Natural gas prices traded flat on Tuesday as the spot

September 15 contract bounced higher on early weakness off lower-2.800 support

to close the day at 2.844, up 2 ticks.

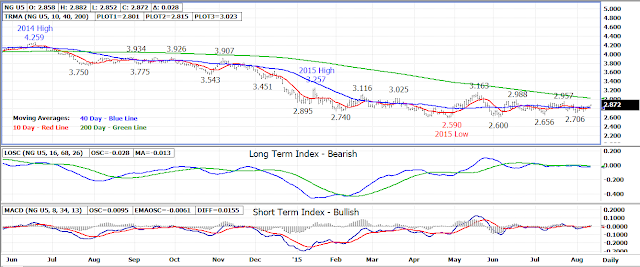

The market remains in a 14-week sideways trading range with

a triangle forming on the weekly chart. Triangles by definition have a

75% chance of being a continuation pattern rather than a reversal

pattern. In this case, the continuation would be down toward a new price

low for 2015.

Triangle support for the September contract is at the

2.700-2.710 level with resistance at the lower-2.900 level. The September

contract is currently trending back toward upper resistance in today’s early

trade.

A breakout from the triangle will set the trend for the

market with an upside breakout above lower-2.900 resistance being a bullish

indicator which will turn the longer term trend back up.

If the breakout comes to the downside under 2.700-2.710

support as expected, the 2.590-2.600 weekly low will become the next downside

support. Longer term support is between 2.440-2.450 and 2.230-2.240.

Technical Indicators: Moving Average Alignment –

Neutral

Long Term Trend Following Index – Bearish

Short

Term Trend Following Index - Bullish

No comments:

Post a Comment