The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Wednesday, November 5, 2014

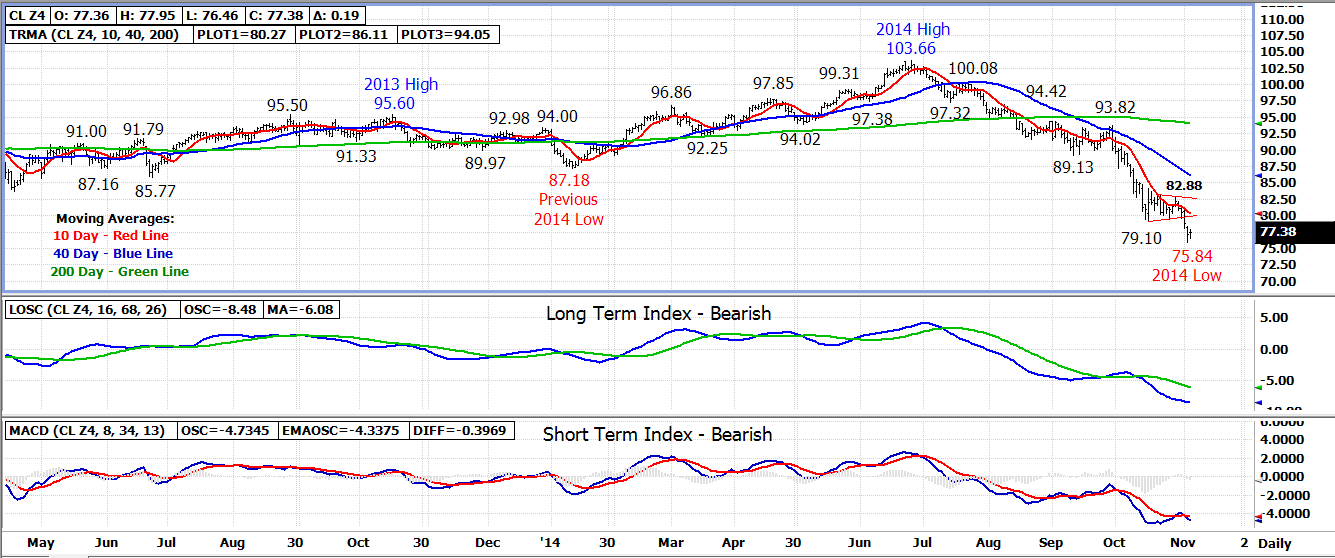

Crude Oil Technical Update - Downside Price Objective For Bearish Triangle Pattern Nearly Reached On Tuesday

Crude oil prices tumbled lower for a fourth consecutive day on Tuesday with the December 14 contract trading down to the lowest spot price level since October 2011.

The December contract bottomed out at a 75.84 low on Tuesday but rose slightly into the close settling at 77.19, down 1.59 (2%).

The bearish triangle triggered on Monday has a downside measuring objective for the December contract to trade down to 75.00-75.50 and was almost reached on Tuesday.

The mid-70.00 is an important long term support level as it was where the market bottomed out at 74.95 and 75.71 lows during August and October 2011.

78.40-78.50 is the first area of resistance with longer term resistance at former triangle trend line support near 80.00.

Bottom line – Mid-70.00 is a key support area to hold. If broken, 64.00-65.00 weekly lows from 2009 and 2010 could be tested.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index- Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment