The one-stop source for the latest fundamental news and technical viewpoints on the natural gas market

natural gas

Monday, September 22, 2014

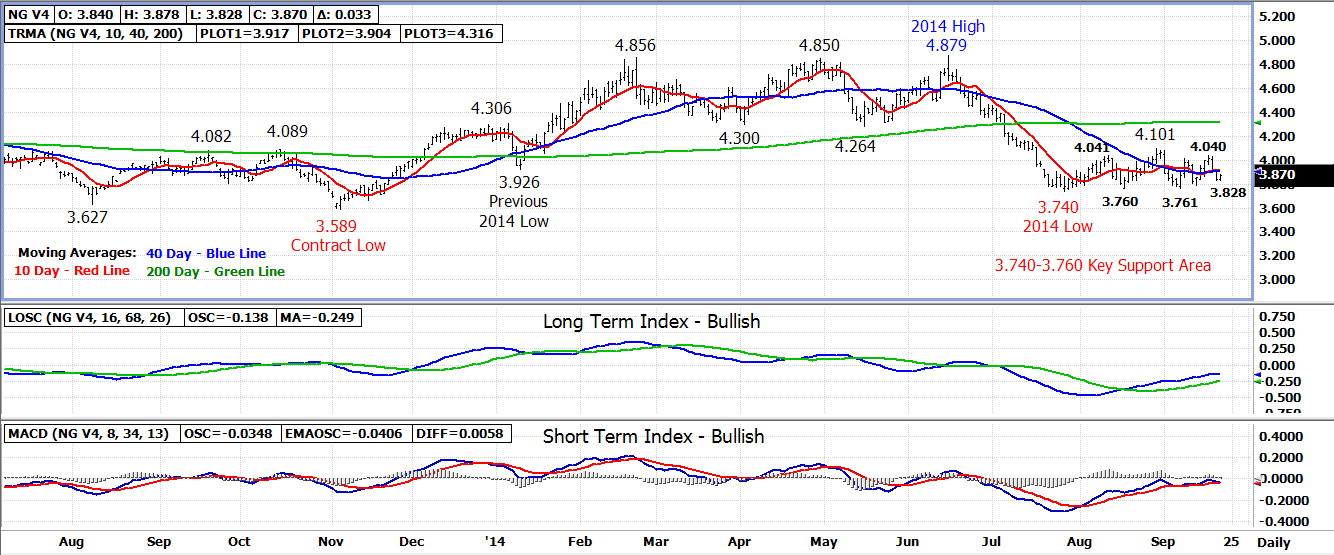

Natural Gas Technical Update - Entering Into A 10th Week of Sideways Trade

It was another volatile and choppy week of trade in the natural gas market last week as the spot October 14 contract swung in a fairly wide .206 range.

The October contract began the week with a three day rally higher topping out for a 4th time at lower-4.000 resistance. After peaking at a 4.040 high on Wednesday, the contract sold back off into

Friday’s close settling at 3.837. For the week, the October contract finished at nearly the same level it began losing .020 over the five days of trade.

Today begins the 10th week of trade during which the October contract has been range bound between 3.740-3.800 weekly low support and 4.000-4.101 resistance. A breakout from this range is needed to determine the next move for the market.

A downside breakout below 3.740 support would turn the 3.589 contract low from last November into the next support. While an upside breakout above 4.101 resistance would turn the longer term trend back higher.

Until the eventual breakout occurs, expect continued voltility.

Hedge funds added to existing long positions in the natural gas market for the first time in three weeks. Friday’s Commitment of Trader’s report showed funds long 185,092 contracts, up 948 from the previous week.

Technical Indicators: Moving Average Alignment – Neutral-Bearish

Long Term Trend Following Index – Bullish

Short Term Trend Following Index - Bullish

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment