The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Tuesday, November 4, 2014

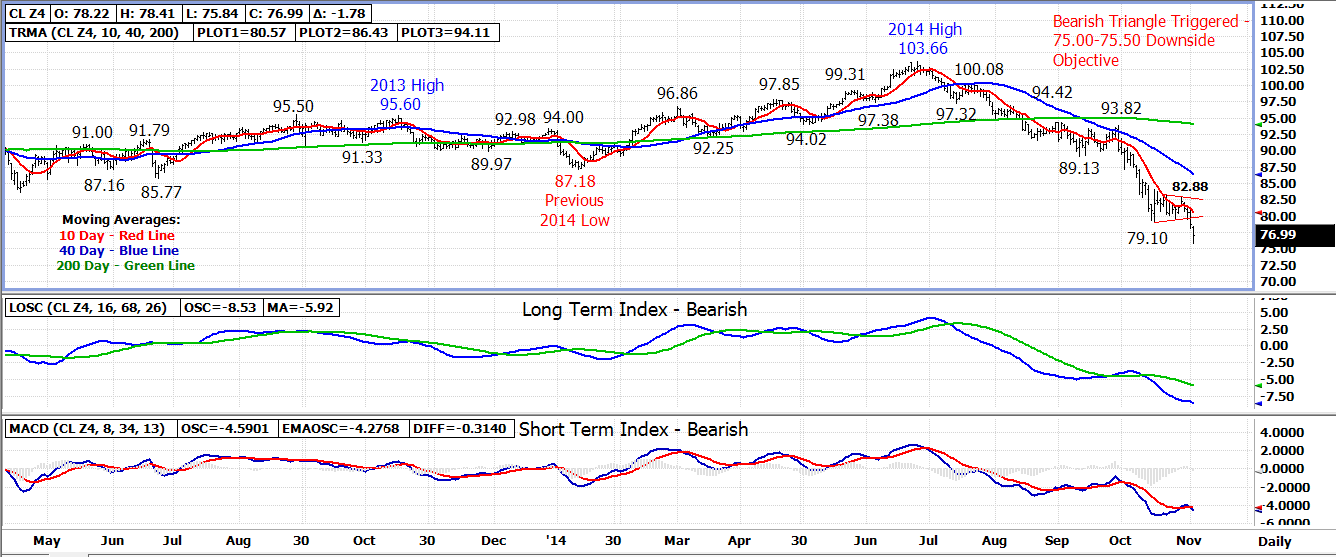

Crude Oil Technical Update - Bearish Triangle Pattern Triggered On Monday

The December 14 crude oil contract broke out to the downside under trend line support near 79.50 on Monday triggering a bearish triangle pattern.

After closing yesterday’s session lower by 1.76 settling at 78.78, the December contract is again under heavy selling pressure in the overnight session currently down over 2.00.

The downside measuring objective for the triangle initiated on Monday is for the December contract to trade down to the 75.00-75.00 area. This support also coincides with weekly chart low at the 74.00-75.00 area set in 2009-2010 and could be an area the market stabilizes.

With crude oil in a near free fall, funds are likely in liquidation mode. Last Friday’s Commitment of Trader’s report showed the funds long a hefty 267,304 contracts as of last Tuesday’s close. Funds accumulated a record high long position of 458,696 contracts the very week the market topped in June. From the June high, funds have been liquidating but remain very long considering recent weakness in the market.

Technical Indicators: Moving Average Alignment - - Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment