The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Friday, January 9, 2015

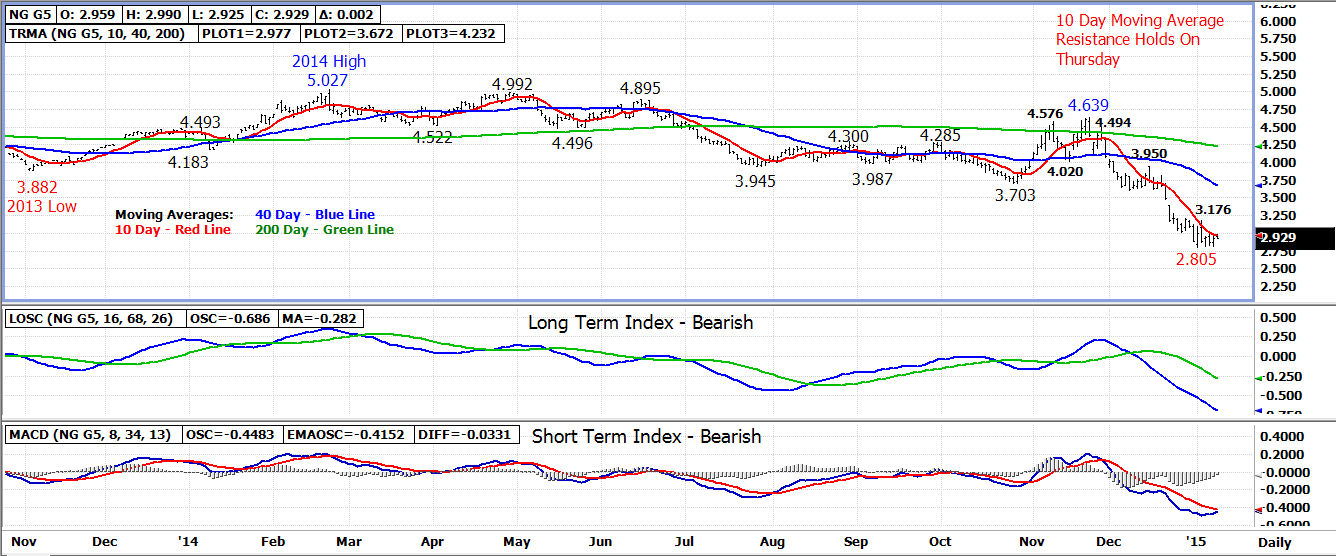

Natural Gas Technical Update - Bearish Right Triangle May Be Forming

The February 15 natural gas contract closed higher on Thursday after holding above 2.805 contract low support on early weakness.

After bottoming out at a 2.811 early morning low, the contract rallied higher into the close gaining .056 to settle at 2.927.

The 10 day moving average held as resistance yesterday’s 2.968 high as well as in the overnight session which keeps the primary market trend down.

If the February contract holds under resistance today at 2.980-3.020, a bearish right triangle on the intraday chart will be completed. A breakout under the 2.805 contract low will initiate the pattern which will have a downside measuring objective for trade down to the 2.450-2.500 area.

A breakout above 2.980-3.020 resistance which includes the 10 day moving average would negate the bearish right triangle and turn the near term trend back higher.

Technical Indicators: Moving Average Alignment – Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index - Bearish

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment