Natural gas prices rallied sharply higher in today's session with the June 15 contract closing up for a third consecutive day.

Nearly all of the daily gains came in just one minute of trade following release of the EIA weekly storage report. The June contract rallied from a 2.559 low to a 2.692 high, a .133 or 5.2% gain at 9:30 am central. It then trended sideways to higher into the daily close settling at $2.752/MMBtu.

The impetus behind today's rally was an 81 Bcf injection as reported by the EIA which was 6 Bcf lower than the average analyst's pre-report guesstimate of 87 Bcf. This is in comparison to a 77 Bcf injection last year and a 5-year average injection of 55 Bcf.

Today's injection was above-average for a fourth week in a row, but not quite as high as pre-report estimates. As market expectations were decidedly bearish, the storage number caused a stampede of the short position holders who found the market exit much smaller and narrower than expected. This is what short-covering rallies are made of.

But was today truly just a short-covering rally or the beginning of a new bullish uptrend?

The news in the market this week has been very bearish including a new record high daily production number on Monday reported by Bentek of 73.8 Bcf exceeding the previous high of 73.5 Bcf (billion cubic feet) reached on December 20th, 2014.

Weather forecasts have also been bearish particularly the longer range summer forecasts predicting below-normal temperatures in both Texas and the upper Midwest, both heavy users of natural gas for summer cooling.

Storage injections have also been negative as the first four injections of the season during April have totaled 249 Bcf, 115 Bcf or 85% higher than the 5-year average.

So why did the market rally higher today? Possibly because of short-covering. But possibly because much of the bearish news has already been discounted into the market price. That is what futures markets do.

A hallmark of a short-covering rally is a counter trend rally higher lasting 2-4 days followed by a price drop back lower which erases most, if not all, of the short-covering rally gains.

Whether or not the natural gas market quickly sells back off over the next few sessions will be a good indication behind recent strength. If the market fails to sell back off very soon, a post-winter and possibly long term low could be set.

But there is a better chance that this week's upside strength will fail. If it does, new lows are expected in the market.

The next few days of trade in the natural gas market should be most interesting and important to watch.

The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Thursday, April 30, 2015

Dow Jones Natural Gas - End of Day Commentary

DJ Natural Gas Has Largest Rally Since January on Smaller-than-Expected Surplus

By Timothy Puko

Natural gas prices surged to their largest one-day gains since January after government data showed stockpiles grew

less than expected.

Prices for the front-month June contract settled up 14.5 cents, or 5.6%, to $2.751 a million British thermal units on

the New York Mercantile Exchange. The gains started from a low point, having fallen by 1.5% in the morning as traders

expected one of the largest surpluses on record for April.

That didn't materialize, sparking the type of rally that is more common for gas in the dead of winter when heating

demand surges. The settlement is the highest since March 24 and halts, at least temporarily, what had been a month-long

grind downward.

The U.S. Energy Information Administration said storage levels grew by 81 billion cubic feet in the week ended April

24. That is 6 bcf less than the 87-bcf consensus average of forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

draw would indicate slightly smaller supply or larger demand than expected.

Traders have been betting big in favor of falling prices, according to regulatory figures that track money managers'

trades. There have been more than three positions in favor of falling prices for every two positions that would benefit

on rising prices.

Many of those bears have been trying to get out in the past week, said Michael Doyle, a broker at Eclipse

International Inc. in New York. And EIA data that suggested lower supply or higher demand than expected could have

amped up that effort.

"It's really a case of too many people on one side of the boat," he said. "If any one person wants to cover, then

it's going to rally like that."

Demand is low in the spring when comfortable weather leads people to turn off their heat for the year. But it is

likely to pick up in the weeks to come as they start to fire up air conditioners and power plants, many of which burn

natural gas, run more to meet the demand.

"Going into the (summer) season, nobody wants to sell $2.50 gas," said John Woods, president of JJ Woods Associates

and a Nymex trader. "I still like this going higher."

Mr. Woods said he has placed bullish bets on gas futures that will pay off if they rise past $2.80/mmBtu.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 30, 2015 15:13 ET (19:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 19:13 -- GMT

------

By Timothy Puko

Natural gas prices surged to their largest one-day gains since January after government data showed stockpiles grew

less than expected.

Prices for the front-month June contract settled up 14.5 cents, or 5.6%, to $2.751 a million British thermal units on

the New York Mercantile Exchange. The gains started from a low point, having fallen by 1.5% in the morning as traders

expected one of the largest surpluses on record for April.

That didn't materialize, sparking the type of rally that is more common for gas in the dead of winter when heating

demand surges. The settlement is the highest since March 24 and halts, at least temporarily, what had been a month-long

grind downward.

The U.S. Energy Information Administration said storage levels grew by 81 billion cubic feet in the week ended April

24. That is 6 bcf less than the 87-bcf consensus average of forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

draw would indicate slightly smaller supply or larger demand than expected.

Traders have been betting big in favor of falling prices, according to regulatory figures that track money managers'

trades. There have been more than three positions in favor of falling prices for every two positions that would benefit

on rising prices.

Many of those bears have been trying to get out in the past week, said Michael Doyle, a broker at Eclipse

International Inc. in New York. And EIA data that suggested lower supply or higher demand than expected could have

amped up that effort.

"It's really a case of too many people on one side of the boat," he said. "If any one person wants to cover, then

it's going to rally like that."

Demand is low in the spring when comfortable weather leads people to turn off their heat for the year. But it is

likely to pick up in the weeks to come as they start to fire up air conditioners and power plants, many of which burn

natural gas, run more to meet the demand.

"Going into the (summer) season, nobody wants to sell $2.50 gas," said John Woods, president of JJ Woods Associates

and a Nymex trader. "I still like this going higher."

Mr. Woods said he has placed bullish bets on gas futures that will pay off if they rise past $2.80/mmBtu.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 30, 2015 15:13 ET (19:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 19:13 -- GMT

------

Dow Jones Post-EIA Report Commentary For Natural Gas

DJ Natural Gas Prices Surge After Smaller-than-Expected Addition to Stockpiles

By Timothy Puko

Natural gas prices flipped to gains Thursday, hitting their highest point in a month after data showed stockpiles

grew less than expected.

The U.S. Energy Information Administration said storage levels grew by 81 billion cubic feet in the week ended April

24. That is 6 bcf less than the 87-bcf consensus average of forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

draw would indicate slightly smaller supply or larger demand than expected.

The front-month June contract recently traded up 11.2 cents, or 4.3%, at $2.718 a million British thermal units on

the New York Mercantile Exchange. It had been trading about 1.5% lower to start the session as traders anticipated one

of the biggest ever surpluses on record for April.

The rally pushed prices to $2.732, their highest intraday point since March 26, before easing slightly.

Traders have been betting big in favor of falling prices, according to regulatory figures that track money managers'

trades. There are more than three positions in favor of falling prices for every two positions that would benefit on

rising prices.

Many of those bears have been trying to get out, said Michael Doyle, a broker at Eclipse International Inc. in New

York. And a number that suggested lower supply or higher demand than expected could have amped up that effort.

"It's really a case of too many people on one side of the boat," he said. "If any one person wants to cover, then

it's going to rally like that."

This addition brought storage levels to 1.7 trillion cubic feet, 76% more than a year ago and 4.2% below the

five-year average.

Write to Timothy Puko at Tim.Puko@wsj.com

-30-

(MORE TO FOLLOW) Dow Jones Newswires

April 30, 2015 11:09 ET (15:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 15:09 -- GMT

------

By Timothy Puko

Natural gas prices flipped to gains Thursday, hitting their highest point in a month after data showed stockpiles

grew less than expected.

The U.S. Energy Information Administration said storage levels grew by 81 billion cubic feet in the week ended April

24. That is 6 bcf less than the 87-bcf consensus average of forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

draw would indicate slightly smaller supply or larger demand than expected.

The front-month June contract recently traded up 11.2 cents, or 4.3%, at $2.718 a million British thermal units on

the New York Mercantile Exchange. It had been trading about 1.5% lower to start the session as traders anticipated one

of the biggest ever surpluses on record for April.

The rally pushed prices to $2.732, their highest intraday point since March 26, before easing slightly.

Traders have been betting big in favor of falling prices, according to regulatory figures that track money managers'

trades. There are more than three positions in favor of falling prices for every two positions that would benefit on

rising prices.

Many of those bears have been trying to get out, said Michael Doyle, a broker at Eclipse International Inc. in New

York. And a number that suggested lower supply or higher demand than expected could have amped up that effort.

"It's really a case of too many people on one side of the boat," he said. "If any one person wants to cover, then

it's going to rally like that."

This addition brought storage levels to 1.7 trillion cubic feet, 76% more than a year ago and 4.2% below the

five-year average.

Write to Timothy Puko at Tim.Puko@wsj.com

-30-

(MORE TO FOLLOW) Dow Jones Newswires

April 30, 2015 11:09 ET (15:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 15:09 -- GMT

------

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Slips on Expectations for Big Surplus

By Timothy Puko

Natural gas prices are falling as traders anticipate one of the biggest surpluses on record for April.

Natural gas for May delivery fell 3.9 cents, or 1.5%, at $2.567 a million British thermal units on the New York

Mercantile Exchange.

Analysts and brokers are expecting data on the way Thursday to show the fourth-largest surplus on record for April, a

time when lingering heating demand usually limits surpluses. The U.S. Energy Information Administration gives its

weekly update on storage levels for the prior week at 10:30 a.m. EDT.

That "would be mucho larger than last year's 77 Bcf, and mucho, mucho larger than the five-year average of 55 Bcf,"

Matt Smith, an analyst at consultant Schneider Electric SA in Louisville, Ky., said in a note to clients.

Producers just had the second-highest April surplus last week. Production has been at or near record levels for more

than a year, so it is overwhelming demand that plummets as mild spring weather cuts the need for heat and electricity,

analysts said.

It is "indicative of a gas market struggling to match demand [with] robust supply," energy investment bank Tudor,

Pickering, Holt & Co. said in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.565/mmBtu, compared with

Wednesday's range of $2.55-$2.565. Cash prices at the Transco Z6 hub in New York last traded at $2.60/mmBtu, compared

with Wednesday's range of $2.37 to $2.46.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 30, 2015 09:55 ET (13:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 13:55 -- GMT

------

By Timothy Puko

Natural gas prices are falling as traders anticipate one of the biggest surpluses on record for April.

Natural gas for May delivery fell 3.9 cents, or 1.5%, at $2.567 a million British thermal units on the New York

Mercantile Exchange.

Analysts and brokers are expecting data on the way Thursday to show the fourth-largest surplus on record for April, a

time when lingering heating demand usually limits surpluses. The U.S. Energy Information Administration gives its

weekly update on storage levels for the prior week at 10:30 a.m. EDT.

That "would be mucho larger than last year's 77 Bcf, and mucho, mucho larger than the five-year average of 55 Bcf,"

Matt Smith, an analyst at consultant Schneider Electric SA in Louisville, Ky., said in a note to clients.

Producers just had the second-highest April surplus last week. Production has been at or near record levels for more

than a year, so it is overwhelming demand that plummets as mild spring weather cuts the need for heat and electricity,

analysts said.

It is "indicative of a gas market struggling to match demand [with] robust supply," energy investment bank Tudor,

Pickering, Holt & Co. said in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.565/mmBtu, compared with

Wednesday's range of $2.55-$2.565. Cash prices at the Transco Z6 hub in New York last traded at $2.60/mmBtu, compared

with Wednesday's range of $2.37 to $2.46.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 30, 2015 09:55 ET (13:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

043015 13:55 -- GMT

------

EIA Weekly Storage Report - 81 Bcf Injection - Lower Than Expected

For the week ended

April 24:

EIA Injection - 81 BCF

Last Year's Injection - 77 BCF

5 Yr Avg Injection - 55 BCF

Range of Estimates - 74 BCF to 94 BCF

Avg Estimate - 87 BCF

Total Gas in Storage - 1.710 TCF

EIA Injection - 81 BCF

Last Year's Injection - 77 BCF

5 Yr Avg Injection - 55 BCF

Range of Estimates - 74 BCF to 94 BCF

Avg Estimate - 87 BCF

Total Gas in Storage - 1.710 TCF

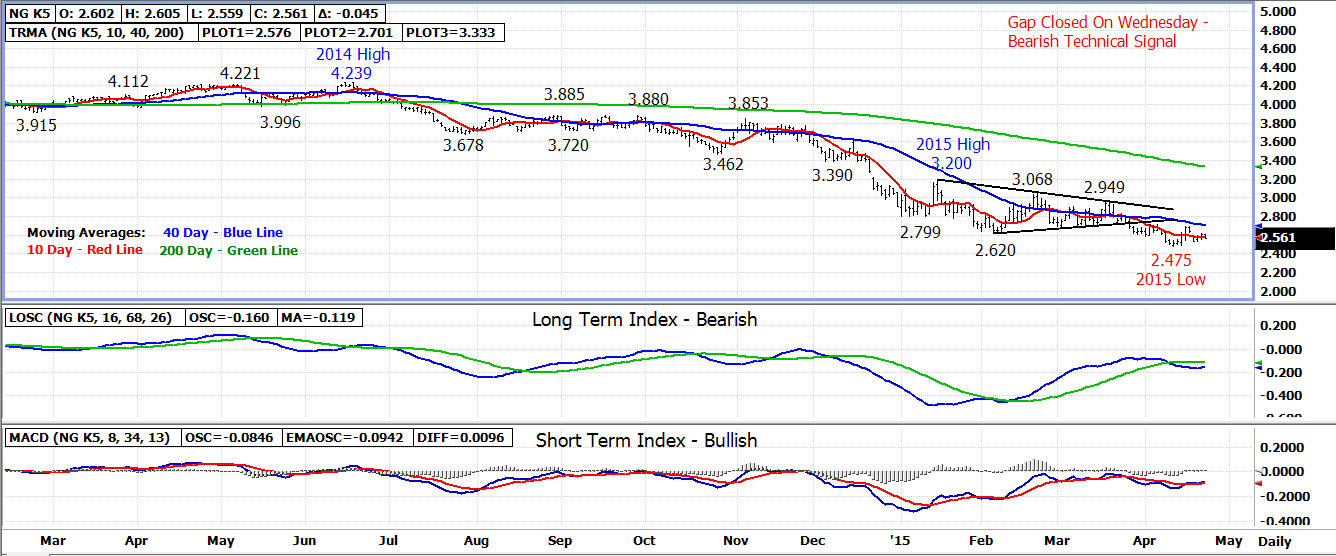

Natural Gas Corner - Technical Update - Two Day Short-Covering Rally May Be Over

A two day short-covering rally that lifted the June 15 natural gas contract by 5% from Monday’s low may have come to an end in yesterday’s trade.

The June contract did gain .069 (2.7%) in Wednesday’s trade settling at 2.606. But it could not close above 10 day moving average resistance which could mark a trend turn back lower.

The 10 day moving average at 2.590 today extending up to yesterday’s 2.612 high is the first area of resistance followed by 2.650-2.660. Longer term resistance is the 40 day moving average at 2.715.

2.540-2.550 is the first area of support today followed by 2.510 and the 2.485 contract low set on Monday. Longer term support from the weekly chart is at 2.230.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Wednesday, April 29, 2015

Analysts' Estimates For Tomorrow's Weekly EIA Natural Gas Storage Report

DJ Analysts See 87-Billion-Cubic-Feet Addition to U.S. Natural Gas Inventories

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural gas inventories added

about 50% more to stockpiles last week than they usually do at this time of year.

The U.S. Energy Information Administration is expected to report storage levels grew by 87 billion cubic feet of gas

during the week ended Friday, according to the average forecast of 14 analysts and traders surveyed by The Wall Street

Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the week ended Friday, the median estimate is for an addition of 89 bcf. Estimates range from an addition of 74

bcf to an addition of 94 bcf.

The estimate for Friday compares to 77 bcf added to storage for the same week last year and the 55-bcf five-year

average addition for that week.

If the storage estimate is correct, inventories as of Friday totaled 1.7 trillion cubic feet, 77% above levels from a

year ago and 3.9% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 29, 2015 15:28 ET (19:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042915 19:28 -- GMT

------

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural gas inventories added

about 50% more to stockpiles last week than they usually do at this time of year.

The U.S. Energy Information Administration is expected to report storage levels grew by 87 billion cubic feet of gas

during the week ended Friday, according to the average forecast of 14 analysts and traders surveyed by The Wall Street

Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the week ended Friday, the median estimate is for an addition of 89 bcf. Estimates range from an addition of 74

bcf to an addition of 94 bcf.

The estimate for Friday compares to 77 bcf added to storage for the same week last year and the 55-bcf five-year

average addition for that week.

If the storage estimate is correct, inventories as of Friday totaled 1.7 trillion cubic feet, 77% above levels from a

year ago and 3.9% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 29, 2015 15:28 ET (19:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042915 19:28 -- GMT

------

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Seeing Rebound From Lowest Point Since 2012

By Timothy Puko

Natural gas prices are inching up for a second straight session as brokers and traders say the small moves are just a

rebound from when gas hit its lowest point since 2012 earlier this week.

Natural gas for June delivery is up 2.5 cents, or 1%, at $2.562 a million British thermal units on the New York

Mercantile Exchange. Gas is up 2.9% since it closed at $2.49/mmBtu on Monday, its lowest settlement since June 15,

2012.

Much of the move is simply a reaction to hitting that low. Bets on falling prices have been outnumbering bets on

rising prices by more than 3 to 2 in recent weeks, making it a crowded trade that dissuades others from selling more,

analysts said. Gas has also rebounded from multi-year lows a few times this year, and so some traders who move based on

charts and momentum are buying because they expect that pattern to repeat now, said Frank Clements, co-owner of

Meridian Energy Brokers Inc. outside New York.

"It's this two-steps-down-one-step-back mentality right now," and it gets people who bet against prices to close out

those bets and lock in profits by buying back contracts they once sold, Mr. Clements said. "Take what the market's been

giving you."

Weather forecasts have changed little and the spring season usually brings comfortable temperatures that damp demand

for energy to heat or cool homes. Trading has been minimal and the small moves of the past two days are ultimately "of

no consequence," said Dean Hazelcorn, trader at the brokerage Coquest Inc. in Dallas.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with Tuesday's

range of $2.5175-$2.56. Cash prices at the Transco Z6 hub in New York last traded at $2.45/mmBtu, compared with

Tuesday's range of $2.40 to $2.43.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 29, 2015 09:54 ET (13:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042915 13:54 -- GMT

------

By Timothy Puko

Natural gas prices are inching up for a second straight session as brokers and traders say the small moves are just a

rebound from when gas hit its lowest point since 2012 earlier this week.

Natural gas for June delivery is up 2.5 cents, or 1%, at $2.562 a million British thermal units on the New York

Mercantile Exchange. Gas is up 2.9% since it closed at $2.49/mmBtu on Monday, its lowest settlement since June 15,

2012.

Much of the move is simply a reaction to hitting that low. Bets on falling prices have been outnumbering bets on

rising prices by more than 3 to 2 in recent weeks, making it a crowded trade that dissuades others from selling more,

analysts said. Gas has also rebounded from multi-year lows a few times this year, and so some traders who move based on

charts and momentum are buying because they expect that pattern to repeat now, said Frank Clements, co-owner of

Meridian Energy Brokers Inc. outside New York.

"It's this two-steps-down-one-step-back mentality right now," and it gets people who bet against prices to close out

those bets and lock in profits by buying back contracts they once sold, Mr. Clements said. "Take what the market's been

giving you."

Weather forecasts have changed little and the spring season usually brings comfortable temperatures that damp demand

for energy to heat or cool homes. Trading has been minimal and the small moves of the past two days are ultimately "of

no consequence," said Dean Hazelcorn, trader at the brokerage Coquest Inc. in Dallas.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with Tuesday's

range of $2.5175-$2.56. Cash prices at the Transco Z6 hub in New York last traded at $2.45/mmBtu, compared with

Tuesday's range of $2.40 to $2.43.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 29, 2015 09:54 ET (13:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042915 13:54 -- GMT

------

Natural Gas Corner - Technical Update - Another Short-Covering Rally Lifting The Market

The new front month June 15 natural gas contract’s late-day recovery on Monday was followed by continued buying in yesterday’s trade as it gained .023 to settle at 2.537.

Recent strength comes after a gap lower open on Monday during which the June contract fell to a new contract low at 2.481. The gap between 2.531-2.555 created on Monday has now been closed in the overnight session turning the 10 day moving average at 2.600 into the next upside resistance.

Once near term strength ends, a retest of Monday’s 2.481 low is expected. If broken, the 2015 spot contract low of 2.443 will become the next downside support followed by 2.390-2.400. Longer term support from the weekly chart is at 2.230.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Tuesday, April 28, 2015

Dow Jones Natural Gas - End of Day Update

DJ Natural Gas Climbs as Contract Expires

By Timothy Puko and Carolyn Cui

Natural gas futures rose Tuesday as the front-month contract headed toward expiration, pushing a rebound amid a raft

of bearish bets.

Bets on falling prices have been outnumbering wagers on rising prices by more than 3 to 2 in recent weeks, a scenario

that can cause a rally on expiration day. Many of those bears will have to close out their bets or roll them over to

the next month, and to do that they must buy back into a contract they once sold.

"Some traders would wait until the last minute to get out of their positions," said Phil Flynn, a futures account

executive at the Price Futures Group in Chicago. Unlike many other commodities, the first notice day comes after the

expiration in the energy markets, allowing traders to hold their positions until the last trading day.

Prices for the front-month May contract gained 2.7 cents, or 1.1%, to $2.5170 a million British thermal units on the

New York Mercantile Exchange. The more heavily traded June contract gained 2.3 cents, or 0.9%, to $2.5370/mmBtu.

Mild weather and healthy supply limited the gains, analysts said. At a time of near-record U.S. production, spring

weather forecasts also look comfortable nationwide, capping demand for energy to heat or cool homes. That is likely to

lead to large weekly surpluses that keep June futures stalled below $2.55/mmBtu, said Jim Ritterbusch, president of

energy-advisory firm Ritterbusch & Associates.

