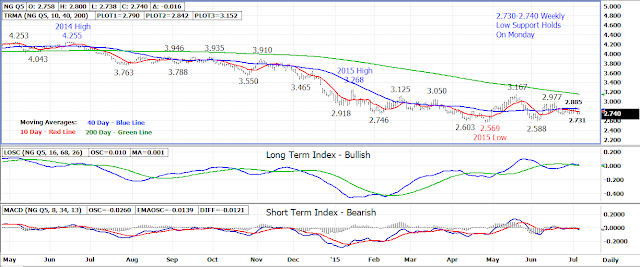

The August 15 natural gas contract fell back toward 2.730-2.740 weekly low support in early trade on Monday which held keeping the market is a two week sideways range.

The August contract spent the remainder of the session in

listless trade settling the day at 2.756, down .066 (2.3%).

The August contract rallied up to a 2.800 overnight high

closing the small open gap area between 2.787-2.795 created on Monday’s

open.

The primary trend remains sideways to lower with a breakout

under 2.730-2.740 weekly low support needed to trigger the next leg down in the

market. If 2.730 support is broken, the 2.569 and 2.588 weekly lows from

April and June will become the next downside objective. A breakout

under weekly low support would be another bearish technical signal for the

market.

The upper end of the past 2 week range at 2.870-2.885 is

primary resistance as a breakout above this area will turn the near term

trend back up. Longer term resistance is the 200 day moving average at

3.155 which coincides with the 3.167 mid-May high. A breakout above these

two resistance areas would turn the longer term trend back up.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – BullishShort Term Trend Following Index - Bearish

No comments:

Post a Comment