The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Friday, January 29, 2016

Natural Gas Corner - Technical Update - Key Resistance Broken In Overnight Trade

The March 16 natural gas contract has broken out above 40

day moving average resistance in today’s early trade. If the breakout

holds, the near term trend for the market will turn back higher.

Prior to the overnight breakout, the March contract had been

holding under the 40 as resistance for the past 8 sessions. With

resistance broken, 2.270-2.280 now becomes the next upside resistance with

longer term resistance at 2.380-2.390 followed by the 2.493 early-January high.

The 40 day moving average now becomes the first area of

support today at 2.190 followed by the 10 day average at 2.155. A drop

back under both averages will turn the near term trend back down with the 2.080

low set last week being the next area of support followed by 1.980-2.000.

If 1.980 support is broken, the 1.910 contract low will then become the next

downside support.

Bottom Line – Overnight breakout puts the bears back on the

defensive.

Technical Indicators: Moving Average Alignment –

Neutral

Long Term Trend Following Index – Bullish

Short Term Trend Following Index - Bullish

Thursday, January 28, 2016

Natural Gas Corner - Market Review - Another Strong Storage Withdrawal Reported

A second consecutive weekly storage withdrawal which exceeded the 5-year average kept natural gas prices firm in today's trade although there were several intraday sell off attempts. The spot March 16 contract traded down to a $2.088/MMBtu low following release of the EIA weekly storage report but and traded as high as 2.233 finishing the day at 2.188, up .025.

Today's 211 Bcf withdrawal report this morning by the EIA came in near the upper end of pre-report estimates but the market tried to sell off anyway as total storage remains high.

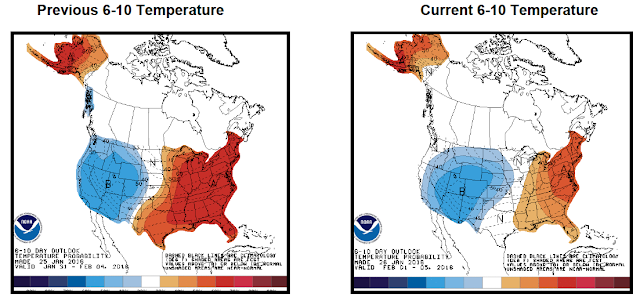

With colder temperatures expected over the upcoming 10-15 days, the market may have another leg up regardless of the longer term bearish forecasts.

Current storage of 3,086 Bcf should fall to the 2,100-2,200 Bcf level by winter's end which would be the second highest end of March storage on record.

Factors which could become supportive are production which could begin a sustained decline this year due to bankruptcies in the sector, and second demand which could increase this summer with higher power generator and industrial usage of natural gas.

Near term, price weakness is expected over upcoming weeks with a probable retest of the mid-December low by early-April. For the spot market, the mid-December low was $1.684/MMBtu, over .500 below the current price. Something to think about.

Today's 211 Bcf withdrawal report this morning by the EIA came in near the upper end of pre-report estimates but the market tried to sell off anyway as total storage remains high.

With colder temperatures expected over the upcoming 10-15 days, the market may have another leg up regardless of the longer term bearish forecasts.

Current storage of 3,086 Bcf should fall to the 2,100-2,200 Bcf level by winter's end which would be the second highest end of March storage on record.

Factors which could become supportive are production which could begin a sustained decline this year due to bankruptcies in the sector, and second demand which could increase this summer with higher power generator and industrial usage of natural gas.

Near term, price weakness is expected over upcoming weeks with a probable retest of the mid-December low by early-April. For the spot market, the mid-December low was $1.684/MMBtu, over .500 below the current price. Something to think about.

Dow Jones - Natural Gas Turns Positive After Inventory Data

DJ Natural Gas Turns Positive After Inventory Data

By Nicole Friedman

NEW YORK--Natural gas prices erased losses to trade higher Thursday on a larger-than-expected storage withdrawal.

Natural-gas inventories fell by 211 billion cubic feet in the week ended Jan. 22, the U.S. Energy Information

Administration said Thursday, more than the 205-bcf draw that analysts surveyed by The Wall Street Journal had

expected.

The large weekly withdrawal helped shrink the oversupply of the fuel. Stockpiles now stand 16% above the five-year

average for the week, down from a 17% surplus as of last week.

Natural gas futures for March delivery recently rose 0.6 cent, or 0.3%, to $2.163 a million British thermal units on

the New York Mercantile Exchange, up from as low as $2.088/mmBtu prior to the inventory data.

However, analysts said that one large withdrawal is not sufficient to clear the glut of natural gas.

"This was a one-time deal," said Kyle Cooper, analyst at IAF Advisors in Houston. "Unfortunately the weather forecast

really turned bearish this morning. ... I think that's why the response [to the inventory data] is a bit muted."

Weather forecasts for the next two weeks show warmer temperatures than previously expected, according to Commodity

Weather Group LLC. Warm weather can reduce demand for natural gas as an indoor-heating fuel.

The inventory data "may not fully offset the forecast for milder temperatures going forward," said Tim Evans, analyst

at Citigroup Inc., in a note. "Failure to rally would underscore the downside vulnerability, with traders concluding

that winter is effectively over."

Write to Nicole Friedman at

nicole.friedman@wsj.com

(END) Dow Jones Newswires

January 28, 2016 11:46 ET (16:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

------

By Nicole Friedman

NEW YORK--Natural gas prices erased losses to trade higher Thursday on a larger-than-expected storage withdrawal.

Natural-gas inventories fell by 211 billion cubic feet in the week ended Jan. 22, the U.S. Energy Information

Administration said Thursday, more than the 205-bcf draw that analysts surveyed by The Wall Street Journal had

expected.

The large weekly withdrawal helped shrink the oversupply of the fuel. Stockpiles now stand 16% above the five-year

average for the week, down from a 17% surplus as of last week.

Natural gas futures for March delivery recently rose 0.6 cent, or 0.3%, to $2.163 a million British thermal units on

the New York Mercantile Exchange, up from as low as $2.088/mmBtu prior to the inventory data.

However, analysts said that one large withdrawal is not sufficient to clear the glut of natural gas.

"This was a one-time deal," said Kyle Cooper, analyst at IAF Advisors in Houston. "Unfortunately the weather forecast

really turned bearish this morning. ... I think that's why the response [to the inventory data] is a bit muted."

Weather forecasts for the next two weeks show warmer temperatures than previously expected, according to Commodity

Weather Group LLC. Warm weather can reduce demand for natural gas as an indoor-heating fuel.

The inventory data "may not fully offset the forecast for milder temperatures going forward," said Tim Evans, analyst

at Citigroup Inc., in a note. "Failure to rally would underscore the downside vulnerability, with traders concluding

that winter is effectively over."

Write to Nicole Friedman at

nicole.friedman@wsj.com

(END) Dow Jones Newswires

January 28, 2016 11:46 ET (16:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

------

EIA Weekly Storage Report - 211 Bcf Draw - Upper End of Expectations

For the week ended

Jan 22:

EIA Withdrawal - 211 BCF

Last Year's Draw - 112 BCF

5 Yr Avg Draw - 170 BCF

Range of Estimates - 180 BCF to 215 BCF

Avg Estimate -205 BCF

Total Gas in Storage - 3.086 TCF

EIA Withdrawal - 211 BCF

Last Year's Draw - 112 BCF

5 Yr Avg Draw - 170 BCF

Range of Estimates - 180 BCF to 215 BCF

Avg Estimate -205 BCF

Total Gas in Storage - 3.086 TCF

Natural Gas Corner - Technical Update - Bearish Signals Heading Into Today's Trade

The new front month March 16 natural gas contract has been

trading in a sideways to higher trend over the past 7 day holding under 40 day

moving average resistance.

With moving average resistance holding, the primary trend

remains sideways to down heading into

today’s trade.

The 2.080 low set two weeks ago is the first area of support followed by 1.980-2.000. If 1.980 support is broken, the 1.910

contract low set two weeks ago will become the next downside objective.

Bottom Line – Early signs point toward continued weakness

today following release of the EIA weekly storage report.

Technical Indicators:

Moving Average Alignment – Bearish

Long

Term Trend Following Index – Bullish

Short Term Trend Following Index - Bearish

Wednesday, January 27, 2016

Analysts' Estimates For Tomorrow's EIA Weekly Storage Report

DJ Analysts See 205 Billion-Cubic Feet Fall in U.S. Natural-Gas Inventories

By Timothy Puko

Analysts expect government data scheduled for release Thursday to show natural-gas inventories last week fell by a

fifth more than average for this time of year.

The U.S. Energy Information Administration is expected to report that storage levels fell by 205 billion cubic feet

of gas during the week ended Jan. 22, according to the average forecast of 19 analysts, brokers and traders surveyed by

The Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EST.

For the Jan. 22 week, the median estimate is for a decline of 208 bcf. Estimates range from a draw of 215 bcf to a

draw of 180 bcf.

The estimate for Jan. 22 compares with 112 bcf drawn from storage for the same week last year and a five-year average

drain of 170 bcf for that week.

If the storage estimate is correct, inventories as of Jan. 22 totaled 3.1 trillion cubic feet, 21% above levels from

a year ago and 17% above the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

January 27, 2016 13:47 ET (18:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012716 18:47 -- GMT

------

By Timothy Puko

Analysts expect government data scheduled for release Thursday to show natural-gas inventories last week fell by a

fifth more than average for this time of year.

The U.S. Energy Information Administration is expected to report that storage levels fell by 205 billion cubic feet

of gas during the week ended Jan. 22, according to the average forecast of 19 analysts, brokers and traders surveyed by

The Wall Street Journal.

The EIA is scheduled to release its storage data for the week on Thursday at 10:30 a.m. EST.

For the Jan. 22 week, the median estimate is for a decline of 208 bcf. Estimates range from a draw of 215 bcf to a

draw of 180 bcf.

The estimate for Jan. 22 compares with 112 bcf drawn from storage for the same week last year and a five-year average

drain of 170 bcf for that week.

If the storage estimate is correct, inventories as of Jan. 22 totaled 3.1 trillion cubic feet, 21% above levels from

a year ago and 17% above the five-year average for the same week.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

January 27, 2016 13:47 ET (18:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012716 18:47 -- GMT

------

Dow Jones - Natural Gas Rises Again On Colder Weather Forecasts

DJ Natural Gas Rises Again on Colder Weather Forecasts

By Timothy Puko

Natural-gas prices rose for a sixth straight session Wednesday as cooler weather forecasts suggest

stronger-than-expected demand is on the way in early February.

Futures for February delivery settled up 0.9 cent, or 0.4%, at $2.189 a million British thermal units on the New York

Mercantile Exchange. The February contract expired at settlement. The more-actively traded March contract fell 0.1

cent, or 0.1%, to $2.157/mmBtu.

Some weather forecasts show a deeper, broader shot of cold coming in the Rockies and Plains next week and through to

the East the following week. About half of all U.S. homes use natural gas for heat, making cold weather a big driver

for demand that often sense prices higher.

But some forecasts also show far-above-average temperatures sporadically hitting key East Coast markets for gas heat

in early February. Stockpiles are also far above normal and could hit a record high for the end of winter, capping

rallies, analysts said.

"The market continues to approach bouts of cold weather with a high degree of caution as supply and inventory levels

are more than adequate to easily meet any cold winter...demand," said Dominick Chirichella, analyst at the Energy

Management Institute.

Natural-gas supplies stood 17% above their five-year average for this time of year as of Jan. 15, according to the

Energy Information Administration. The EIA is due to release its data for the week ended Jan. 22 on Thursday.

Analysts and traders surveyed by The Wall Street Journal expect the EIA to report that inventories fell by 205

billion cubic feet last week, more than the average level for this time of year.

If the storage estimate is correct, inventories as of Jan. 22 totaled 3.1 trillion cubic feet, 21% above levels from

a year ago and 17% above the five-year average for the same week.

--Nicole Friedman contributed to this article

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.189 +0.9c

Nymex March $2.157 -0.1c

Nymex April $2.231 -1.0c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.1075-$2.14 $2.1225-$2.16

El Paso SJ $2.13-$2.15 $2.14-$2.17

Henry Hub $2.19-$2.25 $2.205-$2.245

Katy $2.155-$2.225 $2.165-$2.21

SoCal $2.23-$2.28 $2.28-$2.305

Tex East M3 $1.73-$1.80 $1.78-$2.20

Transco 65 $2.19-$2.295 $2.225-$2.25

Transco Z6 $2.35-$2.44 $2.42-$2.55

Waha $2.11-$2.15 $2.15-$2.16

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

January 27, 2016 14:54 ET (19:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012716 19:54 -- GMT

------

By Timothy Puko

Natural-gas prices rose for a sixth straight session Wednesday as cooler weather forecasts suggest

stronger-than-expected demand is on the way in early February.

Futures for February delivery settled up 0.9 cent, or 0.4%, at $2.189 a million British thermal units on the New York

Mercantile Exchange. The February contract expired at settlement. The more-actively traded March contract fell 0.1

cent, or 0.1%, to $2.157/mmBtu.

Some weather forecasts show a deeper, broader shot of cold coming in the Rockies and Plains next week and through to

the East the following week. About half of all U.S. homes use natural gas for heat, making cold weather a big driver

for demand that often sense prices higher.

But some forecasts also show far-above-average temperatures sporadically hitting key East Coast markets for gas heat

in early February. Stockpiles are also far above normal and could hit a record high for the end of winter, capping

rallies, analysts said.

"The market continues to approach bouts of cold weather with a high degree of caution as supply and inventory levels

are more than adequate to easily meet any cold winter...demand," said Dominick Chirichella, analyst at the Energy

Management Institute.

Natural-gas supplies stood 17% above their five-year average for this time of year as of Jan. 15, according to the

Energy Information Administration. The EIA is due to release its data for the week ended Jan. 22 on Thursday.

Analysts and traders surveyed by The Wall Street Journal expect the EIA to report that inventories fell by 205

billion cubic feet last week, more than the average level for this time of year.

If the storage estimate is correct, inventories as of Jan. 22 totaled 3.1 trillion cubic feet, 21% above levels from

a year ago and 17% above the five-year average for the same week.

--Nicole Friedman contributed to this article

FUTURES SETTLEMENT NET CHANGE

Nymex February $2.189 +0.9c

Nymex March $2.157 -0.1c

Nymex April $2.231 -1.0c

CASH HUB RANGE PREVIOUS SESSION

El Paso Perm $2.1075-$2.14 $2.1225-$2.16

El Paso SJ $2.13-$2.15 $2.14-$2.17

Henry Hub $2.19-$2.25 $2.205-$2.245

Katy $2.155-$2.225 $2.165-$2.21

SoCal $2.23-$2.28 $2.28-$2.305

Tex East M3 $1.73-$1.80 $1.78-$2.20

Transco 65 $2.19-$2.295 $2.225-$2.25

Transco Z6 $2.35-$2.44 $2.42-$2.55

Waha $2.11-$2.15 $2.15-$2.16

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

January 27, 2016 14:54 ET (19:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012716 19:54 -- GMT

------

Tuesday, January 26, 2016

Natural Gas Corner - Market Review

It was a back and forth day in the natural gas market but prices closed generally higher as the 11-14 day forecasts have again turned toward the colder side.

Forecasts which had been negative for prices late last week flip-flopped on Monday leading to a rush of buying on today's open. The early gains were short-lived as the market was back lower by noonday trade.

Storage remains high at 3,297 Bcf which expectations for end of March storage to top the 2,000 Bcf level, the second highest on record for that time of year.