FUTURES SETTLEMENT NET CHANGE

Nymex May $2.517 +2.7c

Nymex June $2.537 +2.3c

Nymex July $2.591 +2.2c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.35-$2.37 $2.28-$2.31

El Paso SJ $2.35-$2.37 $2.2825-$2.31

Henry Hub $2.5175-$2.56 $2.4625-$2.495

Katy $2.48-$2.5450 $2.44-$2.52

SoCal $2.4875-$2.45 $2.40-$2.42

Tex East M3 $1.65-$1.755 $1.62-$1.80

Transco 65 $2.50-$2.52 $2.45-$2.4725

Transco Z6 $2.40-$2.43 $2.45-$2.53

Waha $2.42-$2.43 $2.36-$2.41

Write to Timothy Puko at tim.puko@wsj.com and Carolyn Cui at carolyn.cui@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 28, 2015 15:44 ET (19:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042815 19:44 -- GMT

------

By Timothy Puko and Carolyn Cui

Natural gas futures rose Tuesday as the front-month contract headed toward expiration, pushing a rebound amid a raft

of bearish bets.

Bets on falling prices have been outnumbering wagers on rising prices by more than 3 to 2 in recent weeks, a scenario

that can cause a rally on expiration day. Many of those bears will have to close out their bets or roll them over to

the next month, and to do that they must buy back into a contract they once sold.

"Some traders would wait until the last minute to get out of their positions," said Phil Flynn, a futures account

executive at the Price Futures Group in Chicago. Unlike many other commodities, the first notice day comes after the

expiration in the energy markets, allowing traders to hold their positions until the last trading day.

Prices for the front-month May contract gained 2.7 cents, or 1.1%, to $2.5170 a million British thermal units on the

New York Mercantile Exchange. The more heavily traded June contract gained 2.3 cents, or 0.9%, to $2.5370/mmBtu.

Mild weather and healthy supply limited the gains, analysts said. At a time of near-record U.S. production, spring

weather forecasts also look comfortable nationwide, capping demand for energy to heat or cool homes. That is likely to

lead to large weekly surpluses that keep June futures stalled below $2.55/mmBtu, said Jim Ritterbusch, president of

energy-advisory firm Ritterbusch & Associates.

FUTURES SETTLEMENT NET CHANGE

Nymex May $2.517 +2.7c

Nymex June $2.537 +2.3c

Nymex July $2.591 +2.2c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.35-$2.37 $2.28-$2.31

El Paso SJ $2.35-$2.37 $2.2825-$2.31

Henry Hub $2.5175-$2.56 $2.4625-$2.495

Katy $2.48-$2.5450 $2.44-$2.52

SoCal $2.4875-$2.45 $2.40-$2.42

Tex East M3 $1.65-$1.755 $1.62-$1.80

Transco 65 $2.50-$2.52 $2.45-$2.4725

Transco Z6 $2.40-$2.43 $2.45-$2.53

Waha $2.42-$2.43 $2.36-$2.41

Write to Timothy Puko at tim.puko@wsj.com and Carolyn Cui at carolyn.cui@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 28, 2015 15:44 ET (19:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042815 19:44 -- GMT

------

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Inches Higher on Expiration Day

By Timothy Puko

Natural gas prices inched higher Tuesday as the front-month contract heads toward expiration, pushing a rebound amid

a raft of bearish bets.

Bets on falling prices have been outnumbering bets on rising prices by more than three-to-two in recent weeks, a

scenario that can cause a rally on expiration day. Many of those bears will have to close out their bets or roll them

over to the next month, and to do it they have to buy back into a contract they once sold, according to BNP Paribas SA.

"Expiration can be tricky," said Scott Gettleman, an independent trader in New York.

Prices for the front-month May contract gained 0.3 cent, or 0.1%, to $2.493 a million British thermal units on the

New York Mercantile Exchange. The June contract is now more heavily traded, with May's expiring at the end of Tuesday's

trading. May options expired on Monday. The June contract gained 0.8 cent, or 0.3%, to $2.522/mmBtu.

Mild weather and healthy supply are likely to limit any rally, though, analysts said. At a time of near-record

production, spring weather forecasts also look comfortable nationwide, capping demand for energy to heat or cool homes.

That is likely to lead to large weekly surpluses that keep June futures stalled below $2.55/mmBtu, said Jim

Ritterbusch, president of energy-advisory firm Ritterbusch & Associates.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.54/mmBtu, compared with Monday's

range of $2.4625-$2.495. Cash prices at the Transco Z6 hub in New last traded at $2.40/mmBtu, compared with Monday's

range of $2.45 to $2.53.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 28, 2015 09:08 ET (13:08 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

By Timothy Puko

Natural gas prices inched higher Tuesday as the front-month contract heads toward expiration, pushing a rebound amid

a raft of bearish bets.

Bets on falling prices have been outnumbering bets on rising prices by more than three-to-two in recent weeks, a

scenario that can cause a rally on expiration day. Many of those bears will have to close out their bets or roll them

over to the next month, and to do it they have to buy back into a contract they once sold, according to BNP Paribas SA.

"Expiration can be tricky," said Scott Gettleman, an independent trader in New York.

Prices for the front-month May contract gained 0.3 cent, or 0.1%, to $2.493 a million British thermal units on the

New York Mercantile Exchange. The June contract is now more heavily traded, with May's expiring at the end of Tuesday's

trading. May options expired on Monday. The June contract gained 0.8 cent, or 0.3%, to $2.522/mmBtu.

Mild weather and healthy supply are likely to limit any rally, though, analysts said. At a time of near-record

production, spring weather forecasts also look comfortable nationwide, capping demand for energy to heat or cool homes.

That is likely to lead to large weekly surpluses that keep June futures stalled below $2.55/mmBtu, said Jim

Ritterbusch, president of energy-advisory firm Ritterbusch & Associates.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.54/mmBtu, compared with Monday's

range of $2.4625-$2.495. Cash prices at the Transco Z6 hub in New last traded at $2.40/mmBtu, compared with Monday's

range of $2.45 to $2.53.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 28, 2015 09:08 ET (13:08 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

Natural Gas Corner - Technical Update - Today's Expiring May 15 Contract Closes Strong On Monday

After falling to a new 2015 spot and contract low at 2.443 in Monday’s early trade, the May 15 natural gas contract moved back higher into the close settling at 2.490, just under the daily high.

The May contract which expires on today’s close lost .041 on the session gapping down for a second Monday in a row.

Buying has continued overnight partially closing the open gap between 2.492-2.518. This gap remains the first area of resistance today followed by the 10 day moving average at 2.570.

If early buying fades, the 2.468 overnight low extending down to yesterday’s 2.443 low will be primary support followed by 2.390-2.400.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Monday, April 27, 2015

Natural Gas Corner - Market Review - Falling To A Multi-Year Low

Natural gas prices gapped lower today for the second week in a row with the spot May 15 contract trading down to a near 3-year price low.

Almost all the news is currently bearish including weather forecasts, high storage injections and production outweighing demand by an estimated 3 Bcf per day.

But there are variables which could swing the market back higher possibly over the upcoming 4-6 weeks of trade.

The first variable is summer weather which could turn out hotter than expected boosting demand of natural gas for cooling. With near and longer term forecasts currently negative for natural gas prices, any change in this outlook could quickly cause a reversal. Power generators have been heavy users of natural gas during the first 3 months of the year as lower priced natural gas has been displacing coal by utilities. This increased demand is helping to balance out the record high production of dry gas.

A second variable which could be bullish longer term is production. Two news stories today confirmed that shale fracking has been causing small earthquakes in the production areas of Texas and Oklahoma. If a government agency or the lawyers get involved in fracking, production could be affected. The falling rig count for both natural gas and crude oil will at some point also begin to lower production once legacy wells are retired possibly later this year.

The bearish triangle patterns initiated 4 weeks ago remain viable. The summer 15 strip which was nearly .450 above its downside measuring objective is now just .160 above the objective which is for trade down to the $2.400/MMBtu level.

Triangles appear at the end of a price trend. Current weakness is expected to be a seasonal and possibly long term low for the natural gas market.

Almost all the news is currently bearish including weather forecasts, high storage injections and production outweighing demand by an estimated 3 Bcf per day.

But there are variables which could swing the market back higher possibly over the upcoming 4-6 weeks of trade.

The first variable is summer weather which could turn out hotter than expected boosting demand of natural gas for cooling. With near and longer term forecasts currently negative for natural gas prices, any change in this outlook could quickly cause a reversal. Power generators have been heavy users of natural gas during the first 3 months of the year as lower priced natural gas has been displacing coal by utilities. This increased demand is helping to balance out the record high production of dry gas.

A second variable which could be bullish longer term is production. Two news stories today confirmed that shale fracking has been causing small earthquakes in the production areas of Texas and Oklahoma. If a government agency or the lawyers get involved in fracking, production could be affected. The falling rig count for both natural gas and crude oil will at some point also begin to lower production once legacy wells are retired possibly later this year.

The bearish triangle patterns initiated 4 weeks ago remain viable. The summer 15 strip which was nearly .450 above its downside measuring objective is now just .160 above the objective which is for trade down to the $2.400/MMBtu level.

Triangles appear at the end of a price trend. Current weakness is expected to be a seasonal and possibly long term low for the natural gas market.

Dow Jones Natural Gas - End of Day Commentary

DJ Natural Gas Prices Plunge on Low Spring Demand

By Timothy Puko

Natural gas prices plunged to their lowest point in nearly three years as weather updates suggest this spring

could bring some of the weakest demand in more than a decade.

Prices for the front-month May contract declined 4.1 cents, or 1.6%, to $2.49 a million British thermal units on

the New York Mercantile Exchange. Trading on the June contract surpassed May. May options expired at close and futures

expire Tuesday. The June contract declined 5.4 cents, or 2.1%, to $2.514/mmBtu.

May's settlement is lowest since June 15, 2012. Prices were down more than five cents as soon as electronic

trading began Sunday evening, but did pare some of those losses in the afternoon.

A Sunday-evening plunge is often a sign that weather updates are the dominant factor in trading. Traders,

especially those using automated computer systems, will often have immediate, strong reactions to weather updates when

they come after two days off and can't be priced in gradually as they usually are during the rest of the week.

Most gas consumption goes to heat homes or run power plants, which have their highest demand when air conditioners

are running in hot weather. That makes weather the biggest variable for gas prices, which often plunge as comfortable

spring weather kills demand.

This May could be even worse for demand than usual. Models used by Commodity Weather Group LLC in Bethesda, Md.,

show that the month may see the lowest levels of demand for this century, the company's president and meteorologist,

Matt Rogers, said.

The newest weather forecasts show above-average temperatures in the north, probably eliminating any chance of

heating demand lingering into May. They are also showing below-normal temperatures in the south, capping the likelihood

that people in the south will get an early start running air-conditioners.

"It's the opposite of what you'd want to see in early May to create demand," said Mr. Rogers. "We've got a little

bit of demand this week, and after that it really falls off."

Many traders likely rushed to get in bets against May prices before options expired, said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

They are also probably still reacting to the weekly surplus announced Thursday, she said. It tied for the

second-largest on record in April, though it came mostly in the first half of the month, a time when stronger demand is

still lingering. It shows how much near-record production is overwhelming the market, analysts have said.

"It strongly suggests there are going to be problems ahead" and that prices could fall even more, Ms. Viswanath

said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 27, 2015 14:54 ET (18:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042715 18:54 -- GMT

------

By Timothy Puko

Natural gas prices plunged to their lowest point in nearly three years as weather updates suggest this spring

could bring some of the weakest demand in more than a decade.

Prices for the front-month May contract declined 4.1 cents, or 1.6%, to $2.49 a million British thermal units on

the New York Mercantile Exchange. Trading on the June contract surpassed May. May options expired at close and futures

expire Tuesday. The June contract declined 5.4 cents, or 2.1%, to $2.514/mmBtu.

May's settlement is lowest since June 15, 2012. Prices were down more than five cents as soon as electronic

trading began Sunday evening, but did pare some of those losses in the afternoon.

A Sunday-evening plunge is often a sign that weather updates are the dominant factor in trading. Traders,

especially those using automated computer systems, will often have immediate, strong reactions to weather updates when

they come after two days off and can't be priced in gradually as they usually are during the rest of the week.

Most gas consumption goes to heat homes or run power plants, which have their highest demand when air conditioners

are running in hot weather. That makes weather the biggest variable for gas prices, which often plunge as comfortable

spring weather kills demand.

This May could be even worse for demand than usual. Models used by Commodity Weather Group LLC in Bethesda, Md.,

show that the month may see the lowest levels of demand for this century, the company's president and meteorologist,

Matt Rogers, said.

The newest weather forecasts show above-average temperatures in the north, probably eliminating any chance of

heating demand lingering into May. They are also showing below-normal temperatures in the south, capping the likelihood

that people in the south will get an early start running air-conditioners.

"It's the opposite of what you'd want to see in early May to create demand," said Mr. Rogers. "We've got a little

bit of demand this week, and after that it really falls off."

Many traders likely rushed to get in bets against May prices before options expired, said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

They are also probably still reacting to the weekly surplus announced Thursday, she said. It tied for the

second-largest on record in April, though it came mostly in the first half of the month, a time when stronger demand is

still lingering. It shows how much near-record production is overwhelming the market, analysts have said.

"It strongly suggests there are going to be problems ahead" and that prices could fall even more, Ms. Viswanath

said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 27, 2015 14:54 ET (18:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042715 18:54 -- GMT

------

Natural Gas Corner - Summer 15 Natural Gas Strip - Bearish Triangle Update

The summer 15 natural gas strip has fallen to a new all-time price low in the overnight session and looks poised to continue lower in upcoming trade.

The summer 15 strip (May 15-October 15 contracts) broke out to the downside in late-March from a sideways, triangle consolidation pattern.

The breakout initiated the triangle which has a downside measuring objective for trade down to the $2.400/MMBtu level.

Triangles appear near the end of a price trend. Current weakness should not only be a post-winter plow but possibly a multi-year price low for the natural gas market.

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Prices Plunge on Low Spring Demand

By Timothy Puko

Natural gas prices plunged to their lowest point in nearly three years as weather updates suggest this spring

could bring some of the weakest demand in more than a decade.

Prices for the front-month May contract declined 7.3 cents, or 2.9%, to $2.458 a million British thermal units on

the New York Mercantile Exchange. The June contract is now more heavily traded, with May options expiring at the end of

Monday's trading. May futures expire Monday. The June contract fell 7.6 cents, or 3%, to $2.492/mmBtu.

May's price is the lowest intraday price for the front-month contract since June 14, 2012. Prices were down more

than five cents as soon as electronic trading began Sunday evening and have drifted even lower Monday morning.

A Sunday-evening plunge is often a sign that weather updates are the dominant factor in trading. Traders,

especially those using automated computer systems, will often have immediate, strong reactions to weather updates when

they come after two days off and can't be priced in gradually as they usually are during the rest of the week.

Most gas consumption goes to heat homes or run power plants, which have their highest demand when air conditioners

are running in hot weather. That makes weather the biggest variable for gas prices, which often plunge as comfortable

spring weather kills demand.

This May could be even worse for demand than usual. Models used by Commodity Weather Group LLC in Bethesda, Md.,

show that the month may see the lowest levels of demand in the 2000s, the company's president and meteorologist, Matt

Rogers, said.

The newest weather forecasts show above-average temperatures in the north, probably eliminating any chance of

heating demand lingering into May. They are also showing below-normal temperatures in the south, capping the likelihood

that people in the south will get an early start running air-conditioners.

"It's the opposite of what you'd want to see in early May to create demand," said Mr. Rogers. "We've got a little

bit of demand this week, and after that it really falls off."

Many traders are likely rushing to get in bets against May prices before options expire, said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

They are also probably still reacting to the weekly surplus announced Thursday, she said. It tied for the

second-largest on record in April, though it came mostly in the first half of the month, a time when stronger demand is

still lingering. It shows how much near-record production is overwhelming the market, analysts have said.

"It strongly suggests there are going to be problems ahead" and that prices could fall even more, Ms. Viswanath

said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.49/mmBtu, compared with

Friday's range of $2.545-$2.58. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $2.45/mmBtu

to $2.55/mmBtu, compared with Friday's range of $2.11 to $2.30.

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 27, 2015 10:27 ET (14:27 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042715 14:27 -- GMT

By Timothy Puko

Natural gas prices plunged to their lowest point in nearly three years as weather updates suggest this spring

could bring some of the weakest demand in more than a decade.

Prices for the front-month May contract declined 7.3 cents, or 2.9%, to $2.458 a million British thermal units on

the New York Mercantile Exchange. The June contract is now more heavily traded, with May options expiring at the end of

Monday's trading. May futures expire Monday. The June contract fell 7.6 cents, or 3%, to $2.492/mmBtu.

May's price is the lowest intraday price for the front-month contract since June 14, 2012. Prices were down more

than five cents as soon as electronic trading began Sunday evening and have drifted even lower Monday morning.

A Sunday-evening plunge is often a sign that weather updates are the dominant factor in trading. Traders,

especially those using automated computer systems, will often have immediate, strong reactions to weather updates when

they come after two days off and can't be priced in gradually as they usually are during the rest of the week.

Most gas consumption goes to heat homes or run power plants, which have their highest demand when air conditioners

are running in hot weather. That makes weather the biggest variable for gas prices, which often plunge as comfortable

spring weather kills demand.

This May could be even worse for demand than usual. Models used by Commodity Weather Group LLC in Bethesda, Md.,

show that the month may see the lowest levels of demand in the 2000s, the company's president and meteorologist, Matt

Rogers, said.

The newest weather forecasts show above-average temperatures in the north, probably eliminating any chance of

heating demand lingering into May. They are also showing below-normal temperatures in the south, capping the likelihood

that people in the south will get an early start running air-conditioners.

"It's the opposite of what you'd want to see in early May to create demand," said Mr. Rogers. "We've got a little

bit of demand this week, and after that it really falls off."

Many traders are likely rushing to get in bets against May prices before options expire, said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

They are also probably still reacting to the weekly surplus announced Thursday, she said. It tied for the

second-largest on record in April, though it came mostly in the first half of the month, a time when stronger demand is

still lingering. It shows how much near-record production is overwhelming the market, analysts have said.

"It strongly suggests there are going to be problems ahead" and that prices could fall even more, Ms. Viswanath

said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.49/mmBtu, compared with

Friday's range of $2.545-$2.58. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $2.45/mmBtu

to $2.55/mmBtu, compared with Friday's range of $2.11 to $2.30.

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 27, 2015 10:27 ET (14:27 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042715 14:27 -- GMT

Natural Gas Technical Update - Market Collapses To New 2015 Price Lows Overnight

For a second Monday in a row, the May 15 natural gas contract has gapped lower in the overnight session. Today’s gap down has dropped the May contract to a new contract and 2015 spot low at 2.453 in early trade.

In last week’s session, the May contract gapped lower on Monday, rallied back higher to close the gap by Wednesday and then sold off into Friday’s close. For the week, the May contract lost .103 (3.9%) settling Friday at 2.531.

The overnight gap lower keeps the primary market trend down with 2.390-2.400 being the next downside support under the current 2.453 low.

The open gap area between 2.489-2.518 is the first area of resistance today followed by the 10 day moving average at 2.570.

The overnight gap looks like a breakaway gap which likely will not be closed. The May contract expires on tomorrow’s close.

Funds lightly liquidated existing long positions in the natural gas market last week according to Friday’s Commitment of Trader’s report. Funds as of last Tuesday’s close were long 96,163 contracts, down 1,515 from the previous week.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Commitment of Trader's Report - Funds Still Long The Natural Gas Market, The Question Is, Why?

Funds lightly liquidated existing long positions in the natural gas market last week according to Friday’s Commitment of Trader’s report.

Funds as of last Tuesday’s close were long 96,163 contracts, down 1,515 from the previous week.

There will soon a time to get long the natural gas market but now is the time to step aside and let the market fall to new multi-year price lows.

Funds as of last Tuesday’s close were long 96,163 contracts, down 1,515 from the previous week.

There will soon a time to get long the natural gas market but now is the time to step aside and let the market fall to new multi-year price lows.

Friday, April 24, 2015

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Gets Bump on Summer Speculation

By Timothy Puko

Natural gas prices are getting a boost as traders start to anticipate summer demand.

Natural gas for May delivery rose 1.4 cents, or 0.6%, at $2.545 a million British thermal units on the New York

Mercantile Exchange. Trading has stayed within a 25-cent range for nearly a month.

Prices have been falling since November as near-record production has kept the market oversupplied. But the tumble

has ground almost to halt since late March with few people left to sell and some traders starting to anticipate the

seasonal rise in demand and prices that usually comes in the summer.

Bets on falling prices outnumber bets on rising prices by more than three to two, according to data from U.S.

regulators. Prices have already fallen so far, and the trade for lower prices has become so crowded, that there is

little reward left to jump in and sell now, analysts and traders have said.

"If you're just stepping into the market, you're crazy if you get short at $2.50," said John Woods, president of JJ

Woods Associates and a Nymex trader. "Your parameters are essentially set."

A bet on rising prices is starting to have potential for bigger gains, he said. Rising demand for electricity to run

air conditioners usually sends gas demand and prices higher in the summer. Mr. Woods said he is getting ready to place

trades benefiting from that, expecting prices will soon head toward $2.80/mmBtu.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with Thursday's

range of $2.545-$2.57. Cash prices at the Transco in New York traded in a bid-ask range of $2.30/mmBtu to $2.63/mmBtu,

compared with Thursday's range of $2.565 to $2.59.

Write to Timothy Puko at tim.puko@wsj.com

-30-

(MORE TO FOLLOW) Dow Jones Newswires

April 24, 2015 09:40 ET (13:40 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042415 13:40 -- GMT

------

By Timothy Puko

Natural gas prices are getting a boost as traders start to anticipate summer demand.

Natural gas for May delivery rose 1.4 cents, or 0.6%, at $2.545 a million British thermal units on the New York

Mercantile Exchange. Trading has stayed within a 25-cent range for nearly a month.

Prices have been falling since November as near-record production has kept the market oversupplied. But the tumble

has ground almost to halt since late March with few people left to sell and some traders starting to anticipate the

seasonal rise in demand and prices that usually comes in the summer.

Bets on falling prices outnumber bets on rising prices by more than three to two, according to data from U.S.

regulators. Prices have already fallen so far, and the trade for lower prices has become so crowded, that there is

little reward left to jump in and sell now, analysts and traders have said.

"If you're just stepping into the market, you're crazy if you get short at $2.50," said John Woods, president of JJ

Woods Associates and a Nymex trader. "Your parameters are essentially set."

A bet on rising prices is starting to have potential for bigger gains, he said. Rising demand for electricity to run

air conditioners usually sends gas demand and prices higher in the summer. Mr. Woods said he is getting ready to place

trades benefiting from that, expecting prices will soon head toward $2.80/mmBtu.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with Thursday's

range of $2.545-$2.57. Cash prices at the Transco in New York traded in a bid-ask range of $2.30/mmBtu to $2.63/mmBtu,

compared with Thursday's range of $2.565 to $2.59.

Write to Timothy Puko at tim.puko@wsj.com

-30-

(MORE TO FOLLOW) Dow Jones Newswires

April 24, 2015 09:40 ET (13:40 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042415 13:40 -- GMT

------

Natural Gas Technical Update - Smackdown Thursday

After closing the overhead gap area on Wednesday, the May 15 natural gas contract turned back down yesterday falling to a new weekly low during the session.

Sellers came out in force from the opening bell in Thursday’s trade with selling momentum picking up after release of the EIA weekly storage report. By day’s end, the May contract had bottomed out at a 2.520 late day low settling at 2.531, down .075 or 2.8%.

The market may see short-covering later today if support at the lower-2.5000 level continues to hold. However, the primary trend remains down as the market completes a final leg down of the current trend. Once the market bottoms, a post-winter and possibly long term price low is expected.

A drop under lower-2.5000 support would turn the 2.475 contract low into the next downside support followed by 2.390-2.400.

The 10 day moving average at 2.575 is the first area of resistance today followed by the 2.622 weekly high. Longer term resistance is the 40 day moving average currently at 2.695.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Thursday, April 23, 2015

Natural Gas Corner - Market Review - Bearish Everything

Three consecutive higher than expected weekly storage injections, bearish near term weather forecasts, bearish longer term weather forecasts and bearish production, there just isn't much to get bullish about in the natural gas market.

Which is exactly the mentality needed to set a long term low in the market.

Current weakness is discounting many of the bearish factors mentioned above. That is what futures markets do.

The summer 15 and winter 15-16 strips are still well above the downside measuring objectives for the triangle patterns initiated 3 weeks ago. But once these objectives are met ($2.400/MMBtu for the summer 15 strip) a long term low should be set in the market.

When it never looks like a market low will be set is when lows are set.

Get ready, get your orders placed and wait. Your patience will soon be rewarded over upcoming weeks.

Which is exactly the mentality needed to set a long term low in the market.

Current weakness is discounting many of the bearish factors mentioned above. That is what futures markets do.

The summer 15 and winter 15-16 strips are still well above the downside measuring objectives for the triangle patterns initiated 3 weeks ago. But once these objectives are met ($2.400/MMBtu for the summer 15 strip) a long term low should be set in the market.

When it never looks like a market low will be set is when lows are set.

Get ready, get your orders placed and wait. Your patience will soon be rewarded over upcoming weeks.

Dow Jones Natural Gas - End of Day Commentary

DJ Natural Gas Prices Slip After Larger-Than-Expected Add to Stockpiles

By Timothy Puko

Natural gas prices slipped steadily Thursday as large stockpiles and the threat of larger ones reinforced the idea

that the market is oversupplied.

The U.S. Energy Information Administration said storage levels grew by 90 billion cubic feet in the week ended April

17. That is double the addition from the same week a year ago and 2 bcf more than the 88-bcf consensus average of 21

forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

injection would indicate slightly larger supply or smaller demand than expected.

Natural gas for May delivery settled down 7.5 cents, or 2.9%, at $2.531 a million British thermal units on the New

York Mercantile Exchange. It had already been trading about 2% lower to start the session, and losses accelerated for

another 90 minutes after EIA's data release.

"It is really hammering home this oversupply trend," said Aaron Calder, senior market analyst at energy-consulting

firm Gelber & Associates in Houston.

It is the third week in a row that storage levels increased more than expected. It appears that the season's big

swing buyer, power plants, don't have the capacity to use more gas despite its already low prices, Mr. Calder said.

"If we're ever going to get out of these doldrums it's going to have to be on the supply side, where we're going to

have to see tapering off in production," Mr. Calder added.

This was the year's biggest storage addition so far. At this time a year ago, gas storage grew by only 45 bcf, which

is about the five-year average, too. This addition brought storage levels to 1.6 trillion cubic feet, 82% more than a

year ago and 5.8% below the five-year average.

Warming weather forecasts indicate the surpluses will only get bigger in the weeks to come, said Bob Yawger, director

of the futures division at Mizuho Securities USA Inc. Forecasts are showing normal and above-normal temperatures

covering most of the country two weeks from now, pushing out slightly below-normal temperatures that had been in the

forecasts for the east.

"That puts pressure on price," Mr. Yawger said. "You can only imagine that next week and the week after that the

storage number will be pretty big."

Write to Timothy Puko at Tim.Puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 23, 2015 15:00 ET (19:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042315 19:00 -- GMT

------

By Timothy Puko

Natural gas prices slipped steadily Thursday as large stockpiles and the threat of larger ones reinforced the idea

that the market is oversupplied.

The U.S. Energy Information Administration said storage levels grew by 90 billion cubic feet in the week ended April

17. That is double the addition from the same week a year ago and 2 bcf more than the 88-bcf consensus average of 21

forecasters surveyed by The Wall Street Journal.

The EIA update is widely considered one of the best measures of supply and demand for the natural gas market. This

injection would indicate slightly larger supply or smaller demand than expected.

Natural gas for May delivery settled down 7.5 cents, or 2.9%, at $2.531 a million British thermal units on the New

York Mercantile Exchange. It had already been trading about 2% lower to start the session, and losses accelerated for

another 90 minutes after EIA's data release.

"It is really hammering home this oversupply trend," said Aaron Calder, senior market analyst at energy-consulting

firm Gelber & Associates in Houston.

It is the third week in a row that storage levels increased more than expected. It appears that the season's big

swing buyer, power plants, don't have the capacity to use more gas despite its already low prices, Mr. Calder said.

"If we're ever going to get out of these doldrums it's going to have to be on the supply side, where we're going to

have to see tapering off in production," Mr. Calder added.

This was the year's biggest storage addition so far. At this time a year ago, gas storage grew by only 45 bcf, which

is about the five-year average, too. This addition brought storage levels to 1.6 trillion cubic feet, 82% more than a

year ago and 5.8% below the five-year average.

Warming weather forecasts indicate the surpluses will only get bigger in the weeks to come, said Bob Yawger, director

of the futures division at Mizuho Securities USA Inc. Forecasts are showing normal and above-normal temperatures

covering most of the country two weeks from now, pushing out slightly below-normal temperatures that had been in the

forecasts for the east.

"That puts pressure on price," Mr. Yawger said. "You can only imagine that next week and the week after that the

storage number will be pretty big."

Write to Timothy Puko at Tim.Puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 23, 2015 15:00 ET (19:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042315 19:00 -- GMT

------

EIA Weekly Storage Report - 90 Bcf Injection - Slightly Above Expectations

For the week ended

April 17:

EIA Injection - 90 BCF

Last Year's Injection - 45 BCF

5 Yr Avg Injection - 46 BCF

Range of Estimates - 80 BCF to 101 BCF

Avg Estimate - 88 BCF

Total Gas in Storage - 1.629 TCF

EIA Injection - 90 BCF

Last Year's Injection - 45 BCF

5 Yr Avg Injection - 46 BCF

Range of Estimates - 80 BCF to 101 BCF

Avg Estimate - 88 BCF

Total Gas in Storage - 1.629 TCF

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Slips on Expectations for Big, Growing Surpluses

By Timothy Puko

Natural gas prices are taking their biggest losses of the week as traders believe surpluses are big and growing

bigger.

Natural gas for May delivery fell 5.4 cents, or 2.1%, at $2.552 a million British thermal units on the New York

Mercantile Exchange.

Analysts and brokers are expecting data on the way Thursday to show the largest natural gas surplus of the year. The

U.S. Energy Information Administration gives its weekly update on storage levels for the prior week at 10:30 a.m. EDT.

It is likely to show an 88-billion-cubic-feet addition to storage, nearly double what's common for this time of year,

according to the average forecast of 21 analysts surveyed by The Wall Street Journal. Production has been at or near

record levels for more than a year, so it is overwhelming demand that plummets as mild spring weather cuts the need for

heat and electricity, analysts said.

"Remember the next few weeks will be the darkest as power sector is challenged to produce sufficient absolute gas

demand," energy investment bank Tudor, Pickering, Holt & Co. said in a note.

Warming weather forecasts are adding to the belief that surpluses will be plentiful and keep prices low, said Bob

Yawger, director of the futures division at Mizuho Securities USA Inc. Forecasts are showing normal and above-normal

temperatures covering most of the country two weeks from now, pushing out slightly below-normal temperatures that had

been in the forecasts for the east.

"That puts pressure on price," Mr. Yawger said. "You can only imagine that next week and the week after that the

storage number will be pretty big."

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with

Wednesday's range of $2.58-$2.625. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of

$2.52/mmBtu to $2.61/mmBtu, compared with Wednesday's range of $2.56 to $2.62.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 23, 2015 09:49 ET (13:49 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042315 13:49 -- GMT

------

By Timothy Puko

Natural gas prices are taking their biggest losses of the week as traders believe surpluses are big and growing

bigger.

Natural gas for May delivery fell 5.4 cents, or 2.1%, at $2.552 a million British thermal units on the New York

Mercantile Exchange.

Analysts and brokers are expecting data on the way Thursday to show the largest natural gas surplus of the year. The

U.S. Energy Information Administration gives its weekly update on storage levels for the prior week at 10:30 a.m. EDT.

It is likely to show an 88-billion-cubic-feet addition to storage, nearly double what's common for this time of year,

according to the average forecast of 21 analysts surveyed by The Wall Street Journal. Production has been at or near

record levels for more than a year, so it is overwhelming demand that plummets as mild spring weather cuts the need for

heat and electricity, analysts said.

"Remember the next few weeks will be the darkest as power sector is challenged to produce sufficient absolute gas

demand," energy investment bank Tudor, Pickering, Holt & Co. said in a note.

Warming weather forecasts are adding to the belief that surpluses will be plentiful and keep prices low, said Bob

Yawger, director of the futures division at Mizuho Securities USA Inc. Forecasts are showing normal and above-normal

temperatures covering most of the country two weeks from now, pushing out slightly below-normal temperatures that had

been in the forecasts for the east.

"That puts pressure on price," Mr. Yawger said. "You can only imagine that next week and the week after that the

storage number will be pretty big."

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.55/mmBtu, compared with

Wednesday's range of $2.58-$2.625. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of

$2.52/mmBtu to $2.61/mmBtu, compared with Wednesday's range of $2.56 to $2.62.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 23, 2015 09:49 ET (13:49 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042315 13:49 -- GMT

------

Natural Gas Technical Update - Gap Closed - Bears Back In Control

Natural gas prices moved higher for a second day on Wednesday as the May 15 traded near the 2.600 level for most of the session.

The May contract did pop up to a 2.622 mid-day high almost completely closing the open gap area created on Monday between 2.596-2.625. The gap was a supportive feature for the market. With it now being closed, it becomes a bearish technical signal.

The 2.533 weekly low is the first area of support followed by the 2.475 contract low. Longer term support is between 2.390-2.400 and 2.230-2.250.

2.622-2.625 is the first area of resistance today followed by 2.690-2.700 which is both last week’s high as well as the 40 day moving average.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Wednesday, April 22, 2015

Dow Jones Analyst Survey For Tomorrow's EIA Weekly Natural Gas Storage Report

DJ Analysts See 88-Billion-Cubic-Feet Addition to U.S. Natural Gas Inventories

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural gas inventories added

nearly double the amount they usually do at this time of year.

The U.S. Energy Information Administration is expected to report that storage levels grew by 88 billion cubic feet of

gas during the week ended April 17, according to the average forecast of 21 analysts and traders surveyed by The Wall

Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the April 17 week, the median estimate is for an addition of 88 bcf. Estimates range from an addition of 80 bcf

to an addition of 101 bcf.

The estimate for April 17 compares to 45 bcf added to storage for the same week last year and the 46-bcf five-year

average addition for that week.

If the storage estimate is correct, inventories as of April 17 totaled 1.6 trillion cubic feet, 82% above levels from

a year ago and 5.9% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 22, 2015 14:13 ET (18:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042215 18:13 -- GMT

------

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural gas inventories added

nearly double the amount they usually do at this time of year.

The U.S. Energy Information Administration is expected to report that storage levels grew by 88 billion cubic feet of

gas during the week ended April 17, according to the average forecast of 21 analysts and traders surveyed by The Wall

Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the April 17 week, the median estimate is for an addition of 88 bcf. Estimates range from an addition of 80 bcf

to an addition of 101 bcf.

The estimate for April 17 compares to 45 bcf added to storage for the same week last year and the 46-bcf five-year

average addition for that week.

If the storage estimate is correct, inventories as of April 17 totaled 1.6 trillion cubic feet, 82% above levels from

a year ago and 5.9% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

April 22, 2015 14:13 ET (18:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

042215 18:13 -- GMT

------

Dow Jones Natural Gas - Morning Commentary

DJ Natural Gas Rises on Chance for Strong Heating Demand

By Timothy Puko

Natural gas prices are rising for the second-straight session on Wednesday, as this month's weather forecasts keep

showing cooler-than-normal temperatures and the chance for stronger-than-normal heating demand.

Natural gas for May delivery was up 4.3 cents, or 1.7%, at $2.619 a million British thermal units on the New York

Mercantile Exchange.

Weather forecasts show below-normal temperatures in the eastern half of the country through the end of April. Half of

all U.S. homes use natural gas for heat, making demand--and often prices--highest when the weather is cold.

Power demand is also helping as cheaper natural gas prices encourage generators to move away from other fuels, said

Gene McGillian, an analyst at Tradition Energy.