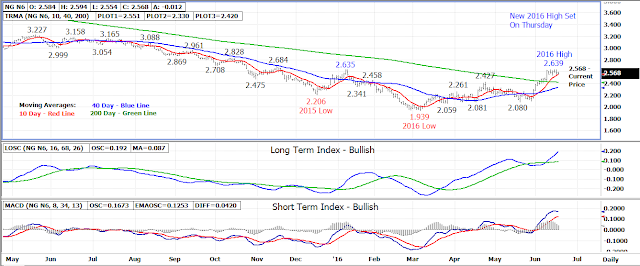

The July 16 natural gas contract pushed up to a new 2016

contract high on Thursday at the 2.639 level exceeding the previous high set

last week by 4 ticks.

However, no follow through buying materialized on the

breakout attempt as the contract instead slumped lower into the close settling

the day at 2.580, down .015.

The 10 day moving average at 2.550 today held as support in

yesterday’s session as well as in today’s early trade. A close under this

average could indicate a near term top has been set in the market with

following support at 2.490-2.500. A drop under 2.490-2.500 could initiate

further liquidation selling as this was a previous “breakout” resistance area.

Longer term support levels are the 200 day moving average at

2.420 and the 40 day average at 2.330.

A breakout above Thursday’ 2.639 high is needed to keep the

primary trend bullish. If this occurs, 2.680-2.690 will become the next

upside resistance.

Bottom line – Key test of 10 day moving average support

today.

Technical Indicators: Moving Average Alignment –

Neutral-Bullish

Long

Term Trend Following Index – Bullish

Short Term Trend Following Index - Bullish

No comments:

Post a Comment