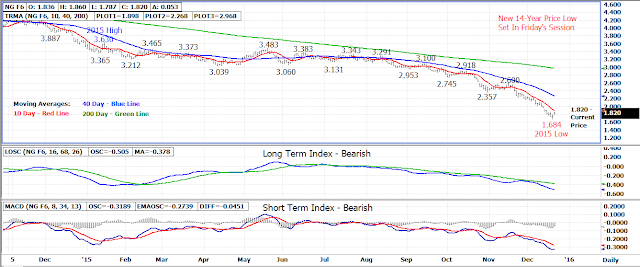

The natural gas has closed down 5 out of the past 6 weeks

trading on Friday down to a new 14-year price low.

The spot January 16 natural gas contract bottomed out at a

1.684 morning low on Friday settling the day at 1.767. For the week, the contract lost .223 or

11.2%.

The market has bounced higher from last week’s low in today’s

early trade but the primary trend remains down.

Last week’s 1.684 low is the first area of support followed by monthly

low support from August 1998 at 1.610.

The 10 day moving average at 1.900 is the first area of

resistance today followed by the open gap created last Monday between

1.923-1.959. A breakout above the top of

open gap area will turn the near term trend back up.

The fund long position in the natural gas market jumped by

over 50% last week according to the Commitment of Trader’s report released on Friday. The fund long futures position rose by 13,268

contracts to 39,479 contracts.

Technical Indicators:

Moving Average Alignment – Bearish

Long

Term Trend Following Index – Bearish

Short Term Trend Following

Index - Bearish

No comments:

Post a Comment