DJ Natural Gas Futures Little Changed Ahead of Hot Weekend

By Timothy Puko

Natural gas prices flip-flopped around unchanged Friday as traders get ready for a hot weekend, but one that may

signal the peak of summer.

Natural gas futures for September delivery recently rose 0.5 cent, or 0.2%, to $2.773 a million British thermal units

on the New York Mercantile Exchange. Trading has been limited to a four-cent range for the day and prices are holding

to the middle of a 31-cent range they have been stuck in for nearly two months.

On the last session for the week, trading could be limited mostly to book-squaring moves amid larger conflicting

signals, analysts said.

This is traditionally the hottest period of the summer, and demand for gas-fired power to run air conditioners has

been strong and growing, analysts said. But weather forecasts for the coming weeks show heat dissipating and large

parts of the country likely to get cooler-than-normal temperatures.

"Even with this heat, the market knows it's not likely to linger," said Teri Viswanath, a natural-gas strategist at

BNP Paribas SA in New York. "At this point, the market is weighing whether to write off the summer."

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.775/mmBtu, compared with

Thursday's range of $2.835-$2.87. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of

$2.05/mmBtu to $2.40/mmBtu, compared with Thursday's range of $2.77-$2.89.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 31, 2015 10:02 ET (14:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

073115 14:02 -- GMT

------

The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Friday, July 31, 2015

Natural Gas Corner - Technical Update - Back Toward The Lower End Of The 3-Month Trading Range

The September 15 natural gas contract was hammered in

Thursday’s session as sellers used a small post-EIA report jump to aggressively

sell it down into the close. Losses for the day totaled .096 or 3.3% with

the September contract settling at 2.768.

Although the market was heavily sold on Thursday, the

September contract failed to break under Monday’s 2.735 weekly low as

support. With the September contract now trading back toward the lower

end of the past 3-month range, the market could see rally back higher near

term.

The overall trend remains sideways to lower with new price

lows expected once the market breaks out from the current range.

2.590-2.600 remains key long term support for the September

contract with a breakout under this level turning 2.430-2.440 and 2.230-2.250

into the next downside support areas.

The 10 and 40 day moving averages at 2.820-2.825 are

the first areas of resistance followed by the 2.895 high set yesterday.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Thursday, July 30, 2015

Natural Gas Corner - Market Review - Lower Than Expected Weekly Injection Fails To Stem Selling

Today's EIA weekly storage injection of 51 Bcf (billion cubic feet) came in 3 Bcf under the average analyst's pre-report estimate.

The September 15 contract gained .030 immediately following release of the weekly report but was trading back down after 10 minutes. Sellers used the uptick to hammer the market back lower.

While today's injection came in slightly lower than expected, it was the 15th injection out of the past 17 which exceeded the 5-year average. The 10.5% deficit of gas in storage that existed the first week of April has now turned into a 3% surplus.

The market is on course for a record amount of gas to be put into storage by year's end. Storage alone could drop the market back toward the 2.250-2.500 spot over the next few months of trade.

The big test for the market will be when summer cooling demand eases toward summer's end. This is when it could really get "ugly" on the downside in pricing.

On the bullish side, weekly production continues to decline, if only slightly, but could be the start of a continued cycle lower. The natural gas rig count last week reached a new all-time low of 216 rigs according to the Baker-Hughes rig count report.

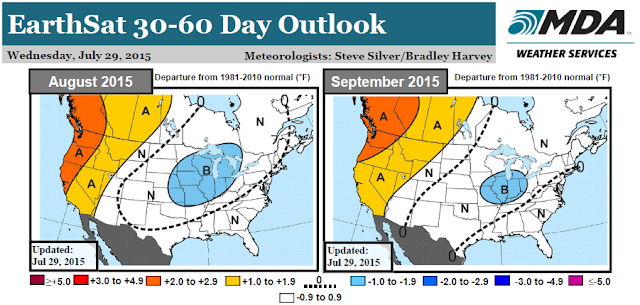

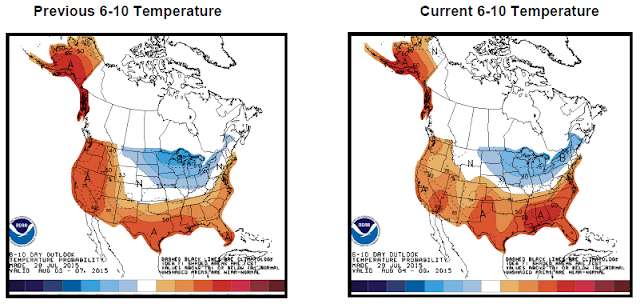

The latest 6-10 day forecast is mildly supportive but the 8-14 day forecast shows an enlarged area of below-normal temperatures.

Once the market breaks out of the current 3-month sideways range, new price lows are expected.

The September 15 contract gained .030 immediately following release of the weekly report but was trading back down after 10 minutes. Sellers used the uptick to hammer the market back lower.

While today's injection came in slightly lower than expected, it was the 15th injection out of the past 17 which exceeded the 5-year average. The 10.5% deficit of gas in storage that existed the first week of April has now turned into a 3% surplus.

The market is on course for a record amount of gas to be put into storage by year's end. Storage alone could drop the market back toward the 2.250-2.500 spot over the next few months of trade.

The big test for the market will be when summer cooling demand eases toward summer's end. This is when it could really get "ugly" on the downside in pricing.

On the bullish side, weekly production continues to decline, if only slightly, but could be the start of a continued cycle lower. The natural gas rig count last week reached a new all-time low of 216 rigs according to the Baker-Hughes rig count report.

The latest 6-10 day forecast is mildly supportive but the 8-14 day forecast shows an enlarged area of below-normal temperatures.

Once the market breaks out of the current 3-month sideways range, new price lows are expected.

Dow Jones - Natural Gas Extends Losses After Inventory Report

DJ Natural Gas Extends Losses After Inventory Report

By Nicole Friedman

NEW YORK--Natural-gas prices extended losses Thursday as traders looked ahead to expected lower demand.

Futures for September delivery settled down 9.6 cents, or 3.4%, to $2.768 a million British thermal units on the New

York Mercantile Exchange.

Forecasts released Thursday called for cooler weather in the Midwest and East in the next six to 10 days than had

been previously expected, according to Commodity Weather Group LLC. Cool temperatures reduce natural-gas demand in the

summer, as fewer people use gas-powered electricity to run their air-conditioning units.

Prices fell Thursday despite weekly inventory data showing that natural-gas stockpiles grew less than expected last

week. The smaller-than-expected inventory injection suggests that consumption was surprisingly strong or that

production was lower than anticipated last week.

Traders are now looking ahead to fall, when weather-driven demand typically fades and production is expected to

remain robust.

"The market has looked beyond what should have been a constructive number, and is looking ahead and is just not

seeing the heat that we're experiencing this week," said Teri Viswanath, director of commodity strategy for natural gas

at BNP Paribas SA. "The market has really vacillated between whether the heat's enough to move enough supply off-market

that we don't have a problem dealing with pipeline and storage constraints later in the season, and the concern that

there's just too much supply in the market."

Inventories now stand at 2.88 trillion cubic feet, 26% above the year-ago level and 3% above the five-year average

for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 30, 2015 15:09 ET (19:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

073015 19:09 -- GMT

------

By Nicole Friedman

NEW YORK--Natural-gas prices extended losses Thursday as traders looked ahead to expected lower demand.

Futures for September delivery settled down 9.6 cents, or 3.4%, to $2.768 a million British thermal units on the New

York Mercantile Exchange.

Forecasts released Thursday called for cooler weather in the Midwest and East in the next six to 10 days than had

been previously expected, according to Commodity Weather Group LLC. Cool temperatures reduce natural-gas demand in the

summer, as fewer people use gas-powered electricity to run their air-conditioning units.

Prices fell Thursday despite weekly inventory data showing that natural-gas stockpiles grew less than expected last

week. The smaller-than-expected inventory injection suggests that consumption was surprisingly strong or that

production was lower than anticipated last week.

Traders are now looking ahead to fall, when weather-driven demand typically fades and production is expected to

remain robust.

"The market has looked beyond what should have been a constructive number, and is looking ahead and is just not

seeing the heat that we're experiencing this week," said Teri Viswanath, director of commodity strategy for natural gas

at BNP Paribas SA. "The market has really vacillated between whether the heat's enough to move enough supply off-market

that we don't have a problem dealing with pipeline and storage constraints later in the season, and the concern that

there's just too much supply in the market."

Inventories now stand at 2.88 trillion cubic feet, 26% above the year-ago level and 3% above the five-year average

for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 30, 2015 15:09 ET (19:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

073015 19:09 -- GMT

------

EIA Weekly Natural Gas Storage Report - 52 Bcf Injection

For the week ended

July 24:

EIA Injection - 52 BCF

Last Year's Injection - 88 BCF

5 Yr Avg Injection - 48 BCF

Range of Estimates - 47 BCF to 59 BCF

Avg Estimate - 54 BCF

Total Gas in Storage - 2.880 TCF

EIA Injection - 52 BCF

Last Year's Injection - 88 BCF

5 Yr Avg Injection - 48 BCF

Range of Estimates - 47 BCF to 59 BCF

Avg Estimate - 54 BCF

Total Gas in Storage - 2.880 TCF

Dow Jones - Natural Gas Slips Ahead of Inventory Report

DJ Natural Gas Slips Ahead of Inventory Report

By Nicole Friedman

NEW YORK--Natural-gas prices declined Thursday ahead of a weekly inventory report that is expected to show that the

surplus of natural-gas supplies persisted last week.

Futures for September delivery recently fell 5.1 cents, or 1.8%, to $2.813 a million British thermal units on the New

York Mercantile Exchange.

The U.S. Energy Information Administration is set to release inventory data for the week ended July 24 at 10:30 a.m.

EDT. Analysts and traders surveyed by The Wall Street Journal expect the agency to report that natural-gas stockpiles

grew by 54 billion cubic feet last week, more than the 48-bcf five-year average build for that week.

If the storage estimate is correct, inventories as of July 24 will total 2.882 trillion cubic feet, 26% above the

year-ago level and 3.1% above the five-year average for the same week.

Prices gained for three straight sessions through Wednesday on expectations that above-normal temperatures would

spark additional demand for gas-powered electricity to run air conditioners. But traders are already looking ahead to

fall, when weather-driven demand typically fades and production is expected to remain robust.

"A supply surplus against normal levels has been established this summer and is likely to be maintained, with the

benefit of year-over-year production gains," said energy-advisory firm Ritterbusch & Associates in a note.

In physical gas markets, cash prices for next-day delivery at the benchmark Henry Hub last traded at $2.8625 a

million Btus, above Wednesday's range of $2.845-$2.9125. Prices at the Transco Z6 hub in New York last traded at $2.89a

million Btus, within Wednesday's range of $2.95-$3.04.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 30, 2015 09:56 ET (13:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

073015 13:56 -- GMT

------

By Nicole Friedman

NEW YORK--Natural-gas prices declined Thursday ahead of a weekly inventory report that is expected to show that the

surplus of natural-gas supplies persisted last week.

Futures for September delivery recently fell 5.1 cents, or 1.8%, to $2.813 a million British thermal units on the New

York Mercantile Exchange.

The U.S. Energy Information Administration is set to release inventory data for the week ended July 24 at 10:30 a.m.

EDT. Analysts and traders surveyed by The Wall Street Journal expect the agency to report that natural-gas stockpiles

grew by 54 billion cubic feet last week, more than the 48-bcf five-year average build for that week.

If the storage estimate is correct, inventories as of July 24 will total 2.882 trillion cubic feet, 26% above the

year-ago level and 3.1% above the five-year average for the same week.

Prices gained for three straight sessions through Wednesday on expectations that above-normal temperatures would

spark additional demand for gas-powered electricity to run air conditioners. But traders are already looking ahead to

fall, when weather-driven demand typically fades and production is expected to remain robust.

"A supply surplus against normal levels has been established this summer and is likely to be maintained, with the

benefit of year-over-year production gains," said energy-advisory firm Ritterbusch & Associates in a note.

In physical gas markets, cash prices for next-day delivery at the benchmark Henry Hub last traded at $2.8625 a

million Btus, above Wednesday's range of $2.845-$2.9125. Prices at the Transco Z6 hub in New York last traded at $2.89a

million Btus, within Wednesday's range of $2.95-$3.04.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 30, 2015 09:56 ET (13:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

073015 13:56 -- GMT

------

Natural Gas Corner - Technical Review - New Prices Lows Expected In Upcoming Trade

The new front month September 15 natural gas contract

rallied higher on Wednesday during expiration of the August 15 contract closing

up for a third consecutive day. Gains for the session were .048 or 1.7%

with the September contract settling at 2.864.

The market could continue higher near term possibly back

toward last week’s 2.957 high. The longer term trend for the market

remains sideways to down with new lows expected in upcoming trade.

The 10 and 40 day moving averages between 2.820-2.840 are

the first support levels today following by the 2.735 weekly low set on

Monday. Longer term support levels are the 2.590-2.600 weekly lows posted

earlier this year. A drop under weekly low support would turn 2.440-2.450

and 2.230-2.250 into the next longer term support levels.

The 2.957-2.988 weekly highs are primary resistance followed

by the 200 day moving average currently at 3.060.

Technical Indicators: Moving Average Alignment –

Neutral-Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Wednesday, July 29, 2015

Natural Gas Corner - Market Update - U.S. Dry Natural Gas Production Falls 5 Out of The Past 8 Weeks

Production data for the natural gas market can be somewhat difficult to gather as the EIA releases production on a delayed basis that is typically delayed around 2 months.

The EIA does on a weekly basis release production data from Bentek which is shown on the above table for the past 8 weeks.

Weekly production when falling is shown in red while weekly production rising is shown in black.

Over the past 8 weeks, production has fallen 5 out of the past 8 weeks. While the decrease is small, it could be showing that the natural gas rig count falling to a new all-time low may be finally affecting production.

If production does continue to fall, it could be a bullish catalyst for the market later this year. At the present time, nearly all of the focus is on storage and the likelihood for a record high amount of gas to be in storage by the end of the year.

Analysts' Estimates For Tomorrow's EIA Weekly Natural Gas Storage Report

DJ Analysts See 54 Billion-Cubic-Feet Rise in U.S. Natural-Gas Inventories

By Nicole Friedman

Analysts and traders expect government data scheduled for release Thursday to show natural-gas inventories rose by

more than typical levels for this time of year.

The U.S. Energy Information Administration is expected to report that 54 billion cubic feet of gas were added to

storage during the week ended July 24, according to the average forecast of 17 analysts and traders surveyed by The

Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the July 24 week, the median estimate is for a rise of 54 bcf. Estimates range from an increase of 47 bcf to a

rise of 59 bcf.

The estimate for July 24 is below last year's 88-bcf build in storage for the same week, and more than the 48-bcf

five-year average build for that week.

If the storage estimate is correct, inventories as of July 24 will total 2.882 trillion cubic feet, 26% above the

year-ago level and 3.1% above the five-year average for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 29, 2015 14:22 ET (18:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

072915 18:22 -- GMT

------

By Nicole Friedman

Analysts and traders expect government data scheduled for release Thursday to show natural-gas inventories rose by

more than typical levels for this time of year.

The U.S. Energy Information Administration is expected to report that 54 billion cubic feet of gas were added to

storage during the week ended July 24, according to the average forecast of 17 analysts and traders surveyed by The

Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the July 24 week, the median estimate is for a rise of 54 bcf. Estimates range from an increase of 47 bcf to a

rise of 59 bcf.

