The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Tuesday, May 31, 2016

Commitment of Trader's Report - Fund Long Position In Natural Gas Falls

The position as of the 05-24 close was estimated at 108,237 contracts, down 16,733 contracts from the previous week.

The funds are expected to be a strong presence in this market on the long side during 2016 following a new 18-year price low being set in March.

Dow Jones - Natural Gas Shoots Up On Technical Trade

DJ Natural Gas Shoots up on Technical Trade

By Timothy Puko

Natural-gas prices surged to a new four-month high after futures surpassed an important technical level and

forecasts warmed for one of the country's biggest markets for demand.

Natural gas for July delivery is up 9 cents, or 4.2%, at $2.259 a million British thermal units on the New York

Mercantile Exchange. That would be one of the biggest percentage gains in the last month. Front-month prices are now up

15% since the June contract expired Thursday at just $1.963/mmBtu.

July's contract hasn't traded below $2/mmBtu since early March, and summer prices are often higher because of

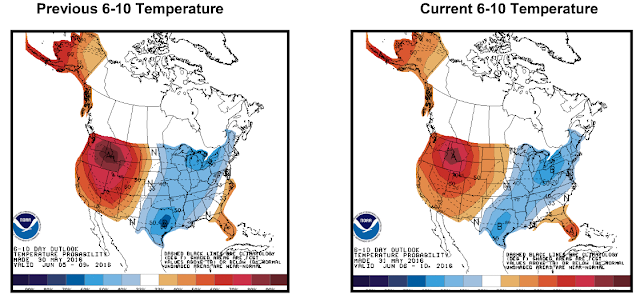

increasing demand for gas-fired power to run air conditioners. Weather updates for mid-June are showing warmer

temperatures in the southeast than Friday's updates before the three-day weekend, and that strengthens demand

expectations in the biggest region for gas-fired power, according to analysts.

But gas may be getting a bigger boost from technical traders that move on price momentum, a broker and trader

said. Prices moved above their 200-day moving average Tuesday for the first time since November 2014, which appeared to

trigger a lot of buy orders, they said. Nearly half the gains came just at 9 a.m. ET, the traditional start of U.S.

trading hours when volume usually increases dramatically.

That 200-day moving average is a widely-watched trigger for technical traders to close out bearish positions or

add to bullish positions. It covers a broad period of time, so if prices can stay above it, technical traders see it as

a major indicator the market sentiment has changed.

"If it stays above there it's significant. Then you can make a case the market is bullish," said Scott Gettleman,

an independent trader in New York.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

May 31, 2016 11:34 ET (15:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

053116 15:34 -- GMT

------

By Timothy Puko

Natural-gas prices surged to a new four-month high after futures surpassed an important technical level and

forecasts warmed for one of the country's biggest markets for demand.

Natural gas for July delivery is up 9 cents, or 4.2%, at $2.259 a million British thermal units on the New York

Mercantile Exchange. That would be one of the biggest percentage gains in the last month. Front-month prices are now up

15% since the June contract expired Thursday at just $1.963/mmBtu.

July's contract hasn't traded below $2/mmBtu since early March, and summer prices are often higher because of

increasing demand for gas-fired power to run air conditioners. Weather updates for mid-June are showing warmer

temperatures in the southeast than Friday's updates before the three-day weekend, and that strengthens demand

expectations in the biggest region for gas-fired power, according to analysts.

But gas may be getting a bigger boost from technical traders that move on price momentum, a broker and trader

said. Prices moved above their 200-day moving average Tuesday for the first time since November 2014, which appeared to

trigger a lot of buy orders, they said. Nearly half the gains came just at 9 a.m. ET, the traditional start of U.S.

trading hours when volume usually increases dramatically.

That 200-day moving average is a widely-watched trigger for technical traders to close out bearish positions or

add to bullish positions. It covers a broad period of time, so if prices can stay above it, technical traders see it as

a major indicator the market sentiment has changed.

"If it stays above there it's significant. Then you can make a case the market is bullish," said Scott Gettleman,

an independent trader in New York.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

May 31, 2016 11:34 ET (15:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

053116 15:34 -- GMT

------

Natural Gas Corner - Technical Update - Short-Squeeze In Progress With Key Support Holding Last Week

A higher open last Monday by the July 16 natural gas

contract topped out at a 2.271 high before steadily selling off into Friday’s

close. For the week, the July contract lost .038 or 1.7%settling

Friday at 2.169.

The July contract bottomed out at a 2.101 low last Thursday

holding above 2.080 weekly low support.

With support holding again, buyers have reemerged in

this week’s trade rallying the July contract up to 40 day moving average

resistance at the 2.220 level.

A breakout above the 40 day average will turn the near

term trend back up with following resistance at last week’s 2.271 high and the

2.327 early-April high. Longer term resistance is the 200 day moving

average currently at 2.440 which coincides with the 2.427 March high.

This rally could lift the July contract back toward the

upper end of the past 3-month trading range. However, strength should

continue to be sold with the expectation for a retest of the 1.939 contract low

later this summer.

Bottom line – Short-squeeze in progress with weekly low

support holding again last week.

Friday’s Commitment of Trader’s report showed a decline in

the long futures position held by the funds in the natural gas market.

The long position as of the 05-24 close was estimated at 108,237 contracts,

down 16,733 from the previous week.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Friday, May 27, 2016

Natural Gas Corner - Technical Update - Summer Downtrend Progresses

The new front month July 16 natural gas contract begins

today’s trade nearly .200 above the price that the June 16 contract expired at

in Thursday’s session.

This gap will likely be quickly closed with lower trade

ahead by the July contract which settled on Thursday at the 2.151 level.

The first level of support is at 2.080 followed by

2.050-2.060. Longer term support is the early-March contract low at 1.939

which is expected to be tested and broken as the seasonal downtrend progresses.

The 10, 40 and 200 day moving averages are now in a bearish

alignment along with the short and long term RMI indexes. The 10 day

average at 2.170 is the first area of resistance followed by the 40 day average

at 2.220.

Bottom line – Bearish momentum increasing.

Technical Indicators: Moving Average Alignment –

Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Posts (Atom)