic oversupply.

Gas prices have been resilient all month, defying a near-record number of bets that money managers placed against

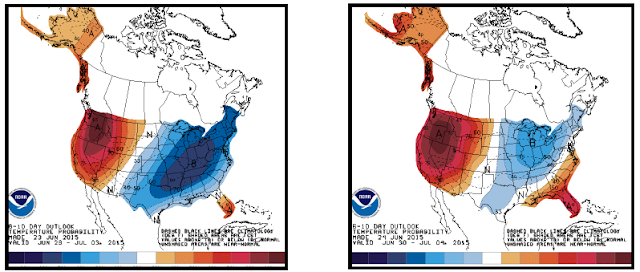

them in recent weeks. A hot spell spread across the country raised demand for gas-fired power just as production cuts

and pipeline outages started to choke back supply.

The U.S. Energy Information Administration said Thursday storage levels grew by 75 billion cubic feet, 13% below the

five-year average, in the week ended June 19. It is the smallest storage addition in more than two months, and suggests

the market has come back into balance after a long period of booming supply repeatedly outpacing demand.

Prices for the front-month July contract settled up 9.1 cents, or 3.3%, to $2.85 a million British thermal unit on

the New York Mercantile Exchange. The gains put gas at its highest settlement in a week and up 7.9% month-to-date.

Power plants usually burn more gas as the weather gets hotter and people turn on their air conditioners. One measure

of that demand, cooling degree days, was 43% above the 30-year average for last week, according to Simmons & Co.

International.

"More demand from here means [the] gas price needs to move higher to keep the market balanced," Tudor, Pickering,

Holt & Co. said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 25, 2015 15:30 ET (19:30 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062515 19:30 -- GMT

------

By Timothy Puko

Natural gas made steady gains Thursday on signs of a rare reprieve from chronic oversupply.

Gas prices have been resilient all month, defying a near-record number of bets that money managers placed against

them in recent weeks. A hot spell spread across the country raised demand for gas-fired power just as production cuts

and pipeline outages started to choke back supply.

The U.S. Energy Information Administration said Thursday storage levels grew by 75 billion cubic feet, 13% below the

five-year average, in the week ended June 19. It is the smallest storage addition in more than two months, and suggests

the market has come back into balance after a long period of booming supply repeatedly outpacing demand.

Prices for the front-month July contract settled up 9.1 cents, or 3.3%, to $2.85 a million British thermal unit on

the New York Mercantile Exchange. The gains put gas at its highest settlement in a week and up 7.9% month-to-date.

Power plants usually burn more gas as the weather gets hotter and people turn on their air conditioners. One measure

of that demand, cooling degree days, was 43% above the 30-year average for last week, according to Simmons & Co.

International.

"More demand from here means [the] gas price needs to move higher to keep the market balanced," Tudor, Pickering,

Holt & Co. said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 25, 2015 15:30 ET (19:30 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062515 19:30 -- GMT

------

EIA Weekly Storage Report - 75 Bcf Injection - Lower End of Estimates

For the week ended June 19:

EIA Injection - 75 BCF

Last Year's Injection - 110 BCF

5 Yr Avg Injection - 86 BCF

Range of Estimates - 72 BCF to 88 BCF

Avg Estimate - 78 BCF

Total Gas in Storage - 2.508 TCF

Natural Gas Corner - Technical Update - Bulls Hold The Fort For A Third Day

The July 15 natural gas contract found good buying interest

at the lower-2.700 level for a third day on Wednesday gaining .033 to settle at

2.759.

The July contract is currently trading near the middle of

the past month’s trading range with support for today again coming in at

the lower-2.700 level. A drop under the 2.700 level would turn the

2.540-2.556 weekly lows into the next downside support.

The top of the gap area at 2.808 created on Monday’s open

has now been completely closed with today’s daily high being 2.811.

The 2.800-2.830 area which includes the top of the gap as

well as the 10 and 40 day moving averages is key resistance today. A

breakout above 2.830 would turn the near term trend back up with following

resistance at the upper trend line currently at 2.910-2.920. A breakout

above upper trend line resistance would be a very bullish technical signal for

the market but is not expected.

Longer term, there might be a bearish right triangle

forming on the July contract. A breakout below 2.540-2.556 support

is needed to trigger the pattern.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Wednesday, June 24, 2015

Natural Gas Corner - Market Review - This Is The Best Rally The Bulls Can Muster?

The inability for the natural gas market to move higher early this week with above-normal temperature readings across much of the U.S. is certainly not a bullish omen.

The strong storage injections made over the first 11 weeks of the injection season should push end of October storage levels to a new all-time high exceeding the 3,929 Bcf peak reached in 2012.

If this prediction holds true, new price lows toward the end of summer are expected.

Increased power generator demand should continue to be a supportive feature as is decreasing production which some models suggest has fallen by over 3 Bcf per day from December 2014.

If production does fall, the lows set in upcoming trade could be a multi-year price low for the natural gas market.

The strong storage injections made over the first 11 weeks of the injection season should push end of October storage levels to a new all-time high exceeding the 3,929 Bcf peak reached in 2012.

If this prediction holds true, new price lows toward the end of summer are expected.

Increased power generator demand should continue to be a supportive feature as is decreasing production which some models suggest has fallen by over 3 Bcf per day from December 2014.

If production does fall, the lows set in upcoming trade could be a multi-year price low for the natural gas market.

Analysts' Estimates For Tomorrow's EIA Weekly Storage Report

DJ Analysts See 78-Billion-Cubic-Feet Rise in U.S. Natural Gas Inventories

By Nicole Friedman

Analysts and traders expect government data scheduled for release on Thursday to show natural-gas inventories rose by

less than typical levels for this time of year.

The U.S. Energy Information Administration is expected to report that 78 billion cubic feet of gas were added to

storage during the week ended June 19, according to the average forecast of 17 analysts and traders surveyed by The

Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the June 19 week, the median estimate is for a rise of 79 bcf. Estimates ranged from an increase of 72 bcf to a

rise of 88 bcf.

The estimate for June 19 is below last year's 110-bcf build in storage for the same week, and less than the 86-bcf

five-year average build for that week.

If the storage estimate is correct, inventories as of June 19 will total 2.511 trillion cubic feet, 39% above the

year-ago level and 1.6% above the five-year average for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 13:41 ET (17:41 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 17:41 -- GMT

------

By Nicole Friedman

Analysts and traders expect government data scheduled for release on Thursday to show natural-gas inventories rose by

less than typical levels for this time of year.

The U.S. Energy Information Administration is expected to report that 78 billion cubic feet of gas were added to

storage during the week ended June 19, according to the average forecast of 17 analysts and traders surveyed by The

Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the June 19 week, the median estimate is for a rise of 79 bcf. Estimates ranged from an increase of 72 bcf to a

rise of 88 bcf.

The estimate for June 19 is below last year's 110-bcf build in storage for the same week, and less than the 86-bcf

five-year average build for that week.

If the storage estimate is correct, inventories as of June 19 will total 2.511 trillion cubic feet, 39% above the

year-ago level and 1.6% above the five-year average for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 13:41 ET (17:41 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 17:41 -- GMT

------

Dow Jones - End of Day Commentary

DJ Natural Gas Rises Ahead of Inventory Data

By Nicole Friedman

NEW YORK--Natural-gas prices ticked higher Wednesday ahead of weekly inventory data, which is expected to show that

supplies have increased by less than is typical for this time of year.

Natural-gas futures for July delivery settled up 3.3 cents, or 1.2%, at $2.759 a million British thermal units on the

New York Mercantile Exchange.

Natural-gas stockpiles typically grow between April and October, as producers store the heating fuel ahead of the

winter, when consumption usually peaks. Producers have injected large amounts of natural gas into storage in recent

weeks, suggesting that robust production is keeping the market oversupplied.

The U.S. Energy Information Administration is due to release its inventory data for the week ended Thursday. Analysts

and traders surveyed by The Wall Street Journal expect the agency to report that stockpiles grew by 78 billion cubic

feet in the week, less than the five-year average build for that week of 86 bcf.

"The market is moving sideways today in anticipation of tomorrow's number," said Aaron Calder, analyst at Gelber &

Associates, in a note. "Most likely it will show that the market remains oversupplied but the heat is creating enough

overall power generation demand to keep natural gas usage at normal levels."

Summertime heat is typically bullish for natural-gas prices, as households and offices use more gas-powered

electricity to run air-conditioning units. While weather forecasts are calling for cool temperatures in the coming two

weeks, the outlook is slightly warmer than previously expected, said Commodity Weather Group LLC in a note.

FUTURES SETTLEMENT NET CHANGE

Nymex July $2.759 +3.3c

Nymex August $2.782 +3.6c

Nymex September $2.795 +3.4c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.67-$2.735 $2.69-$2.76

El Paso SJ $2.66-$2.72 $2.665-$2.76

Henry Hub $2.745-$2.81 $2.81-$2.85

Katy $2.70-$2.74 $2.75-$2.79

SoCal $2.80-$2.96 $2.80-$2.96

Tex East M3 $1.32-$1.40 $1.475-$1.535

Transco 65 $2.75-$2.785 $2.77-$2.835

Transco Z6 $2.48-$2.65 $2.85-$2.93

Waha $2.70-$2.735 $2.73-$2.78

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 15:44 ET (19:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 19:44 -- GMT

------

By Nicole Friedman

NEW YORK--Natural-gas prices ticked higher Wednesday ahead of weekly inventory data, which is expected to show that

supplies have increased by less than is typical for this time of year.

Natural-gas futures for July delivery settled up 3.3 cents, or 1.2%, at $2.759 a million British thermal units on the

New York Mercantile Exchange.

Natural-gas stockpiles typically grow between April and October, as producers store the heating fuel ahead of the

winter, when consumption usually peaks. Producers have injected large amounts of natural gas into storage in recent

weeks, suggesting that robust production is keeping the market oversupplied.

The U.S. Energy Information Administration is due to release its inventory data for the week ended Thursday. Analysts

and traders surveyed by The Wall Street Journal expect the agency to report that stockpiles grew by 78 billion cubic

feet in the week, less than the five-year average build for that week of 86 bcf.

"The market is moving sideways today in anticipation of tomorrow's number," said Aaron Calder, analyst at Gelber &

Associates, in a note. "Most likely it will show that the market remains oversupplied but the heat is creating enough

overall power generation demand to keep natural gas usage at normal levels."

Summertime heat is typically bullish for natural-gas prices, as households and offices use more gas-powered

electricity to run air-conditioning units. While weather forecasts are calling for cool temperatures in the coming two

weeks, the outlook is slightly warmer than previously expected, said Commodity Weather Group LLC in a note.

FUTURES SETTLEMENT NET CHANGE

Nymex July $2.759 +3.3c

Nymex August $2.782 +3.6c

Nymex September $2.795 +3.4c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.67-$2.735 $2.69-$2.76

El Paso SJ $2.66-$2.72 $2.665-$2.76

Henry Hub $2.745-$2.81 $2.81-$2.85

Katy $2.70-$2.74 $2.75-$2.79

SoCal $2.80-$2.96 $2.80-$2.96

Tex East M3 $1.32-$1.40 $1.475-$1.535

Transco 65 $2.75-$2.785 $2.77-$2.835

Transco Z6 $2.48-$2.65 $2.85-$2.93

Waha $2.70-$2.735 $2.73-$2.78

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 15:44 ET (19:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 19:44 -- GMT

------

Dow Jones - Natural Gas Rises Off Two-Week Low

DJ Natural Gas Rises Off Two-Week Low

By Nicole Friedman

NEW YORK--Natural-gas prices rose from a two-week low Wednesday as weather forecasts boosted expectations for

natural-gas demand.

Summertime heat is typically bullish for natural-gas prices, as households and offices use more gas-powered

electricity to run air-conditioning units. While weather forecasts are calling for cool temperatures in the coming two

weeks, the outlook is slightly warmer than previously expected, said Commodity Weather Group LLC in a note.

Natural-gas futures for July delivery recently traded up 1.4 cents, or 0.5%, at $2.740 a million British thermal

units on the New York Mercantile Exchange.

Traders are also looking ahead to weekly inventory data due Thursday. Natural-gas producers have injected large

amounts of gas into storage in recent weeks, suggesting that the market is oversupplied.

However, some market watchers expect summer weather to help eat away at the surplus.

"Though Thursday's storage report ended a three-week streak of triple-digit injections, our balances indicate

injections to be lower for the next two reports," said PIRA Energy Group in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.765/mmBtu, compared with Tuesday's

range of $2.81-$2.85. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $2.65/mmBtu to

$2.70/mmBtu, compared with Tuesday's range of $2.85-$2.93.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 10:10 ET (14:10 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 14:10 -- GMT

------

By Nicole Friedman

NEW YORK--Natural-gas prices rose from a two-week low Wednesday as weather forecasts boosted expectations for

natural-gas demand.

Summertime heat is typically bullish for natural-gas prices, as households and offices use more gas-powered

electricity to run air-conditioning units. While weather forecasts are calling for cool temperatures in the coming two

weeks, the outlook is slightly warmer than previously expected, said Commodity Weather Group LLC in a note.

Natural-gas futures for July delivery recently traded up 1.4 cents, or 0.5%, at $2.740 a million British thermal

units on the New York Mercantile Exchange.

Traders are also looking ahead to weekly inventory data due Thursday. Natural-gas producers have injected large

amounts of gas into storage in recent weeks, suggesting that the market is oversupplied.

However, some market watchers expect summer weather to help eat away at the surplus.

"Though Thursday's storage report ended a three-week streak of triple-digit injections, our balances indicate

injections to be lower for the next two reports," said PIRA Energy Group in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.765/mmBtu, compared with Tuesday's

range of $2.81-$2.85. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $2.65/mmBtu to

$2.70/mmBtu, compared with Tuesday's range of $2.85-$2.93.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

June 24, 2015 10:10 ET (14:10 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

062415 14:10 -- GMT

------

Subscribe to:

Comments (Atom)