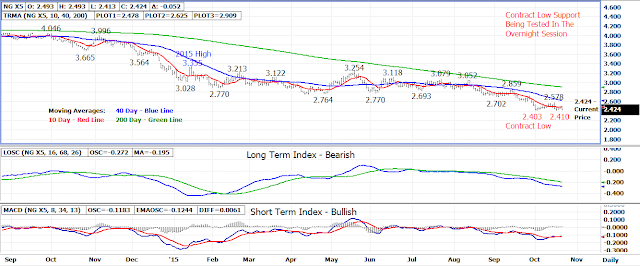

Natural gas prices rose for a second day on Tuesday but the

November 15 contract was unable to clear 10 day moving average resistance.

With resistance holding, the near term trend remains sideways to down for

the market.

After settling yesterday’s session at 2.476, up .034, the

November 15 contract has since sold back off in today’s early trade falling

back toward 2.403 weekly low support.

The 2.403 weekly low extending down to 2.385 is primary

support. If support is broken, 2.230-2.250 will turn into the next

longer term support.

The 10 day moving average at 2.480 is the first area of

resistance followed by last week’s 2.578 high. A breakout above last

week’s high and the 40 day moving average currently at 2.625 will turn the

longer term trend back up.

The bullish double bottom reversal will remain viable if

2.403-2.410 support can hold today.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

No comments:

Post a Comment