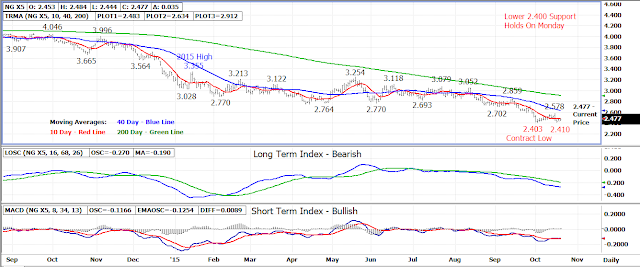

The November 15 natural gas contract held above support at

the lower-2.400 level for a second day on Monday. If support continues to

hold, a double bottom low reversal could be forming.

The November contract bottomed out at a 2.430 intraday low

on Monday but was unable to rally above 10 day moving average resistance

settling the day at 2.442, up .012.

The 10 day moving average at 2.485 today is the first area

of resistance followed by last week’s 2.578 high. A breakout above last

week’s high and the 40 day moving average at 2.640 will turn trigger the double

bottom reversal and will also turn the longer term trend back up.

The 2.403-2.410 lows set over the past month are primary

support. If broken, the trend will remain down with 2.230-2.250 becoming

the next longer term support.

Technical Indicators: Moving Average Alignment -

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

No comments:

Post a Comment