DJ Natural Gas Soars in Second Quarter

By Nicole Friedman

NEW YORK--Natural gas posted its largest quarterly percentage gain since 2005 on expectations that falling production

and strong demand would shrink the glut of fuel.

Prices rose 96.5 cents, or 49%, in the second quarter to $2.924 a million British thermal units on the New York

Mercantile Exchange.

Prices rose Thursday after weekly inventory data showed that inventories grew less than expected last week. Futures

for August delivery settled up 0.61 cent, or 2.1%.

Producers added 42 billion cubic feet of natural gas to storage in the week ended June 24, the Energy Information

Administration said Thursday, less than the 48-bcf injection that analysts surveyed by The Wall Street Journal had

expected.

The natural-gas market remains oversupplied following a winter of sluggish demand, but the relative surplus of fuel

in storage has shrunk in recent weeks due to declining production and rising demand. Inventories as of June 24 totaled

3.14 trillion cubic feet, 23% above levels from a year ago and 25% above the five-year average for the same week.

Prices have risen strongly in recent weeks on forecasts for hot weather, which can increase demand for gas-powered

electricity to run air-conditioning units.

"With strong weather-induced power demand...the next two [storage injections] are likely to be very light," said

Jefferies in a note.

However, prices might not be able to hold gains above $3/mmBtu, because that level could prompt some power plants to

switch from natural gas to coal, which is cheaper, and could encourage some producers to drill new wells, said Teri

Viswanath, managing director at PIRA Energy Group.

"Despite the bullish sentiment, a premature arrival of the $3 handle poses a significant risk for reversing this

hard-won balancing achieved this season," she said.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

June 30, 2016 15:10 ET (19:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

063016 19:10 -- GMT

The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Thursday, June 30, 2016

EIA Weekly Storage Report - 37 Bcf Injection - Lower Than Expected

For the week ended June 24:

EIA Injection - 37 BCF (-5 BCF Reclassified as Base Gas)

Last Year's Injection - 73 BCF

5 Yr Avg Injection - 78 BCF

Range of Estimates - 42 BCF to 61 BCF

Avg Estimate - 47 BCF

Total Gas in Storage - 3.140 tcf

EIA Injection - 37 BCF (-5 BCF Reclassified as Base Gas)

Last Year's Injection - 73 BCF

5 Yr Avg Injection - 78 BCF

Range of Estimates - 42 BCF to 61 BCF

Avg Estimate - 47 BCF

Total Gas in Storage - 3.140 tcf

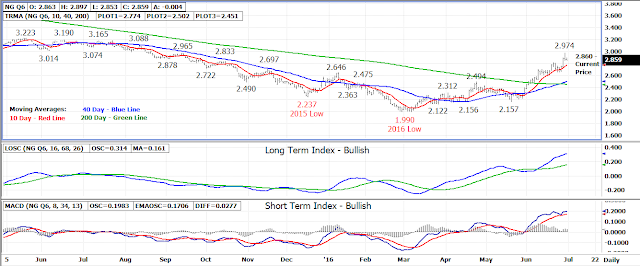

Natural Gas Corner - Technical Update - Key Resistance Area Reached On Wednesday

The August 16 natural gas contract started out yesterday’s

session sharply higher rallying up to a price level last reached in August

2015.

The 2.974 daily high came in a resistance area between

2.950-3.050 where the market topped out on a weekly basis last

summer.

Early buying turned into selling by mid-morning dropping the

August contract to a lower close on the day settling at 2.863, down .027.

A bearish shooting star Japanese candlestick formed on yesterday’s bar warning

of a possible near or longer term pull back in the market but the trend at this

point remains up.

Strong selling resistance is expected between 2.950-3.050

which will be interesting to watch as it gets tested in upcoming trade.

Former daily high resistance at 2.812 is the first area of

support under yesterday’s 2.844 low followed closely behind by the 10 day

moving average at 2.775. It was from 10 day moving average support

reached earlier this week from which the latest rally higher began. A

close under the 10 day average could signal a reversal is in progress.

Bottom line – Bearish technical signals forming but no

change in upward trend yet evident.

Technical Indicators: Moving Average Alignment –

Bullish

Long Term Trend Following Index – Bullish

Short Term Trend Following Index - Bullish

Wednesday, June 29, 2016

Dow Jones - Natural Gas Falls As Weather Forecasts Cool

DJ Natural Gas Falls as Weather Forecasts Cool

By Timothy Puko

Natural gas prices inched lower Wednesday as hot near-term weather forecasts got slightly cooler, weakening

expectations for strong summer demand.

Natural gas for August delivery settled down 2.2 cents, or 0.9%, at $2.863 a million British thermal units on the New

York Mercantile Exchange. Prices briefly moved into positive territory at the start of traditional U.S. trading hours,

but retreated quickly.

The move down comes after the market had its strongest daily rally in months on Tuesday, up 7.4%. Prices are still up

46% since the June contract expired at just $1.963/mmBtu on May 26.

That created an opportunity for many traders to cash out winning bets Tuesday once weather forecasts appeared cooler,

a trader and analyst said. Traders have steadily moved into bullish positions in recent months--betting on falling

supply and rising demand to resolve a big glut--and prices can fall when those traders sell their contracts to close

out winning bets.