Dry-gas production has remained near the 71.4-71.6 Bcf per day level the past two weeks holding under the 74.3 Bcf high reached in December 2014. With storage expected to remain high, a further production drop could be the factor which finally swings the market back higher in later-2016.

Near term, it would not be surprising to see the market turn back up as weather turns cooler possibly challenging the $2.495/MMBtu spot price high set in early-January. But unless weather turns markedly colder for an extended period of time, rallies should continue to be sold as the mid-December 14-year lows are retested as support over upcoming months.

Forecasts which had been negative for prices late last week flip-flopped on Monday leading to a rush of buying on today's open. The early gains were short-lived as the market was back lower by noonday trade.

Storage remains high at 3,297 Bcf which expectations for end of March storage to top the 2,000 Bcf level, the second highest on record for that time of year.

Dry-gas production has remained near the 71.4-71.6 Bcf per day level the past two weeks holding under the 74.3 Bcf high reached in December 2014. With storage expected to remain high, a further production drop could be the factor which finally swings the market back higher in later-2016.

Near term, it would not be surprising to see the market turn back up as weather turns cooler possibly challenging the $2.495/MMBtu spot price high set in early-January. But unless weather turns markedly colder for an extended period of time, rallies should continue to be sold as the mid-December 14-year lows are retested as support over upcoming months.

Dow Jones - Natural Gas Gains On Weather Expectations

DJ Natural Gas Gains on Weather Expectations

By Nicole Friedman

NEW YORK--Natural-gas prices rose Tuesday as weather outlooks called for colder temperatures in the next two weeks

than previously forecast, boosting demand expectations.

Futures for February delivery recently rose 2.9 cents, or 1.3%, to $2.187 a million British thermal units on the New

York Mercantile Exchange. The February contract expires at settlement Wednesday. The more-actively traded March

contract recently traded up 1.9 cents, or 0.9%, at $2.174/mmBtu.

Wintry weather boosts natural-gas demand as more households and offices turn up the heat. About half of U.S.

households use natural gas as a primary heating fuel.

Mild weather this winter has kept demand subdued, pushing more natural gas into inventory.

Weather forecasts for the next two weeks show cooler temperatures in the next two weeks, which could increase demand

for the heating fuel, but it is uncertain whether the cold will last, Commodity Weather Group LLC said in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.225/mmBtu, compared with Monday's

range of $2.10-$2.175. Cash prices at the Transco Z6 hub in New York traded between $2.55 and $2.685/mmBtu, compared

with Monday's range of $2.60-$2.75.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

January 26, 2016 10:06 ET (15:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012616 15:06 -- GMT

------

By Nicole Friedman

NEW YORK--Natural-gas prices rose Tuesday as weather outlooks called for colder temperatures in the next two weeks

than previously forecast, boosting demand expectations.

Futures for February delivery recently rose 2.9 cents, or 1.3%, to $2.187 a million British thermal units on the New

York Mercantile Exchange. The February contract expires at settlement Wednesday. The more-actively traded March

contract recently traded up 1.9 cents, or 0.9%, at $2.174/mmBtu.

Wintry weather boosts natural-gas demand as more households and offices turn up the heat. About half of U.S.

households use natural gas as a primary heating fuel.

Mild weather this winter has kept demand subdued, pushing more natural gas into inventory.

Weather forecasts for the next two weeks show cooler temperatures in the next two weeks, which could increase demand

for the heating fuel, but it is uncertain whether the cold will last, Commodity Weather Group LLC said in a note.

Physical gas for next-day delivery at the Henry Hub in Louisiana last traded at $2.225/mmBtu, compared with Monday's

range of $2.10-$2.175. Cash prices at the Transco Z6 hub in New York traded between $2.55 and $2.685/mmBtu, compared

with Monday's range of $2.60-$2.75.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

January 26, 2016 10:06 ET (15:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

012616 15:06 -- GMT

------

Subscribe to:

Posts (Atom)