The estimate for July 24 is below last year's 88-bcf build in storage for the same week, and more than the 48-bcf

five-year average build for that week.

If the storage estimate is correct, inventories as of July 24 will total 2.882 trillion cubic feet, 26% above the

year-ago level and 3.1% above the five-year average for the same week.

Write to Nicole Friedman at nicole.friedman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 29, 2015 14:22 ET (18:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

072915 18:22 -- GMT

------

Dow Jones - Natural Gas Gains As Cooling Front Fades

DJ Natural Gas Gains as Cooling Front Fades

By Christian Berthelsen

Natural gas futures rose Wednesday as new forecasts said a hoped-for cooling-off after a spate of high temperatures

in the Midwest and eastern seaboard would be less intense than expected, increasing expectations for gas-fired summer

air conditioning.

Natural gas futures for September delivery were up 3 cents, or 1.1%, at $2.85 a million British thermal units on the

New York Mercantile Exchange, on pace for its third straight gain. The market has wavered in recent weeks as the first

sustained summer heat has started to kick in, gaining 2.5% since last week.

Natural gas demand rises during the summer to meet power-generation demand as homes and offices turn on the air

conditioning. Temperatures have been surging in the East, and now forecasts say an anticipated cooling front in the

coming weeks will be smaller and weaker than previously expected.

"There are reports of elevated power generation demand for natural gas across the U.S., as air conditioning demand

ticks higher," research consultancy Hightower Report said in a note.

In physical gas markets, cash prices for next-day delivery at the benchmark Henry Hub last traded at $2.9075 a

million Btus, above Tuesday's range of $2.84-$2.89. Prices at the Transco Z6 hub in New York last traded at $3.00 a

million Btus, within Tuesday's range of $2.96.-$3.01.

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 29, 2015 10:16 ET (14:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

072915 14:16 -- GMT

------

By Christian Berthelsen

Natural gas futures rose Wednesday as new forecasts said a hoped-for cooling-off after a spate of high temperatures

in the Midwest and eastern seaboard would be less intense than expected, increasing expectations for gas-fired summer

air conditioning.

Natural gas futures for September delivery were up 3 cents, or 1.1%, at $2.85 a million British thermal units on the

New York Mercantile Exchange, on pace for its third straight gain. The market has wavered in recent weeks as the first

sustained summer heat has started to kick in, gaining 2.5% since last week.

Natural gas demand rises during the summer to meet power-generation demand as homes and offices turn on the air

conditioning. Temperatures have been surging in the East, and now forecasts say an anticipated cooling front in the

coming weeks will be smaller and weaker than previously expected.

"There are reports of elevated power generation demand for natural gas across the U.S., as air conditioning demand

ticks higher," research consultancy Hightower Report said in a note.

In physical gas markets, cash prices for next-day delivery at the benchmark Henry Hub last traded at $2.9075 a

million Btus, above Tuesday's range of $2.84-$2.89. Prices at the Transco Z6 hub in New York last traded at $3.00 a

million Btus, within Tuesday's range of $2.96.-$3.01.

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

July 29, 2015 10:16 ET (14:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

072915 14:16 -- GMT

------

Natural Gas Corner - Technical Review - Market Gains For A Second Day

Today’s expiring August 15 natural gas contract moved higher

for a second day on Tuesday but remains mired in a sideways trading

range. The August contract gained .032 settling at 2.821.

The trend for the market remains sideways to down but could

see further upside price action today during expiration of the August contract.

The current overnight high of 2.873 is the first area of

resistance followed by last week’s 2.951 high. Longer term

resistance is the 200 day moving average currently at 3.070.

Last Friday’s 2.735 low is primary support followed by the

early-July 2.644 low. Longer term support levels at the 2.569 and 2.588

weekly lows set in late-April and early-June.

Technical Indicators: Moving Average Alignment –

Neutral

Long

Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Comments (Atom)