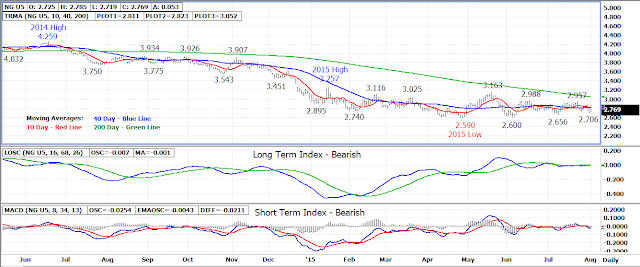

Natural gas prices remained weak into last Friday’s close

with the spot September 15 contract trading down to a new 2 ½ week price

low.

For the week, the September contract lost .059 or 2.1% with

all the losses coming during Thursday and Friday’s sessions.

Last Friday’s 2.706 low is the fourth in a series of

increasing high lows dating back to the 2.590 contract low for the

September contract. The last three lows have been followed by rallies

back higher.

Longer term, the market remains in a 3+ month sideways

trading range with support for the September contract between 2.590-2.700 and

resistance between 2.950-3.050. The market should breakout from this

range toward summer’s end, possibly in the next few weeks.

A downside breakout under 2.590-2.700 support would turn

2.440-2.450 into the next longer term support area followed by

2.230-2.250. If the breakout instead comes to the upside above

2.950-3.050 resistance, the longer term market trend will turn back up.

Funds are back in buying natural gas futures according to

Friday’s Commitment of Trader’s report. The speculative long position in

the natural gas market (futures only) was estimated at 144,048 contracts,

up 17,085 from the previous week.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

No comments:

Post a Comment