"Today is just digesting the Thanksgiving dinner," said Donald Morton, senior vice president at Herbert J. Sims &

Co., who runs an energy-trading desk.

Weather forecasts are still showing hot weather across the country, which can raise demand for gas-fired power to run

air conditioners in the summer. But forecasts did cool slightly in some parts of the country for the next five days.

MDA Weather Services in Maryland is forecasting temperatures as much as 8-degrees-Fahrenheit-below normal in parts of

the Midwest from Western Kansas to Western Pennsylvania.

Many may have also wanted to get out of the market ahead of Thursday's weekly inventory report, which often brings

some of the market's most volatile trading, said Tim Evans, analyst at Citi Futures Perspective in New York. The U.S.

Energy Information Administration releases its storage data update at 10:30 a.m.

It is likely to report stockpiles grew by 47 billion-cubic feet of gas during the week ended June 24, according to

the average forecast of 18 analysts, brokers and traders surveyed by The Wall Street Journal. If the storage estimate

is correct, inventories as of June 24 totaled 3 trillion cubic feet, 18% above levels from a year ago and 21% above the

five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

June 29, 2016 14:47 ET (18:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

062916 18:47 -- GMT

------

By Timothy Puko

Natural gas prices inched lower Wednesday as hot near-term weather forecasts got slightly cooler, weakening

expectations for strong summer demand.

Natural gas for August delivery settled down 2.2 cents, or 0.9%, at $2.863 a million British thermal units on the New

York Mercantile Exchange. Prices briefly moved into positive territory at the start of traditional U.S. trading hours,

but retreated quickly.

The move down comes after the market had its strongest daily rally in months on Tuesday, up 7.4%. Prices are still up

46% since the June contract expired at just $1.963/mmBtu on May 26.

That created an opportunity for many traders to cash out winning bets Tuesday once weather forecasts appeared cooler,

a trader and analyst said. Traders have steadily moved into bullish positions in recent months--betting on falling

supply and rising demand to resolve a big glut--and prices can fall when those traders sell their contracts to close

out winning bets.

"Today is just digesting the Thanksgiving dinner," said Donald Morton, senior vice president at Herbert J. Sims &

Co., who runs an energy-trading desk.

Weather forecasts are still showing hot weather across the country, which can raise demand for gas-fired power to run

air conditioners in the summer. But forecasts did cool slightly in some parts of the country for the next five days.

MDA Weather Services in Maryland is forecasting temperatures as much as 8-degrees-Fahrenheit-below normal in parts of

the Midwest from Western Kansas to Western Pennsylvania.

Many may have also wanted to get out of the market ahead of Thursday's weekly inventory report, which often brings

some of the market's most volatile trading, said Tim Evans, analyst at Citi Futures Perspective in New York. The U.S.

Energy Information Administration releases its storage data update at 10:30 a.m.

It is likely to report stockpiles grew by 47 billion-cubic feet of gas during the week ended June 24, according to

the average forecast of 18 analysts, brokers and traders surveyed by The Wall Street Journal. If the storage estimate

is correct, inventories as of June 24 totaled 3 trillion cubic feet, 18% above levels from a year ago and 21% above the

five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

June 29, 2016 14:47 ET (18:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

062916 18:47 -- GMT

------

Analysts' Estimates For Tomorrow's EIA Weekly Storage Report

DJ Analysts See 47 Billion-Cubic Feet Addition to U.S. Natural-Gas Inventories

By Timothy Puko

Analysts expect government data scheduled for release Thursday to show natural-gas inventories last week rose by far

less than average for this time of year

The U.S. Energy Information Administration is expected to report that storage levels grew by 47 billion-cubic feet of

gas during the week ended June 24, according to the average forecast of 18 analysts, brokers and traders surveyed by

The Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the June 24 week, the median estimate is for an increase of 46 bcf. Estimates range from an increase of 42 bcf to

an addition of 61 bcf.

The estimate for June 24 compares to 73 bcf added to storage in the same week last year and a five-year average

addition of 78 bcf for that week.

If the storage estimate is correct, inventories as of June 24 totaled 3 trillion cubic feet, 18% above levels from a

year ago and 21% above the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

June 29, 2016 14:18 ET (18:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

062916 18:18 -- GMT

------

By Timothy Puko

Analysts expect government data scheduled for release Thursday to show natural-gas inventories last week rose by far

less than average for this time of year

The U.S. Energy Information Administration is expected to report that storage levels grew by 47 billion-cubic feet of

gas during the week ended June 24, according to the average forecast of 18 analysts, brokers and traders surveyed by

The Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EDT.

For the June 24 week, the median estimate is for an increase of 46 bcf. Estimates range from an increase of 42 bcf to

an addition of 61 bcf.

The estimate for June 24 compares to 73 bcf added to storage in the same week last year and a five-year average

addition of 78 bcf for that week.

If the storage estimate is correct, inventories as of June 24 totaled 3 trillion cubic feet, 18% above levels from a

year ago and 21% above the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

June 29, 2016 14:18 ET (18:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

062916 18:18 -- GMT

------

Subscribe to:

Posts (Atom)