DJ Natural Gas Sets Fresh Two-Year Low on Strong Supply

By Timothy Puko

Natural gas extended its losing streak to a third session and set a fresh two-year low as traders continue to sell

off because of strong supply, analysts said.

The front-month March contract settled down 2.8 cents, or 1%, at $2.691 a million British thermal units on the New

York Mercantile Exchange.

Losses are still mounting from strong stockpile data issued Thursday, analysts said. Storage levels shrank by 94

billion cubic feet, the EIA reported Wednesday. That was 17 bcf lower than expectations and was just the fourth time in

20 years that the stockpile drain for this week of January wasn't at least 100 bcf, according to Simmons & Co.

International.

"Demand has simply not been strong enough this winter to have a significant impact on the robust production levels,"

Dominick Chirichella, analyst at the Energy Management Institute, said in a note.

Traders are concerned with how quickly storage is building up, a pace fast enough right now to exceed the country's

storage capacity, according to analysts. Utilities are waiting before they strike any contracts for long-term supply,

expecting that growing stockpiles will keep prices cheap even as the high summer season for electricity demand

approaches, Aaron Calder, senior market analyst at energy-consulting firm Gelber & Associates in Houston, said in a

note to clients.

"If the cold weather fails to materialize, the market will have a serious glut on its hands," he added.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 30, 2015 15:02 ET (20:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

013015 20:02 -- GMT

------

The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Friday, January 30, 2015

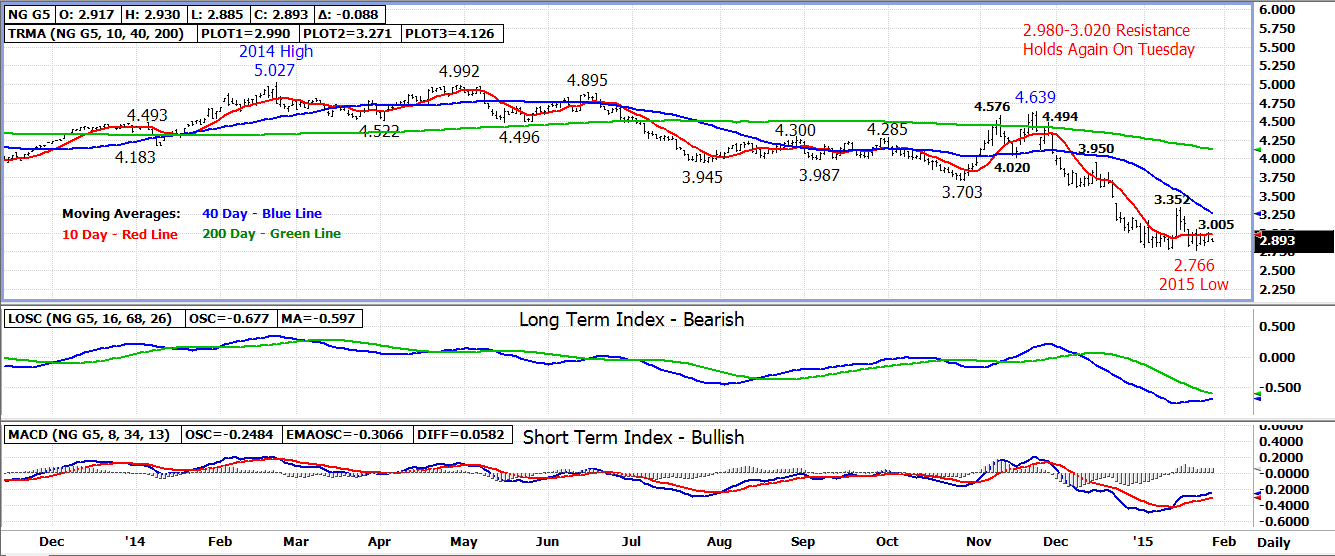

Natural Gas Technical Update - 4-Week Support Broken On Thursday - Bearish

The March 15 natural gas contract on Thursday broke out below 2.750-2.760 weekly low support that had held for nearly 4 weeks.

With support broken, the March contract tumbled to a 2.672 daily low settling at 2.719, down .123 or 4.3%.

Selling has continued overnight dropping the March under yesterday’s 2.672 low. The next downside objective now becomes the 2.575 weekly low from August 2012.

If 2.575 weekly low support is reached and broken, there is not much downside support on the weekly chart until the 2.170-2.230 level.

Former support between 2.750-2.760 now becomes the first level of upside resistance followed by the 10 day moving average at 2.860.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Thursday, January 29, 2015

Natural Gas Corner - Market Review - A Repeat Of 2012?

The natural gas market today fell to the lowest spot price level since September 2012.

Today's weekly EIA storage withdrawal came in near the lower end of pre-report estimates totaling just 94 Bcf which was well below the 97-144 Bcf withdrawal expected.

To put today's withdrawal in perspective, it was 125 Bcf or 57% below last year's withdrawal and 74 Bcf or 44% below the 5-year average. Not a bullish signal during the coldest month of the year.

The natural gas market faces another oversupply situation similar to 2012 when the spot price fell to a 1.906 low in late-April if winter heating demand doesn't quickly escalate.

Today's EIA storage report showed 2,543 Bcf of gas in storage for week ended 01/23/15. With 9 weeks left in the current withdrawal season, an average of 108 Bcf of gas per week will need to be pulled out of storage to reach the 10-year average for end of March storage of 1,565 Bcf.

Over the past 10 years, an average of 114 Bcf has been withdrawn from storage over the next 9 weeks which could keep the market from trend too much lower from the current price level.

However, the difference this year is increased production which is adding a extra 2-3 Bcf per day onto the market. This could put an additional 150-160 Bcf of supply into the market depending on upcoming demand by the end of March.

The bearish headwinds facing the natural gas market over the upcoming 9-10 weeks of trade are daunting. Seasonally, the market tends to set a post-winter low during the months of March or April. This time period should be the best opportunity to add to summer coverage.

Today's weekly EIA storage withdrawal came in near the lower end of pre-report estimates totaling just 94 Bcf which was well below the 97-144 Bcf withdrawal expected.

To put today's withdrawal in perspective, it was 125 Bcf or 57% below last year's withdrawal and 74 Bcf or 44% below the 5-year average. Not a bullish signal during the coldest month of the year.

The natural gas market faces another oversupply situation similar to 2012 when the spot price fell to a 1.906 low in late-April if winter heating demand doesn't quickly escalate.

Today's EIA storage report showed 2,543 Bcf of gas in storage for week ended 01/23/15. With 9 weeks left in the current withdrawal season, an average of 108 Bcf of gas per week will need to be pulled out of storage to reach the 10-year average for end of March storage of 1,565 Bcf.

Over the past 10 years, an average of 114 Bcf has been withdrawn from storage over the next 9 weeks which could keep the market from trend too much lower from the current price level.

However, the difference this year is increased production which is adding a extra 2-3 Bcf per day onto the market. This could put an additional 150-160 Bcf of supply into the market depending on upcoming demand by the end of March.

The bearish headwinds facing the natural gas market over the upcoming 9-10 weeks of trade are daunting. Seasonally, the market tends to set a post-winter low during the months of March or April. This time period should be the best opportunity to add to summer coverage.

Dow Jones End of Day Natural Gas Commentary

DJ Natural Gas Prices Sink on Smaller-Than-Expected Stockpile Drain

By Timothy Puko

Natural gas closed at its lowest price in more than two years after federal data showed U.S. storage levels fell

far less than expected last week.

Storage levels shrank by 94 billion cubic feet in the week ended Jan. 23, the U.S. Energy Information

Administration said. That 17 bcf less than the 111-bcf average of 20 forecasters surveyed by The Wall Street Journal,

none of whom predicted such a small drain.

Prices sank as soon as the data came out. The front-month March contract settled down 12.3 cents, or 4.3%, at

$2.719 a million British thermal units on the New York Mercantile Exchange. This is the lowest front-month settlement

since Sept. 7, 2012, when gas fell to $2.682/mmBtu.

The drain was 44% lower than the five-year average for that week of the year. That is another reminder of how

severely oversupplied the market is, said Stephen Smith, an energy consultant based in Natchez, Miss. UBS AG cut its

price forecast for gas earlier this week, saying the market is oversupplied by about 2.5 bcf a day.

"You might get weather situations that make it...look like a balanced market," Mr. Smith said. "The truth is,

underlying this whole thing, you can't grow production (at this) rate and not be oversupplied."

The drain brought storage levels to 2.5 trillion cubic feet, 15% more than a year ago and 3% below the five-year

average.

The fall to 2012 prices is significant, said Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New

York. After a mild winter that year, the strong supply coming from the U.S. shale gas boom crashed the market, sending

prices below $2/mmBtu.

Milder weather reports also came in in the afternoon, suggesting softer demand for gas heat in the coming weeks,

Ms. Viswanath added. She said early pipeline data suggests a 125-bcf withdrawal for next week's storage update, and

that would be a quarter lower than the five-year average for the week, according to EIA data.

"The question is whether this will lead to the same precipitous collapse that we had" in 2012, Ms. Viswanath said.

"This is a real problem."

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 15:18 ET (20:18 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 20:18 -- GMT

By Timothy Puko

Natural gas closed at its lowest price in more than two years after federal data showed U.S. storage levels fell

far less than expected last week.

Storage levels shrank by 94 billion cubic feet in the week ended Jan. 23, the U.S. Energy Information

Administration said. That 17 bcf less than the 111-bcf average of 20 forecasters surveyed by The Wall Street Journal,

none of whom predicted such a small drain.

Prices sank as soon as the data came out. The front-month March contract settled down 12.3 cents, or 4.3%, at

$2.719 a million British thermal units on the New York Mercantile Exchange. This is the lowest front-month settlement

since Sept. 7, 2012, when gas fell to $2.682/mmBtu.

The drain was 44% lower than the five-year average for that week of the year. That is another reminder of how

severely oversupplied the market is, said Stephen Smith, an energy consultant based in Natchez, Miss. UBS AG cut its

price forecast for gas earlier this week, saying the market is oversupplied by about 2.5 bcf a day.

"You might get weather situations that make it...look like a balanced market," Mr. Smith said. "The truth is,

underlying this whole thing, you can't grow production (at this) rate and not be oversupplied."

The drain brought storage levels to 2.5 trillion cubic feet, 15% more than a year ago and 3% below the five-year

average.

The fall to 2012 prices is significant, said Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New

York. After a mild winter that year, the strong supply coming from the U.S. shale gas boom crashed the market, sending

prices below $2/mmBtu.

Milder weather reports also came in in the afternoon, suggesting softer demand for gas heat in the coming weeks,

Ms. Viswanath added. She said early pipeline data suggests a 125-bcf withdrawal for next week's storage update, and

that would be a quarter lower than the five-year average for the week, according to EIA data.

"The question is whether this will lead to the same precipitous collapse that we had" in 2012, Ms. Viswanath said.

"This is a real problem."

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 15:18 ET (20:18 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 20:18 -- GMT

Dow Jones Natural Gas - Prices Sink On Smaller Than Expected Stockpile Drain

DJ Natural Gas Prices Sink on Smaller-Than-Expected Stockpile Drain

By Timothy Puko

Natural gas prices dropped to a new two-year low on Thursday after federal data showed U.S. storage levels fell less

than expected last week.

Storage levels shrank by 94 billion cubic feet in the week ended Jan. 23, the U.S. Energy Information Administration

said. The drain was 17 bcf less than the 111-bcf average of 20 forecasters surveyed by The Wall Street Journal.

The smaller-than-expected drain caused prices to drop sharply. The front-month March contract recently traded down

14.7 cents, or 5.2%, at $2.695 a million British thermal units on the New York Mercantile Exchange. The contract had

been trading around unchanged before the data. This is the lowest front-month price since Sept. 10, 2012, when gas fell

to $2.682/mmBtu.

The drain was 44% lower than the five-year average for that week of that year. That is another reminder of how

severely oversupplied the market is, said Stephen Smith, an energy consultant based in Natchez, Miss. UBS AG cut its

price forecast for gas earlier this week, saying the market is oversupplied by about 2.5 bcf a day.

"You might get weather situations that make it ... look like a balanced market," Mr. Smith said. "The truth is,

underlying this whole thing, you can't grow production (at this) rate and not be oversupplied."

The drain brought storage levels to 2.5 trillion cubic feet, 15% more than a year ago and 3% below the five-year

average.

"What's more, the short-term weather outlook suggests that the call on storage will likely remain comparatively

light" in the weeks to come, Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New York, said in a note

earlier Thursday.

Analysts expect stockpiles to keep rising compared to their historic levels and surpass their five-year averages

before the spring. Early pipeline data suggests a 125-bcf withdrawal for next week's storage update, Ms. Viswanath

said, and that would be a quarter lower than the five-year average for the week, according to EIA data.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 11:20 ET (16:20 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 16:20 -- GMT

------

By Timothy Puko

Natural gas prices dropped to a new two-year low on Thursday after federal data showed U.S. storage levels fell less

than expected last week.

Storage levels shrank by 94 billion cubic feet in the week ended Jan. 23, the U.S. Energy Information Administration

said. The drain was 17 bcf less than the 111-bcf average of 20 forecasters surveyed by The Wall Street Journal.

The smaller-than-expected drain caused prices to drop sharply. The front-month March contract recently traded down

14.7 cents, or 5.2%, at $2.695 a million British thermal units on the New York Mercantile Exchange. The contract had

been trading around unchanged before the data. This is the lowest front-month price since Sept. 10, 2012, when gas fell

to $2.682/mmBtu.

The drain was 44% lower than the five-year average for that week of that year. That is another reminder of how

severely oversupplied the market is, said Stephen Smith, an energy consultant based in Natchez, Miss. UBS AG cut its

price forecast for gas earlier this week, saying the market is oversupplied by about 2.5 bcf a day.

"You might get weather situations that make it ... look like a balanced market," Mr. Smith said. "The truth is,

underlying this whole thing, you can't grow production (at this) rate and not be oversupplied."

The drain brought storage levels to 2.5 trillion cubic feet, 15% more than a year ago and 3% below the five-year

average.

"What's more, the short-term weather outlook suggests that the call on storage will likely remain comparatively

light" in the weeks to come, Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New York, said in a note

earlier Thursday.

Analysts expect stockpiles to keep rising compared to their historic levels and surpass their five-year averages

before the spring. Early pipeline data suggests a 125-bcf withdrawal for next week's storage update, Ms. Viswanath

said, and that would be a quarter lower than the five-year average for the week, according to EIA data.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 11:20 ET (16:20 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 16:20 -- GMT

------

EIA Weekly Storage Report - 94 Bcf Withdrawal - Bombs Away!

For the week ended

Jan 23:

EIA Withdrawal – 94 BCF

Last Year’s Draw – 219 BCF

5 Yr Avg Draw – 168 BCF

Range of Estimates – 97 BCF to 144 BCF

Avg Estimate – 111 BCF

Total Gas in Storage - 2543 BCF

EIA Withdrawal – 94 BCF

Last Year’s Draw – 219 BCF

5 Yr Avg Draw – 168 BCF

Range of Estimates – 97 BCF to 144 BCF

Avg Estimate – 111 BCF

Total Gas in Storage - 2543 BCF

Dow Jones Natural Gas - Market Starts To Fall Ahead of Storage Update

DJ Natural Gas Starts to Fall Ahead of Storage Update

By Timothy Puko

Natural gas prices have started to fall ahead of a weekly storage update that's expected to signal soft demand for

the heating fuel.

Natural gas for March delivery is down 0.4 cent, or 0.2%, at $2.837 a million British thermal units on the New York

Mercantile Exchange. Trading volumes are light, but analysts said that will probably change after the U.S. Energy

Information Administration updates storage levels at 10:30 a.m. EST.

Analysts and brokers expect the report to be a very bearish comparison of supply and demand for the peak of winter

home-heating season.

Stockpiles likely fell by 111 billion cubic feet of gas during the week ended Jan. 23, a third less than they usually

do for this time of year, according to the average forecast of 20 analysts and traders surveyed by The Wall Street

Journal.

"What's more the short-term weather outlook suggests that the call on storage will likely remain comparatively

light," Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New York, said in a note.

Stockpiles have already surged past their levels from this time a year ago and could be poised to pass five-year

averages this winter. Early pipeline data suggests a 125 withdrawal for next week's storage update, Ms. Viswanath said,

and that would be a quarter lower than the five-year average for the week, according to EIA data.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.87/mmBtu, compared with

Wednesday's range of $2.86-$2.9075. Cash prices at the Transco Z6 in New York traded in a bid-ask range of $7.00/mmBtu

to $20.00/mmBtu, compared with Wednesday's range of $3.60 to $4.25.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 09:43 ET (14:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 14:43 -- GMT

------

By Timothy Puko

Natural gas prices have started to fall ahead of a weekly storage update that's expected to signal soft demand for

the heating fuel.

Natural gas for March delivery is down 0.4 cent, or 0.2%, at $2.837 a million British thermal units on the New York

Mercantile Exchange. Trading volumes are light, but analysts said that will probably change after the U.S. Energy

Information Administration updates storage levels at 10:30 a.m. EST.

Analysts and brokers expect the report to be a very bearish comparison of supply and demand for the peak of winter

home-heating season.

Stockpiles likely fell by 111 billion cubic feet of gas during the week ended Jan. 23, a third less than they usually

do for this time of year, according to the average forecast of 20 analysts and traders surveyed by The Wall Street

Journal.

"What's more the short-term weather outlook suggests that the call on storage will likely remain comparatively

light," Teri Viswanath, a natural-gas strategist at BNP Paribas SA in New York, said in a note.

Stockpiles have already surged past their levels from this time a year ago and could be poised to pass five-year

averages this winter. Early pipeline data suggests a 125 withdrawal for next week's storage update, Ms. Viswanath said,

and that would be a quarter lower than the five-year average for the week, according to EIA data.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.87/mmBtu, compared with

Wednesday's range of $2.86-$2.9075. Cash prices at the Transco Z6 in New York traded in a bid-ask range of $7.00/mmBtu

to $20.00/mmBtu, compared with Wednesday's range of $3.60 to $4.25.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 29, 2015 09:43 ET (14:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012915 14:43 -- GMT

------

Natural Gas Technical Update - Down To New Lows Today?

The new front month March 15 natural gas contract on Wednesday traded back toward the lower end of the past month’s range losing .093 (3.1%) to settle at 2.842.

Similar to the now expired February 15 contract, the 2.750-2.760 level remains key support. A drop under 2.750 will keep the primary market trend bearish with the 2.575 low from August 2012 becoming the next downside support.

The 10 day moving average which held as resistance at the 2.924 overnight high is the first area of resistance today followed by 2.980-3.020. A breakout above lower-3.000 level would turn the near term trend back up with the 40 day moving average currently at 3.220 being the next upside resistance.

A breakout above the 40 day moving average at 3.250 as well as the 3.299 mid-January high is needed to turn the longer term trend back up.

Although the natural gas market has been in a sideways trend for nearly 4 weeks, a final low in the market has likely not been set.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Wednesday, January 28, 2015

Dow Jones Natural Gas - Prices Decline On Growing Supply

DJ Natural Gas Declines on Growing Supply

By Timothy Puko

Natural gas prices gave back all the prior day's gains on expectations that supplies are rising and will keep

overwhelming demand.

The front-month February contract settled down 11.5 cents, or 3.9%, at $2.866 a million British thermal units on the

New York Mercantile Exchange. The more actively traded March contract settled down 9.3 cents, or 3.2%, at $2.842/mmBtu.

The February contract expired at close.

Analysts and brokers are expecting that gas inventories last week shrunk by a third less than they usually do for

this time of year. The U.S. Energy Information Administration has its weekly storage update scheduled for Thursday at

10:30 a.m., and it is likely to report that storage levels fell by 111 billion cubic feet during the week ended Jan.

23, according to the average forecast of 20 analysts and traders surveyed by The Wall Street Journal. The average draw

on storage for that week of the year is 168 bcf.

A 111-bcf addition would put stockpiles at 2.5 trillion cubic feet, 14% above levels from a year ago and 3.6% below

the five-year average for the same week.

"There is ample...gas in inventory to meet the demand of the remaining winter season even if it is colder than

normal," Dominick Chirichella, analyst at the Energy Management Institute, said in a note to clients.

Half of U.S. homes use natural gas for heat, making winter cold typically the biggest driver for demand. But prices

have plummeted 36% since November because record production has been enough to easily cover demand, even in the coldest

weeks of the year.

Citing stronger-than-expected supply, UBS Group AG joined BNP Paribas, Citigroup and Societe Generale in cutting its

forecast for natural gas prices. UBS is cutting its estimates between 12% and 20% for the next three years. Its

forecast for 2015 fell to $3.25/mmBtu from $3.75.

The annualized production growth rate is likely to increase to 3.4 bcf a day between 2014 to 2019, up from 2.1 bcf a

day in the last five-year period. Oversupply is already at 2.5 bcf a day, the bank said. UBS still believes that

closing coal-fired power plants, opening export terminals and building new petrochemical plants will start driving up

long-term demand, but producers can meet it at prices around $4.50/mmBtu, not the prices above $5 the bank had once

projected.

Production is already edging higher after concerns it might be wavering earlier this month, according to Citigroup

Inc. Producers are doing better in several gas-rich shale formations, especially the Marcellus, its analyst Anthony

Yuen said in a note to clients Wednesday. They are quickly recovering from cold weather that can choke off supply and

they keep making technological advancements that allow each well to produce more, he said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 28, 2015 15:36 ET (20:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 20:36 -- GMT

------

By Timothy Puko

Natural gas prices gave back all the prior day's gains on expectations that supplies are rising and will keep

overwhelming demand.

The front-month February contract settled down 11.5 cents, or 3.9%, at $2.866 a million British thermal units on the

New York Mercantile Exchange. The more actively traded March contract settled down 9.3 cents, or 3.2%, at $2.842/mmBtu.

The February contract expired at close.

Analysts and brokers are expecting that gas inventories last week shrunk by a third less than they usually do for

this time of year. The U.S. Energy Information Administration has its weekly storage update scheduled for Thursday at

10:30 a.m., and it is likely to report that storage levels fell by 111 billion cubic feet during the week ended Jan.

23, according to the average forecast of 20 analysts and traders surveyed by The Wall Street Journal. The average draw

on storage for that week of the year is 168 bcf.

A 111-bcf addition would put stockpiles at 2.5 trillion cubic feet, 14% above levels from a year ago and 3.6% below

the five-year average for the same week.

"There is ample...gas in inventory to meet the demand of the remaining winter season even if it is colder than

normal," Dominick Chirichella, analyst at the Energy Management Institute, said in a note to clients.

Half of U.S. homes use natural gas for heat, making winter cold typically the biggest driver for demand. But prices

have plummeted 36% since November because record production has been enough to easily cover demand, even in the coldest

weeks of the year.

Citing stronger-than-expected supply, UBS Group AG joined BNP Paribas, Citigroup and Societe Generale in cutting its

forecast for natural gas prices. UBS is cutting its estimates between 12% and 20% for the next three years. Its

forecast for 2015 fell to $3.25/mmBtu from $3.75.

The annualized production growth rate is likely to increase to 3.4 bcf a day between 2014 to 2019, up from 2.1 bcf a

day in the last five-year period. Oversupply is already at 2.5 bcf a day, the bank said. UBS still believes that

closing coal-fired power plants, opening export terminals and building new petrochemical plants will start driving up

long-term demand, but producers can meet it at prices around $4.50/mmBtu, not the prices above $5 the bank had once

projected.

Production is already edging higher after concerns it might be wavering earlier this month, according to Citigroup

Inc. Producers are doing better in several gas-rich shale formations, especially the Marcellus, its analyst Anthony

Yuen said in a note to clients Wednesday. They are quickly recovering from cold weather that can choke off supply and

they keep making technological advancements that allow each well to produce more, he said.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 28, 2015 15:36 ET (20:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 20:36 -- GMT

------

Analysts' Estimates For Tomorrow's EIA Natural Gas Storage Report

DJ Analysts See 111 Billion Cubic-Feet Drop in Natural-Gas Inventories

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural-gas inventories shrunk by

a third less than their average decline for this time of year.

The U.S. Energy Information Administration is expected to report that storage levels fell by 111 billion cubic feet

of gas during the week ended Jan. 23, according to the average forecast of 20 analysts and traders surveyed by The Wall

Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EST.

For the Jan. 23 week, the median estimate is for a drop of 110 bcf. Estimates range from a decline of 97 bcf to a

decline of 144 bcf.

The estimate for Jan. 23 is less than the 219 bcf drained from storage for the same week last year and less than the

168-bcf five-year average drain for that week.

If the storage estimate is correct, inventories as of Jan. 23 totaled 2.5 trillion cubic feet, 14% above levels from

a year ago and 3.6% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 28, 2015 13:51 ET (18:51 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 18:51 -- GMT

------

By Timothy Puko

Analysts and traders expect government data scheduled for release Thursday to show natural-gas inventories shrunk by

a third less than their average decline for this time of year.

The U.S. Energy Information Administration is expected to report that storage levels fell by 111 billion cubic feet

of gas during the week ended Jan. 23, according to the average forecast of 20 analysts and traders surveyed by The Wall

Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EST.

For the Jan. 23 week, the median estimate is for a drop of 110 bcf. Estimates range from a decline of 97 bcf to a

decline of 144 bcf.

The estimate for Jan. 23 is less than the 219 bcf drained from storage for the same week last year and less than the

168-bcf five-year average drain for that week.

If the storage estimate is correct, inventories as of Jan. 23 totaled 2.5 trillion cubic feet, 14% above levels from

a year ago and 3.6% below the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 28, 2015 13:51 ET (18:51 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 18:51 -- GMT

------

Dow Jones Natural Gas - Prices Decline On Growing Supply

DJ Natural Gas Prices Decline on Growing Supply

By Timothy Puko

Natural gas prices are falling back as production appears to be edging higher.

Natural gas for February delivery is down 11.4 cents, or 3.8%, at $2.867 a million British thermal units on the New

York Mercantile Exchange. The front-month contract hasn't had back-to-back sessions of gains or losses in more than a

week.

The more actively traded March contract is down 10.4 cents, or 3.5%, at $2.831/mmBtu. Options expired at Tuesday's

close and the February contract expires Wednesday at close.

"There is ample ... gas in inventory to meet the demand of the remaining winter season even it is colder than

normal," Dominick Chirichella, analyst at the Energy Management Institute, said in a note to clients.

Half of U.S. homes use natural gas for heat, making winter cold typically the biggest driver for demand. But prices

have plummeted 36% since November because record production has been enough to easily cover demand, even in the coldest

weeks of the year.

And that production is still edging higher, according to Citigroup Inc. Producers are extracting more in several

gas-rich shale formations, especially the Marcellus, its analyst Anthony Yuen said in a note to clients Wednesday. They

are quickly recovering from cold weather that can choke off supply and they keep making technological advancements that

allow each well to produce more, he said.

That production is on pace to create a surplus of more than 4 trillion cubic feet for natural gas storage, beyond its

practical capacity, Mr. Yeun said. Prices for both 2015 and 2016 will have to come down another 30 cents/mmBtu in order

to get power producers to buy the gas that can't go into storage, he said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.87/mmBtu, compared with Tuesday's

range of $2.93-$2.97. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $4.25/mmBtu to

$5.00/mmBtu, compared with Tuesday's range of $8.95 to $12.00.

Write to Timothy Puko at

tim.puko@wsj.com

mailto:

tim.puko@wsj.com

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2015 10:02 ET (15:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 15:02 -- GMT

------

By Timothy Puko

Natural gas prices are falling back as production appears to be edging higher.

Natural gas for February delivery is down 11.4 cents, or 3.8%, at $2.867 a million British thermal units on the New

York Mercantile Exchange. The front-month contract hasn't had back-to-back sessions of gains or losses in more than a

week.

The more actively traded March contract is down 10.4 cents, or 3.5%, at $2.831/mmBtu. Options expired at Tuesday's

close and the February contract expires Wednesday at close.

"There is ample ... gas in inventory to meet the demand of the remaining winter season even it is colder than

normal," Dominick Chirichella, analyst at the Energy Management Institute, said in a note to clients.

Half of U.S. homes use natural gas for heat, making winter cold typically the biggest driver for demand. But prices

have plummeted 36% since November because record production has been enough to easily cover demand, even in the coldest

weeks of the year.

And that production is still edging higher, according to Citigroup Inc. Producers are extracting more in several

gas-rich shale formations, especially the Marcellus, its analyst Anthony Yuen said in a note to clients Wednesday. They

are quickly recovering from cold weather that can choke off supply and they keep making technological advancements that

allow each well to produce more, he said.

That production is on pace to create a surplus of more than 4 trillion cubic feet for natural gas storage, beyond its

practical capacity, Mr. Yeun said. Prices for both 2015 and 2016 will have to come down another 30 cents/mmBtu in order

to get power producers to buy the gas that can't go into storage, he said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.87/mmBtu, compared with Tuesday's

range of $2.93-$2.97. Cash prices at the Transco Z6 hub in New York traded in a bid-ask range of $4.25/mmBtu to

$5.00/mmBtu, compared with Tuesday's range of $8.95 to $12.00.

Write to Timothy Puko at

tim.puko@wsj.com

mailto:

tim.puko@wsj.com

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2015 10:02 ET (15:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012815 15:02 -- GMT

------

Natural Gas Technical Update - Bears Retake Control

Today’s expiring February 15 natural gas contract gained .100 in Tuesday’s trade but couldn’t rally above 2.980-3.020 resistance topping out at a 3.005 intraday high.

With resistance holding again, the market has since tipped back lower in today’s early trade dropping the February contract back toward the lower-2.900 level.

The primary trend remains down with 2.750-2.760 being a key area of support. This support has now held the past 4 weeks. A drop under 2.750 would turn the August 2012 weekly low of 2.575 into the next downside support area.

A breakout above 2.980-3.020 resistance would turn the near term trend back up with the next areas of resistance being 3.180-3.210 followed by the 40 day moving average at 3.270. As long as the market trades below the 40 day moving average, the trend will remain down.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Tuesday, January 27, 2015

Dow Jones Natural Gas - Market Bounces As Weather Forecasts Grow Colder

DJ Natural Gas Bounces as Weather Forecasts Grow Colder

By Timothy Puko

Natural gas closed with strong gains on Tuesday, briefly cracking the $3 mark for the first time in more than a week

on colder weather and options expiration.

The front-month February contract settled up 10 cents, or 3.5%, at $2.981 a million British thermal units on the New

York Mercantile Exchange. Trading went as high as $3.005/mmBtu, highest in intraday trading since Jan. 16.

The more actively traded March contract settled up 8.7 cents, or 3%, at $2.935/mmBtu. Options expired at close and

the February contract expires Wednesday at close.

Many options traders sold puts with a $3 strike price, and they had an incentive to bid up the futures contract

Tuesday to avoid paying out on their options deal, said Aaron Calder, senior market analyst at energy-consulting firm

Gelber & Associates in Houston.

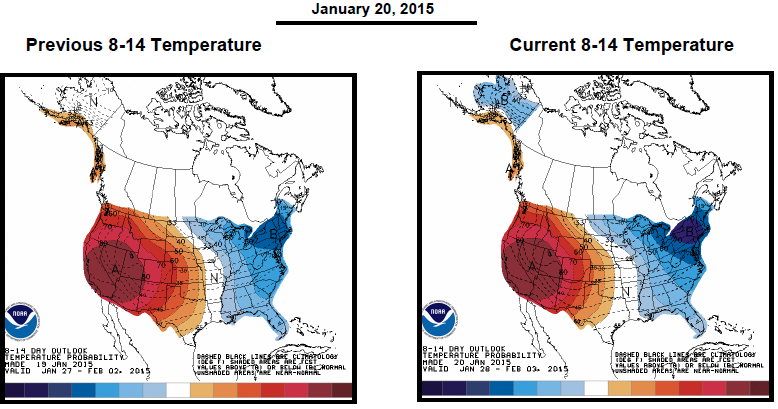

Colder weather helped, too. The blizzard that hit the Northeast is part of a spate cold weather settling in over the

eastern half of the country for at least two weeks, meteorologists said. The Northeast will take the worst of the cold

in the coming days, but below-normal temperatures are likely to spread all the way to the Rockies by Feb. 5, according

to Weather Services International in Andover, Mass.

"Colder Northeastern temperatures and the promise of more to come are dragging up cash prices and futures are coming

along for the ride," Mr. Calder wrote in a note to clients.

Half of U.S. homes use natural gas heat, and the colder weather would raise expectations for gas heating demand.

Demand should stay above normal for at least the next week or two, said Dominick Chirichella, analyst at the Energy

Management Institute.

"Everybody's staying home. You've got to heat your house," said Frank Clements, co-owner of Meridian Energy Brokers

Inc. outside New York. "I think you'll see definitely demand go up."

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 27, 2015 14:53 ET (19:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012715 19:53 -- GMT

------

By Timothy Puko

Natural gas closed with strong gains on Tuesday, briefly cracking the $3 mark for the first time in more than a week

on colder weather and options expiration.

The front-month February contract settled up 10 cents, or 3.5%, at $2.981 a million British thermal units on the New

York Mercantile Exchange. Trading went as high as $3.005/mmBtu, highest in intraday trading since Jan. 16.

The more actively traded March contract settled up 8.7 cents, or 3%, at $2.935/mmBtu. Options expired at close and

the February contract expires Wednesday at close.

Many options traders sold puts with a $3 strike price, and they had an incentive to bid up the futures contract

Tuesday to avoid paying out on their options deal, said Aaron Calder, senior market analyst at energy-consulting firm

Gelber & Associates in Houston.

Colder weather helped, too. The blizzard that hit the Northeast is part of a spate cold weather settling in over the

eastern half of the country for at least two weeks, meteorologists said. The Northeast will take the worst of the cold

in the coming days, but below-normal temperatures are likely to spread all the way to the Rockies by Feb. 5, according

to Weather Services International in Andover, Mass.

"Colder Northeastern temperatures and the promise of more to come are dragging up cash prices and futures are coming

along for the ride," Mr. Calder wrote in a note to clients.

Half of U.S. homes use natural gas heat, and the colder weather would raise expectations for gas heating demand.

Demand should stay above normal for at least the next week or two, said Dominick Chirichella, analyst at the Energy

Management Institute.

"Everybody's staying home. You've got to heat your house," said Frank Clements, co-owner of Meridian Energy Brokers

Inc. outside New York. "I think you'll see definitely demand go up."

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 27, 2015 14:53 ET (19:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012715 19:53 -- GMT

------

Natural Gas Technical Update - Slammed Again In Monday's Session

Outside of a brief two day rally in mid-January, the February 15 natural gas contract has been trading for the most part between 2.750-2.760 support and the 2.980-3.020 level as resistance during 2015.

The February 15 contract which expires on tomorrow’s close pulled back from upper resistance reached on Friday in yesterday’s trade closing the session at 2.881, down .105 (3.5%).

The market has since reversed back higher in today’s early trade rallying up to a 2.991 early morning high. A breakout above 2.980-3.020 would turn the near term trend back up with 3.180-3.210 becoming the next upside resistance. Longer term resistance is the 40 day moving average at 3.300 followed closely behind by the mid-January 3.352 high.

2.750-2.760 weekly low support has held throughout the month of January. The longer amount of time a market holds above support, the more important the support level becomes. A drop under 2.750 is needed to keep the primary market trend bearish. If this occurs, the 2.575 weekly low from August 2012 will become the next downside price target.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Monday, January 26, 2015

16-Year Trend Line Support In Crude Oil Holds For A Second Week

The crude oil market begins a third week of trade holding above 16-year trend line support at the mid-40.00 area.

This trend line was first reached two weeks ago as the spot market fell to a 44.20 and held throughout all of last week’s trade. In today’s session, the market fell to a 44.35 early morning low but subsequently recovered.

If this trend line continues to hold over the next few weeks of trade, a long term low could be set in the crude oil market.

If trend line support is broken, it would be a very bearish technical signal for the market turning the 32.40 low from December 2008 into the next downside price objective.

Natural Gas Corner - Market Review - No Comment Needed

One of the biggest storms to reach the Northeastern U.S. in history and natural gas prices lose 4% in today's trade.

Watch out below.

Watch out below.

Dow Jones Natural Gas - Market Slides As Market Looks Beyond Blizzard

DJ Natural Gas Slides as Market Looks Beyond Blizzard

By Christian Berthelsen

Natural gas prices fell more than 3% on Monday despite the onset of a massive northeastern blizzard, as traders

looked ahead to February weather that is now expected to be warmer than previously predicted.

Natural gas for February delivery ended the day down 10.5 cents, or 3.5%, at $2.881 a million British thermal units

on the New York Mercantile Exchange. The market has lost ground in five of the last seven sessions and is off more than

10% in the last two weeks.

Prices have fallen as inconsistent weather forecasts and robust domestic production have combined to ensure weak

gas-fired heating demand and adequate supplies. Even as the storm that hit the Northeast on Monday was expected to dump

as much as three feet of snow, the forecasts into early February turned warmer than previously expected, particularly

in key consuming areas such as the Midwest, damping demand expectations.

"We don't have a lot of buying appetite because we have full supplies at the end of January, and what we see

occurring ahead is a continuing pattern of variability," said Teri Viswanath, a natural gas market strategist at BNP

Paribas. "What we need to shore up gas prices is a persistent cold outlook."

Temperatures have been solidly cold so far this winter, but robust domestic gas production has helped the U.S.

recover from extraordinary supply drawdowns brought on by last year's brutal winter. There were 2.6 trillion cubic feet

of natural gas in storage according to official U.S. data last week, 8.2% above year-ago levels but 5.5% below average

for this time of year. Analysts are looking toward the end of the winter heating season to see if inventories will be

adequately used up, since a strong production season in the spring and summer is expected to result in a large addition

to supplies.

"A serious shortage is not likely," research consultancy Gelber & Associates said in a note.

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.881 -10.5c

Nymex March $2.848 -11.0c

Nymex April $2.836 -8.7c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.63-$2.66 $2.75-$2.77

El Paso SJ $2.64-$2.66 $2.76-$2.77

Henry Hub $2.915-$2.935 $2.90-$2.955

Katy $2.77-$2.82 $2.82-$2.85

SoCal $2.75-$2.82 $2.79-$2.87

Tex East M3 $6.30-$8.00 $2.695-$2.92

Transco 65 $2.89-$2.95 $2.84-$2.93

Transco Z6 $11.75-$13.25 $3.23-$3.28

Waha $2.68-$2.72 $2.74-$2.785

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 26, 2015 15:47 ET (20:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012615 20:47 -- GMT

------

By Christian Berthelsen

Natural gas prices fell more than 3% on Monday despite the onset of a massive northeastern blizzard, as traders

looked ahead to February weather that is now expected to be warmer than previously predicted.

Natural gas for February delivery ended the day down 10.5 cents, or 3.5%, at $2.881 a million British thermal units

on the New York Mercantile Exchange. The market has lost ground in five of the last seven sessions and is off more than

10% in the last two weeks.

Prices have fallen as inconsistent weather forecasts and robust domestic production have combined to ensure weak

gas-fired heating demand and adequate supplies. Even as the storm that hit the Northeast on Monday was expected to dump

as much as three feet of snow, the forecasts into early February turned warmer than previously expected, particularly

in key consuming areas such as the Midwest, damping demand expectations.

"We don't have a lot of buying appetite because we have full supplies at the end of January, and what we see

occurring ahead is a continuing pattern of variability," said Teri Viswanath, a natural gas market strategist at BNP

Paribas. "What we need to shore up gas prices is a persistent cold outlook."

Temperatures have been solidly cold so far this winter, but robust domestic gas production has helped the U.S.

recover from extraordinary supply drawdowns brought on by last year's brutal winter. There were 2.6 trillion cubic feet

of natural gas in storage according to official U.S. data last week, 8.2% above year-ago levels but 5.5% below average

for this time of year. Analysts are looking toward the end of the winter heating season to see if inventories will be

adequately used up, since a strong production season in the spring and summer is expected to result in a large addition

to supplies.

"A serious shortage is not likely," research consultancy Gelber & Associates said in a note.

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.881 -10.5c

Nymex March $2.848 -11.0c

Nymex April $2.836 -8.7c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.63-$2.66 $2.75-$2.77

El Paso SJ $2.64-$2.66 $2.76-$2.77

Henry Hub $2.915-$2.935 $2.90-$2.955

Katy $2.77-$2.82 $2.82-$2.85

SoCal $2.75-$2.82 $2.79-$2.87

Tex East M3 $6.30-$8.00 $2.695-$2.92

Transco 65 $2.89-$2.95 $2.84-$2.93

Transco Z6 $11.75-$13.25 $3.23-$3.28

Waha $2.68-$2.72 $2.74-$2.785

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 26, 2015 15:47 ET (20:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012615 20:47 -- GMT

------

Dow Jones Natural Gas - Prices Slide As Market Looks Beyond Northeastern Storm

DJ Natural Gas Slides as Market Looks Beyond Northeastern Storm

By Christian Berthelsen

Natural gas futures fell more than 3% Monday despite the approach of a massive northeastern storm, as forecasts

for early February point to warmer weather, damping expectations for gas-fired heating demand.

The Northeast was expected to be pounded with a storm that could dump as much as three feet of snow Monday night

and Tuesday, but the effects were expected to be short-lived. In the longer term, forecasts were trending warmer into

February, with above-normal temperatures spreading over much of the western U.S. and below-normal temperatures receding

in the Northeast in the first week of the month.

"Only the Northeast is set to see above-normal heating demand for the next seven days, with heating demand for the

rest of the U.S. below normal," research consultancy Schneider Electric said in a note. "Combine this with ongoing

rampant domestic production, and (natural gas) remains unflustered by snow storms."

Natural gas for February delivery was down 11.5 cents, or 3.9%, at $2.8710 a million British thermal units on the

New York Mercantile Exchange.

Temperatures have been solidly cold so far this winter, but robust domestic gas production has helped the U.S.

recover from extraordinary supply drawdowns brought on by last year's brutal winter and kept the U.S. adequately

supplied. There were 2.6 trillion cubic feet of natural gas in storage according to official U.S. data last week, 8.2%

above year-ago levels but 5.5% below average for this time of year.

In the physical market, cash prices for next-day delivery of natural gas at the benchmark Henry Hub in Louisiana

last traded at $2.92 a million Btus, compared with Friday's range of $2.90-$2.955. Physical gas at the Transco Z6 hub

in New York traded in a bid-offer range of $7.25-$20.00, compared with Friday's range of $3.23-$3.28.

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 26, 2015 09:50 ET (14:50 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012615 14:50 -- GMT

------

By Christian Berthelsen

Natural gas futures fell more than 3% Monday despite the approach of a massive northeastern storm, as forecasts

for early February point to warmer weather, damping expectations for gas-fired heating demand.

The Northeast was expected to be pounded with a storm that could dump as much as three feet of snow Monday night

and Tuesday, but the effects were expected to be short-lived. In the longer term, forecasts were trending warmer into

February, with above-normal temperatures spreading over much of the western U.S. and below-normal temperatures receding

in the Northeast in the first week of the month.

"Only the Northeast is set to see above-normal heating demand for the next seven days, with heating demand for the

rest of the U.S. below normal," research consultancy Schneider Electric said in a note. "Combine this with ongoing

rampant domestic production, and (natural gas) remains unflustered by snow storms."

Natural gas for February delivery was down 11.5 cents, or 3.9%, at $2.8710 a million British thermal units on the

New York Mercantile Exchange.

Temperatures have been solidly cold so far this winter, but robust domestic gas production has helped the U.S.

recover from extraordinary supply drawdowns brought on by last year's brutal winter and kept the U.S. adequately

supplied. There were 2.6 trillion cubic feet of natural gas in storage according to official U.S. data last week, 8.2%

above year-ago levels but 5.5% below average for this time of year.

In the physical market, cash prices for next-day delivery of natural gas at the benchmark Henry Hub in Louisiana

last traded at $2.92 a million Btus, compared with Friday's range of $2.90-$2.955. Physical gas at the Transco Z6 hub

in New York traded in a bid-offer range of $7.25-$20.00, compared with Friday's range of $3.23-$3.28.

Write to Christian Berthelsen at christian.berthelsen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 26, 2015 09:50 ET (14:50 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012615 14:50 -- GMT

------

Natural Gas Technical Update - Bears Sell Into Storm Strength

The February 15 natural gas contract traded in a fairly wide .462 range in last week’s trade setting a new contract low at 2.766 in Wednesday’s trade.

The contract was unable, however, to break out below 2.750-2.760 weekly low support which has now held throughout the entire month of January.

With weekly low support holding on Wednesday, the February contract moved higher into Friday’s close settling the week at 2.986, down .141. It was the 8th lower weekly settle out of the past 9 weeks.

The market is weaker in today’s early trade with 2.750-2.760 remaining primary support. A drop under 2.750 will keep the trend bearish with the 2.575 weekly low from August 2012 becoming the next downside support.

2.980-3.020 is the first area of resistance followed by 3.180-3.210. Longer term resistance is the 40 day moving average at 3.335 which coincides with the 3.352 high set two weeks ago. A breakout above these two areas of resistance is needed to turn the trend back higher.

The fund long position in the natural gas market jumped by nearly 22% last week according to the Commitment of Trader’s report released on Friday. The speculative long futures position by the funds is currently 117,764 contracts, up 20,953 from the previous week.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Natural Gas Seasonal Price Trend - Fading the Seasonal Trend

The seasonal price trend for natural gas at this time of year is typically higher. But with one of the strongest winter storms in years hitting the Northeastern U.S., natural gas prices are currently lower in early trade today.

Time for a winter rally is quickly running out. Record high production is overwhelming all other news in the market.

Time for a winter rally is quickly running out. Record high production is overwhelming all other news in the market.

Speculative Long Position In Natural Gas Jumps By Over 20% Last Week

Funds were active buyers in the natural gas market according the Commitment of Trader's report released on Friday.

The report showed funds long 117,764 natural gas futures contracts, up 20,952 or 22% from the previous week.

The report showed funds long 117,764 natural gas futures contracts, up 20,952 or 22% from the previous week.

Bitter Winter Storms Hits The Northeastern U.S. and Gas Prices Are Down?

Not a bullish signal. Look out below.

Friday, January 23, 2015

Dow Jones Natural Gas - Natural Gas Surges On Signs Of Cold Weather And Heating Demand

DJ Natural Gas Surges on Signs of Cold Weather and Heating Demand

By Timothy Puko

Natural gas is rebounding Friday as weather forecasts for a frigid East Coast spark hopes of strong demand for the

heating fuel.

Natural gas for February delivery is up 10.5 cents, or 3.7%, at $2.94 a million British thermal units on the New York

Mercantile Exchange. The market has not had back-to-back gains or losses yet this week.

Weather forecasts look especially promising because of far-below normal temperatures hovering over the New York

metropolitan area through at least the first week of February. A cold front descending on the entire East Coast is also

likely to spread the Midwest's big heating markets by the end of January.

"What you're seeing this morning is more confidence that February will begin on a cold note," said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

Ms. Viswanath warned that that may have only limited impact unless the cold lingers over both of those regions for a

prolonged period. Production is still growing enough to cover just about anything except sustained, exceptional demand.

Low prices are forcing producers to moderate their growth by about 2 billion cubic feet a day, but that isn't likely

enough to balance the market, Macquarie Group Ltd. said in its new "Commodities Compendium." It expects year-over-year

growth to continue in 2015 at about 4 bcf a day, keeping up production's record pace of about 73 bcf a day.

"As a direct result, barring extremely cold weather during the remainder of 2015, followed by a hot summer, we find

little to support the market in the near term," researchers for the Australian investment bank wrote. "If 2014 has

taught us anything, it's that America's natural gas producers are like the Marine Corps of the energy industry--they

adapt, modify, and persevere in any manner needed to continue growing production."

It expects prices to test levels near mid $2/mmBtu. To balance, the market will probably need to go low enough to get

power generators in Texas to use gas instead of very cheap coal, it said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.94/mmBtu, compared with Thursday's

range of $2.90-$2.955. Cash prices at the Transco Z6 in New York traded with a bid of $4.00/mmBtu but no ask, compared

with Thursday's range of $3.23 to $3.28.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 23, 2015 09:40 ET (14:40 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012315 14:40 -- GMT

------

By Timothy Puko

Natural gas is rebounding Friday as weather forecasts for a frigid East Coast spark hopes of strong demand for the

heating fuel.

Natural gas for February delivery is up 10.5 cents, or 3.7%, at $2.94 a million British thermal units on the New York

Mercantile Exchange. The market has not had back-to-back gains or losses yet this week.

Weather forecasts look especially promising because of far-below normal temperatures hovering over the New York

metropolitan area through at least the first week of February. A cold front descending on the entire East Coast is also

likely to spread the Midwest's big heating markets by the end of January.

"What you're seeing this morning is more confidence that February will begin on a cold note," said Teri Viswanath, a

natural-gas strategist at BNP Paribas SA in New York.

Ms. Viswanath warned that that may have only limited impact unless the cold lingers over both of those regions for a

prolonged period. Production is still growing enough to cover just about anything except sustained, exceptional demand.

Low prices are forcing producers to moderate their growth by about 2 billion cubic feet a day, but that isn't likely

enough to balance the market, Macquarie Group Ltd. said in its new "Commodities Compendium." It expects year-over-year

growth to continue in 2015 at about 4 bcf a day, keeping up production's record pace of about 73 bcf a day.

"As a direct result, barring extremely cold weather during the remainder of 2015, followed by a hot summer, we find

little to support the market in the near term," researchers for the Australian investment bank wrote. "If 2014 has

taught us anything, it's that America's natural gas producers are like the Marine Corps of the energy industry--they

adapt, modify, and persevere in any manner needed to continue growing production."

It expects prices to test levels near mid $2/mmBtu. To balance, the market will probably need to go low enough to get

power generators in Texas to use gas instead of very cheap coal, it said.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.94/mmBtu, compared with Thursday's

range of $2.90-$2.955. Cash prices at the Transco Z6 in New York traded with a bid of $4.00/mmBtu but no ask, compared

with Thursday's range of $3.23 to $3.28.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 23, 2015 09:40 ET (14:40 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012315 14:40 -- GMT

------

Natural Gas Technical Update - Weekly Low Support Holds Again

The February 15 natural gas contract traded down to a new contract low of 2.766 in Thursday’s trade but was unable to drop below 2.750 weekly chart support.

This support has been tested on several occasions during the month of January but has held each time. If 2.750 support is broken, the 2.575 weekly low from August 2012 will become the next downside objective.

The first area of resistance today which coincides with the 10 day moving average is 2.980-3.020 with yesterday’s failed rally topping out at a 3.048 high. A breakout above lower-3.000 resistance would turn 3.180-3.210 into the next upside resistance.

Longer term resistance is the 3.352 high set last week followed closely behind by the 40 day moving average at 3.370. A breakout above these two resistance levels is needed to turn the longer term trend back up.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bullish

Thursday, January 22, 2015

Natural Gas Corner - Market Review - Too Much Gas and No Where To Place It

Natural gas prices today plunged following release of the EIA weekly storage report which came in at a 216 Bcf withdrawal, near the lower end of the pre-report estimated range.

While storage withdrawals over the past 3 weeks have been large, they have been unable to actively draw down domestic supplies needed with the increase in production. U.S. production of natural gas continues to grow with daily production adding an additional 4-8 Bcf of supply onto an already oversupplied market.

The combination of lower demand and increased supply have led some analyst's to predict storage could reach 4,600-4,700 Bcf by the end of 2015. If correct, this would have U.S. gas supplies 400-500 Bcf above available storage space leaving excess gas supplies to be dumped on the cash market depressing prices even more.

Lower gas prices should entice power generation buying of natural gas by the utilities but this might not be enough to decrease stockpiles to more manageable levels.

With 9 weeks left in the current withdrawal season, time is running out for potential weather demand leaving the market is a situation very similar to 2012 when spot prices fell to a 1.906 low in April.

Weather forecasts in the eastern U.S. could increase gas usage but weather demand will need to rapidly increase or the natural gas market could be setting up for substantial downside price break in upcoming trade.

While storage withdrawals over the past 3 weeks have been large, they have been unable to actively draw down domestic supplies needed with the increase in production. U.S. production of natural gas continues to grow with daily production adding an additional 4-8 Bcf of supply onto an already oversupplied market.

The combination of lower demand and increased supply have led some analyst's to predict storage could reach 4,600-4,700 Bcf by the end of 2015. If correct, this would have U.S. gas supplies 400-500 Bcf above available storage space leaving excess gas supplies to be dumped on the cash market depressing prices even more.

Lower gas prices should entice power generation buying of natural gas by the utilities but this might not be enough to decrease stockpiles to more manageable levels.

With 9 weeks left in the current withdrawal season, time is running out for potential weather demand leaving the market is a situation very similar to 2012 when spot prices fell to a 1.906 low in April.

Weather forecasts in the eastern U.S. could increase gas usage but weather demand will need to rapidly increase or the natural gas market could be setting up for substantial downside price break in upcoming trade.

Dow Jones Natural Gas - Futures Lose Big On Smaller Than Expected Stockpile Drain

DJ Natural Gas Futures Lose Big on Smaller-Than-Expected Stockpile Drain

By Timothy Puko

Natural-gas futures sold off Thursday after a smaller-than-expected drain on storage levels added to pessimism about

an oversupplied market.

The front-month February contract settled down 13.9 cents, or 4.7%, at $2.835 a million British thermal units on the

New York Mercantile Exchange. Prices had fallen below $2.80/mmBtu and set a new two-year low in intraday trading before

a small rally to end floor trading.

Storage levels shrank by 216 billion cubic feet in the week ended Jan. 16, the U.S. Energy Information Administration

said. The drain was 11 bcf smaller than the 227-bcf consensus average of 19 forecasters surveyed by The Wall Street

Journal.

That damped hope that winter cold could rebalance an oversupplied market. Half of U.S. homes use natural gas for

heat, and that usually leads to price peaks in the winter. This year, supply has been so overwhelming that even

near-record demand hasn't been enough to keep up.

"There is little hope from current sellers that natural gas will be at a premium in late February," Aaron Calder,

senior market analyst at energy-consulting firm Gelber & Associates in Houston, said in a note to clients.

Macquarie Group Ltd. had said Tuesday that the country could have 4.7 trillion cubic feet of gas available for

storage by October, 600 billion cubic feet more than the country's storage system has the capacity to hold. Analysts

said Thursday that the lower-than-expected storage drain is a sign that producers hadn't slowed down as much as some

traders had hoped.

"You're seeing a market that is well-stocked," said John Woods, president of JJ Woods Associates and a Nymex trader.

The losses put natural gas at a crossroads. Such low prices could be within a few cents of competing against the

country's cheapest coal, which means power plants could step in and buy more gas, lifting the market, analysts at CIBC

World Markets said in a note. But if there is no string of consistent cold, even that may not be enough new demand to

soak up a growing glut and prices could drop below $2.50/mmBtu heading into the summer, the bank adds.

"You still have guys who are trying to sell anything they can...anything eight months out," said Michael Doyle, a

broker at Eclipse International Inc. in New York.

The drain brought storage levels to 2.6 trillion cubic feet, 8.2% more than a year ago and 5.5% below the five-year

average.

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.835 -13.9c

Nymex March $2.827 -11.3c

Nymex April $2.817 -8.9c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.75-$2.77 $2.765-$2.80

El Paso SJ $2.76-$2.77 $2.7725-$2.80

Henry Hub $2.90-$2.955 $2.91-$2.965

Katy $2.82-$2.85 $2.83-$2.89

SoCal $2.79-$2.87 $2.85-$2.90

Tex East M3 $2.695-$2.92 $2.45-$2.955

Transco 65 $2.84-$2.93 $2.875-$2.96

Transco Z6 $3.23-$3.28 $3.18-$3.30

Waha $2.74-$2.785 $2.76-$2.81

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 22, 2015 14:59 ET (19:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012215 19:59 -- GMT

------

By Timothy Puko

Natural-gas futures sold off Thursday after a smaller-than-expected drain on storage levels added to pessimism about

an oversupplied market.

The front-month February contract settled down 13.9 cents, or 4.7%, at $2.835 a million British thermal units on the

New York Mercantile Exchange. Prices had fallen below $2.80/mmBtu and set a new two-year low in intraday trading before

a small rally to end floor trading.

Storage levels shrank by 216 billion cubic feet in the week ended Jan. 16, the U.S. Energy Information Administration

said. The drain was 11 bcf smaller than the 227-bcf consensus average of 19 forecasters surveyed by The Wall Street

Journal.

That damped hope that winter cold could rebalance an oversupplied market. Half of U.S. homes use natural gas for

heat, and that usually leads to price peaks in the winter. This year, supply has been so overwhelming that even

near-record demand hasn't been enough to keep up.

"There is little hope from current sellers that natural gas will be at a premium in late February," Aaron Calder,

senior market analyst at energy-consulting firm Gelber & Associates in Houston, said in a note to clients.

Macquarie Group Ltd. had said Tuesday that the country could have 4.7 trillion cubic feet of gas available for

storage by October, 600 billion cubic feet more than the country's storage system has the capacity to hold. Analysts

said Thursday that the lower-than-expected storage drain is a sign that producers hadn't slowed down as much as some

traders had hoped.

"You're seeing a market that is well-stocked," said John Woods, president of JJ Woods Associates and a Nymex trader.

The losses put natural gas at a crossroads. Such low prices could be within a few cents of competing against the

country's cheapest coal, which means power plants could step in and buy more gas, lifting the market, analysts at CIBC

World Markets said in a note. But if there is no string of consistent cold, even that may not be enough new demand to

soak up a growing glut and prices could drop below $2.50/mmBtu heading into the summer, the bank adds.

"You still have guys who are trying to sell anything they can...anything eight months out," said Michael Doyle, a

broker at Eclipse International Inc. in New York.

The drain brought storage levels to 2.6 trillion cubic feet, 8.2% more than a year ago and 5.5% below the five-year

average.

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.835 -13.9c

Nymex March $2.827 -11.3c

Nymex April $2.817 -8.9c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.75-$2.77 $2.765-$2.80

El Paso SJ $2.76-$2.77 $2.7725-$2.80

Henry Hub $2.90-$2.955 $2.91-$2.965

Katy $2.82-$2.85 $2.83-$2.89

SoCal $2.79-$2.87 $2.85-$2.90

Tex East M3 $2.695-$2.92 $2.45-$2.955

Transco 65 $2.84-$2.93 $2.875-$2.96

Transco Z6 $3.23-$3.28 $3.18-$3.30

Waha $2.74-$2.785 $2.76-$2.81

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 22, 2015 14:59 ET (19:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012215 19:59 -- GMT

------

Dow Jones Post-EIA Report Commentary

DJ Natural Gas Prices Fall on Smaller-Than-Expected Stockpile Drain

By Timothy Puko

Natural gas futures added to losses Thursday after federal data showed U.S. storage levels didn't fall as far as

expected last week.

Storage levels shrank by 216 billion cubic feet in the week ended Jan. 16, the U.S. Energy Information

Administration said. The drain was 11 bcf smaller than the 227 bcf expected on average by 19 forecasters surveyed by

The Wall Street Journal.

The smaller-than-expected drain caused prices to drop another 8 cents, or 2.7%, on top of losses from earlier in

the morning. The front-month February contract recently traded down 14.4 cents, or 4.8%, at $2.83/mmBtu on the New York

Mercantile Exchange.

The drain brought storage levels to 2.6 trillion cubic feet, 8.2% more than a year ago and 5.5% below the

five-year average.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 22, 2015 10:56 ET (15:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012215 15:56 -- GMT

By Timothy Puko

Natural gas futures added to losses Thursday after federal data showed U.S. storage levels didn't fall as far as

expected last week.

Storage levels shrank by 216 billion cubic feet in the week ended Jan. 16, the U.S. Energy Information

Administration said. The drain was 11 bcf smaller than the 227 bcf expected on average by 19 forecasters surveyed by

The Wall Street Journal.

The smaller-than-expected drain caused prices to drop another 8 cents, or 2.7%, on top of losses from earlier in

the morning. The front-month February contract recently traded down 14.4 cents, or 4.8%, at $2.83/mmBtu on the New York

Mercantile Exchange.

The drain brought storage levels to 2.6 trillion cubic feet, 8.2% more than a year ago and 5.5% below the

five-year average.

Write to Timothy Puko at tim.puko@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwireshttp://online.wsj.com?mod=djnwires">http://online.wsj.com?mod=djnwires

>

(END) Dow Jones Newswires

January 22, 2015 10:56 ET (15:56 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

012215 15:56 -- GMT

EIA Weekly Storage Report - 216 Bcf Draw - Lower End of Estimates

For the week ended

Jan 16:

EIA Withdrawal - 216 BCF

Last Year's Draw - 133 BCF

5 Yr Avg Draw - 176 BCF

Range of Estimates - 193 BCF to 250 BCF

Avg Estimate - 227 BCF

Total Gas in Storage - 2.637 TCF

EIA Withdrawal - 216 BCF

Last Year's Draw - 133 BCF

5 Yr Avg Draw - 176 BCF

Range of Estimates - 193 BCF to 250 BCF

Avg Estimate - 227 BCF

Total Gas in Storage - 2.637 TCF

Dow Jones Natural Gas - Prices In Steady Retreat On Concerns About Bear Market

DJ Natural Gas in a Steady Retreat on Concerns About Bear Market

By Timothy Puko

Natural gas is in a steady retreat Thursday as concerns about a long-term bear market are pushing traders back into a

selloff.

Natural gas for February delivery is down 7 cents, or 2.4%, at $2.904 a million British thermal units on the New York

Mercantile Exchange. Trading volumes are light, but analysts said that will probably change and volatility is likely to

pick back up after the federal government's weekly storage update, scheduled for 10:30 a.m.

Stockpiles likely fell by 227 billion cubic feet of gas during the week ended Jan. 16, according to the average

forecast of 19 analysts and traders surveyed by The Wall Street Journal. That would be among the 20 largest draws on

storage in EIA records dating back to 1994.

But many traders have been looking past that and have focused on the chance that record supply could lead to a glut

later this year. Macquarie Group Ltd. had said Tuesday that the country could have 4.7 trillion cubic feet of gas

available for storage by October, 600 billion cubic feet more than the country's storage system has the capacity to