The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Wednesday, February 11, 2015

Natural Gas Technical Update - Key Resistance Level Broken Overnight

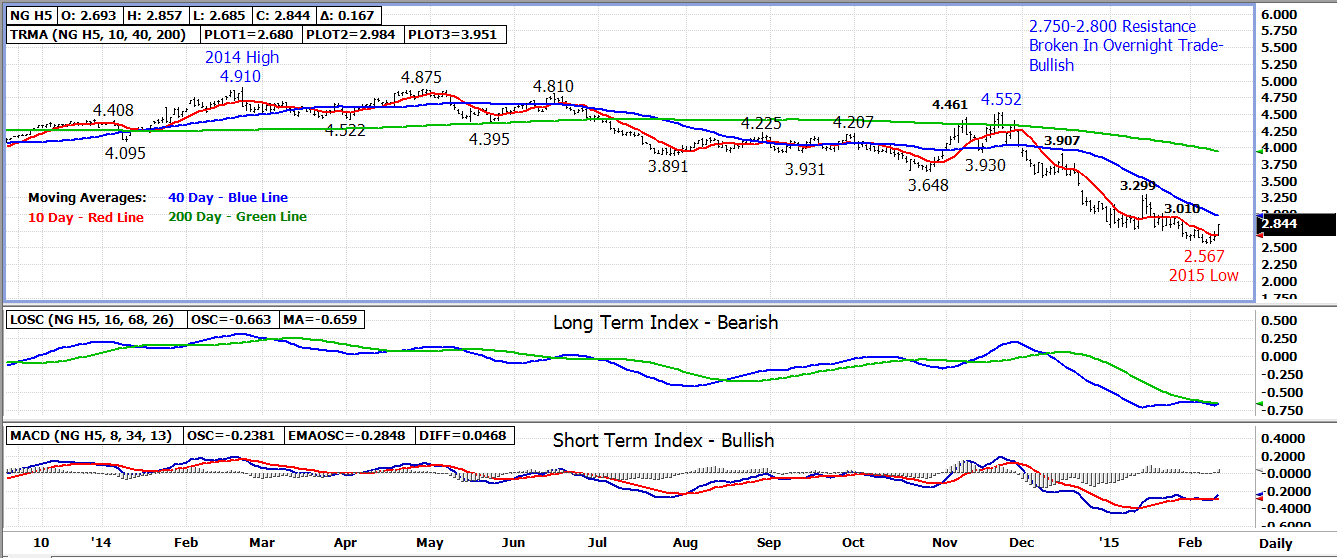

The near term trend for the natural gas market has turned back higher following an overnight breakout above 2.750-2.800 resistance by the March 15 contract.

2.750-2.800 was former daily low support throughout month of January. If the March 15 contract can hold above this level over the next few days of trade, a near term and possibly long term low could be set in the market.

The next longer term resistance now becomes 2.980-3.020.

A drop back under 2.750-2.800 would turn the 10 day moving average at 2.680 into the next downside support.

The March contract pushed down to a 2.567 low last week but was unable to close under weekly low support from August 2012 at 2.575. A drop under both lows is needed to keep the primary market trend bearish.

Technical Indicators: Moving Average Alignment – Neutral-Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index – Bullish (turned higher yesterday)

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment